ICB in risk of losing Tk48cr more as Universal Financials owner flees

After making bad investment choices with a number of non-bank financial institutions (NBFI), the Investment Corporation of Bangladesh (ICB) now finds itself in another crisis over its investments in Universal Financials Solution (UFS), whose owner recently fled the country.

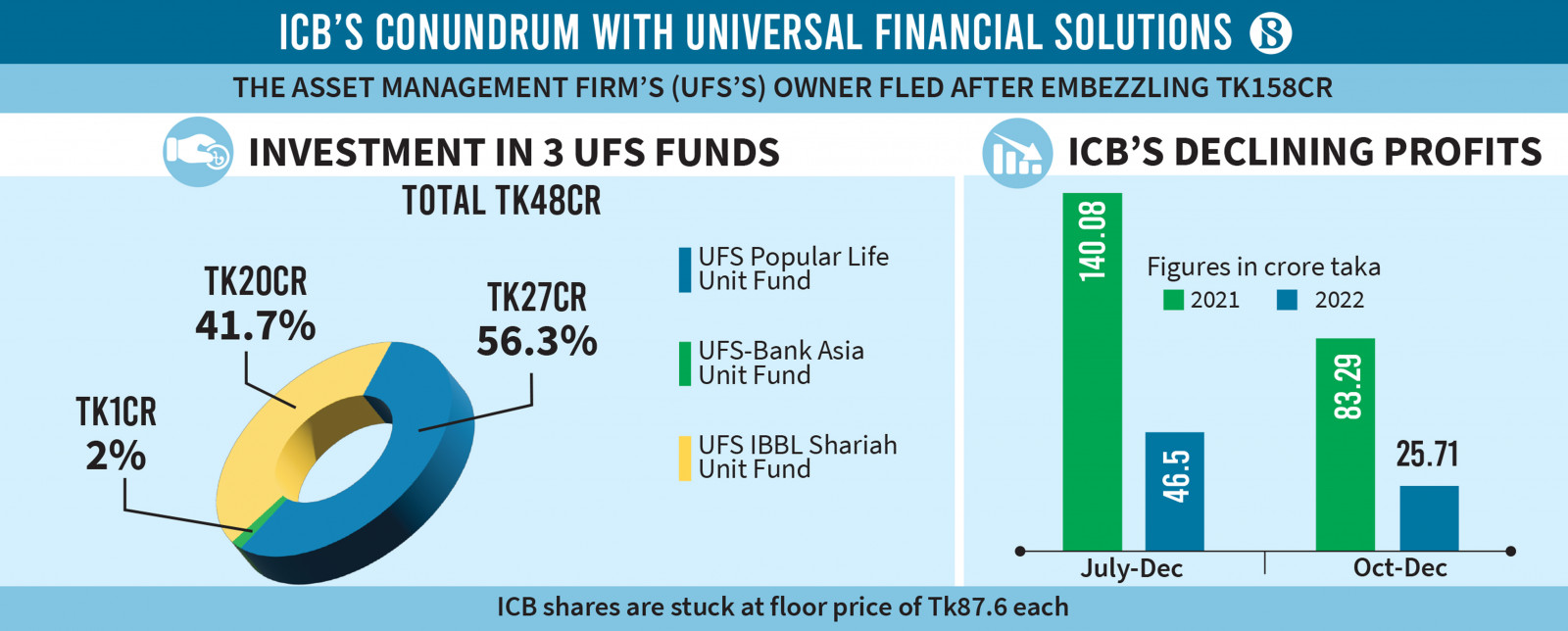

According to its latest annual report, the ICB – a state-owned corporation – has invested Tk48 crore in three mutual funds under the UFS asset management company.

Earlier, around Tk667 crore of ICB investments at a number of NBFIs got stuck as those institutions failed to pay back when their funds' tenure ended. Some of those NBFIs have extended their fund tenures but the others could not.

ICB Managing Director Md Abul Hossain told The Business Standard, "ICB has invested in the UFS funds for profits but its owner has fled the country. We are trying to recover the investment. A case has been filed and the owners' bank accounts have been frozen."

"The absconding UFS owner has communicated with us over e-mail and said he will return the money. We have informed the stock market regulator. Hopefully, the ICB will get the money back."

According to its audit report, the ICB has invested Tk27 crore in UFS Popular Life Unit fund, Tk1 crore in UFS Bank Asia Unit Fund, and Tk20 crore in UFS IBBL-Shariah Fund.

The Bangladesh Securities and Exchange Commission (BSEC) has banned audit firm Ahmed Zaker and Co from the stock market for colluding with the UFS to embezzle the investors' money.

During the preliminary investigation, the stock market regulator has found that Syed Hamza Alamgir, managing director and owner of UFS, embezzled around Tk158 crore in total from four open-end mutual funds managed by the company and fled abroad, said sources at the BSEC.

The investigation is still going on and the total amount of embezzled money is believed to be as large as Tk300 crore, said sources.

The four embezzled funds are – UFS-Popular Life Unit Fund, UFS-IBBL Shariah Unit Fund, UFS-Padma Life Islamic Unit Fund, and UFS-Bank Asia Unit Fund.

The ICB is the trustee and guarantor of these funds.

The UFS, which obtained licence from the securities regulator in 2010, currently manages five open-end funds. The total assets of the mutual funds currently managed by the company are worth around Tk460 crore.

According to sources, the main sponsors of these funds are Islami Bank, Popular Life Insurance, Padma Life Islamic Insurance, and Bank Asia. The National Bank has also made an investment of Tk50 crore in UFS funds.

UFS has got approval for two more funds, but they have not come into operation yet.

The shocking news of embezzlement came at a time, when the ICB as well as the stock market have been facing a serious fund crisis amid the liquidity crunch.

ICB profit erodes as shares are stuck at floor price

The ICB suffered a heavy blow in the July-December period of FY23 as it could not find buyers for its shares which are stuck at the floor price.

According to its financial report, in the first-half of the current fiscal year, the ICB's net profit declined by 66% to Tk46.50 crore, from Tk140.08 crore in the July-December period of FY22.

The BSEC set a floor price to arrest the freefall of share prices in July last year, when the stock market faced excessive fall amid the Ukraine-Russia war, the global energy and commodity crises, and deteriorating exchange rate of currencies.

In December last year, the BSEC removed floor prices for 168 scrips — mainly mutual funds and small-cap stocks.

According to ICB officials, in the first half of FY22, the company's capital gain from the stock market was Tk512 crore, which declined to below Tk200 crore in the July-December of FY23.

Capital gain, and dividend income from the stock market are two of the main earnings sources of the ICB.

On condition of anonymity, an ICB official said, "Due to the floor price, most of the shares got stuck, so, the ICB failed to sell shares. Consequently, the capital gain significantly declined during the period."

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel