Top 20 defaulters owe Tk16,588 crore to lenders: Finance minister

The minister also informed the House that the total number of defaulters in the country is 7.86 lakh

The top 20 defaulters in Bangladesh owe Tk16,587.92 crore to various lenders, with CLC Power Company Limited, a concern of Maisha Group, founded by late Awami League lawmaker Aslamul Haque, being the biggest defaulter with Tk1,649.44 crore.

Revealing the names and numbers, Finance Minister AHM Mustafa Kamal on Tuesday told parliament that Maisha Property Development Ltd, another of the group's concerns, was the 12th largest defaulter with Tk663.18 crore.

The finance minister also informed parliament that the total number of defaulters in the country was 7,86,065 as of November last year.

Maisha Group is one of the largest clients of the National Bank, which has been suffering from a severe liquidity crisis caused mainly by loan corruption.

Kamal provided the data when responding to a question from ruling Awami League MP Shahiduzzaman Sarker.

The total loans of the top 20 defaulters amounted to a princely Tk19,283.93 crore and their defaulted amount was Tk16,587.92 crore, which is 12.37% of the total default loans in the banking industry.

But the amount should be much higher, according to experts.

Former finance adviser to a caretaker government Dr AB Mirza Azizul Islam said the International Monetary Fund (IMF) said Bangladesh doesn't follow the international standards in classifying nonperforming loans or NPLs.

"If we followed the international standards, the NPLs would be doubled," Mirza Azizul told The Business Standard.

He said legal action must be taken against these top 20 defaulters so that others feel pressured to repay their loans.

He, however, said many borrowers could reschedule while some who are not wilful defaulters do not get this facility.

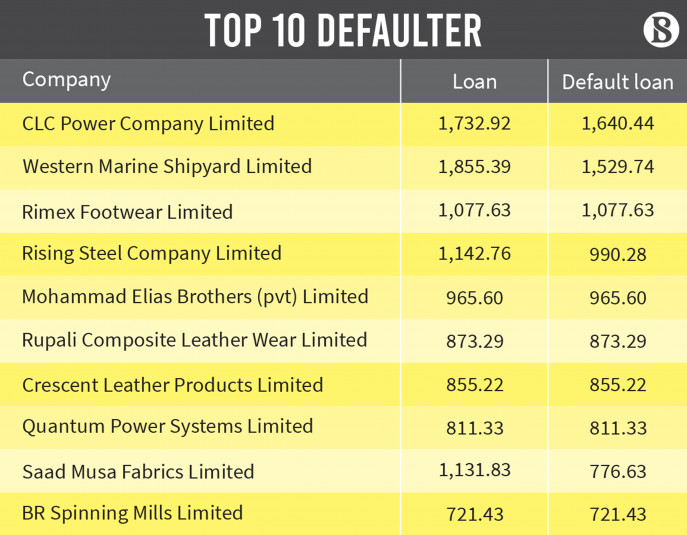

After CLC Power Company, the second biggest defaulter is Western Marine Shipyard with Tk1,529.74 crore, followed by Remex Footwear (Tk1,077.63 crore), Rising Steel Company (Tk990.28 crore) and Mohammad Elias Brothers (Tk965.60 crore).

Rupali Composite Leather Wire Ltd's defaulted loan amount is Tk873.29 crore, Crescent Leathers Products Tk855.22 crore, Quantum Power Systems Tk811.33 crore, Saad Musa Fabrics Tk776.63 crore, BR Spinning Mills Tk721.43 crore and SA Oil Refinery Tk703.53 crore.

Other big defaulters are Samannaz Super Oil Limited Tk651.07 crore, Manha Precast Technology Tk647.16 crore, Asian Education Limited Tk635.94 crore, SM Steel Re-rolling Mills Tk630.26 crore, Apollo Ispat Tk623.34 crore, Ehsan Steel Re-rolling Tk590.23 crore and Siddique Traders Tk541.20 crore.

Mohamad Mohsin, managing director of the Saad Musa Group, told The Business Standard that they tried to regularise loans by making a down payment. Still, the Bangladesh Bank did not allow this.

Chattogram also has nine in the top 20 list, with a total default amount of Tk7,275 crore.

M/s Siddique Traders Managing Director Abu Saeed Samrat said business involved profit and loss.

Imports of consumer goods suffered huge losses between 2006-2013 due to the collapse of domestic and international markets, but the banks did not offer any refinances.

"It put us out of business. We are now paying the bank by selling land. I can't do business. If there were some refinances, the debts could be paid off by doing business," he said.

Captain Tareque M Nasrullah, the director of Western Marine, Md Shahabuddin Alam, the chairman of SA Group, and Abu Alam, chairman of Ehsan Group did not receive the phone.

The executives of Rising Group, MEB, SM Steel and Siddique Traders could not be contacted either.

Some experts have pointed out that the defaulters' list needed to be more accurate and comprehensive.

Former Bangladesh Bank governor Salehuddin Ahmed told TBS that big loan defaulters were not even on the list as they got away on the back of being granted easy facilities.

"The reason for bringing it up in parliament now is to give a warning to others. Now, the Bangladesh Bank needs to take strict measures. Just publishing the list will not help," Salehuddin said.

He said the central bank should make an action plan to move against the defaulters and policies in other countries in this regard can be consulted.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, told TBS that the central bank had given various policy facilities to defaulters through which big defaulters ensured they did not end up on the list.

Shrewd defaulters get the loan normalised for five years with just a 2% down payment and, after the five years, get a refinance, which offers some more wiggle room.

"It is necessary to create a task force for debt collection. In this case, the central bank will have to make guidelines. The defaulters who are not giving loans have to sell their collateral to meet the loan amount."

He also said many were given loans without providing collateral.

"In such cases, the relevant bank authorities should be held accountable."

In a period of economic recovery from the Covid-19 pandemic and the threat of a global recession, defaulted loans in Bangladesh continue to soar, rising to a total of Tk31,122 crore in the last nine months, despite numerous facilities being offered.

According to data from the Bangladesh Bank, the total disbursed loans in the country stood at Tk14.36 lakh crore till September. Out of this, defaulted loans amount to Tk1.34 lakh crore.

At the end of June, defaulted loans were Tk1.25 lakh crore.

In response to a question from a reserved seat lawmaker from the ruling party, Nazma Akhtar, the finance minister said there is no plan to waive interest on agricultural loans, reports the UNB.

The minister said that banks give loans to farmers with money collected from depositors. As depositors have to be paid interest, banks can't waive the interest on the loans given to the farmers.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel