BB plans to introduce managed floating exchange rate mechanism

The upcoming monetary policy is likely to mention a shift from the previously announced move to a floating exchange rate regime

The Bangladesh Bank is going to introduce a managed floating exchange rate mechanism, backtracking from its earlier decision of entering into a market-driven exchange rate mechanism as announced in the existing monetary policy for the first half of the current fiscal year.

A technical mission from the International Monetary Fund (IMF) has started collaboration with the Bangladesh Bank to formulate a new arrangement for controlled currency movement, which is also known as the "crawling peg", according to central bank sources.

The new arrangement is likely to be announced in the upcoming monetary policy for the second half of the current fiscal year scheduled to be announced on 15 January.

The Bangladesh Bank is now working with the IMF to prepare a formula of the crawling peg, said a senior executive of the central bank.

In June, in its existing monetary policy, the Bangladesh Bank had announced to adopt a unified and market-driven single exchange rate regime from July; but it was not implemented finally.

Now, the central bank has backtracked from its earlier stance as the market-driven exchange rate is very risky for inflation amid a high volatility in the forex market, said a senior executive in the monetary policy department.

He said the Bangladesh Bank, with the assistance of the IMF, will introduce the crawling peg mechanism which is effective in managing high volatility and allows greater flexibility in exchange rate movements even in a controlled mechanism.

He also said the crawling peg is the preliminary stage before transitioning into a floating exchange rate mechanism.

According to an IMF working paper, the share of developed and emerging markets in the pegging regime was 68% in 1990, but it came down to 16% in 2001 as most of them shifted to a floating regime.

Conversely, the share of countries adopting a floating regime surged from 16% to 46% during the same period, as indicated by the findings in the working paper titled "The Evaluation of Exchange Rate Regime Since 1990."

Earlier on 9 December, Bangladesh Bank Governor Abdur Rouf Talukder ruled out the possibility of adopting a floating exchange rate and suggested the potential introduction of a new mechanism.

While delivering his speech at the annual conference of the Bangladesh Institute of Development Studies (BIDS), he explained that "it will be more market-based that will allow ups and downs within a band so that the exchange rate remains closer to the real exchange rate."

The new formula of the crawling peg mechanism will be a step forward but the question is: Will it be enough to resolve the ongoing crisis? – asked Zahid Hussain, former lead economist of the World Bank Dhaka office.

Because it is a delayed process as the IMF will prepare a strategic paper on the new formula which will take a long time, he said.

"We need an immediate solution to stop reserve depletion as the central bank has to sell at least $1 billion dollars every month," he added.

He said Bangladesh was in a fixed rate mechanism till 2022 and going back to a fixed rate mechanism through the crawling peg is unnecessary.

"At present, we do not know on what basis the central bank is raising or reducing the dollar price, as well as the reasons behind devaluation by Tk1 or Tk2. But with the crawling peg there will be a prediction about the movement of the dollar price," he added.

He said the central bank could introduce a corridor in the movement of exchange rate similar to the new lending rate mechanism for immediate solution.

He said if the crawling peg is introduced that it should be competitive with the informal market rate to bring dollars in the formal channel. If the price range is fixed at a maximum Tk115 per dollar, and the market rate exceeds Tk125, this new mechanism will fail again, he said.

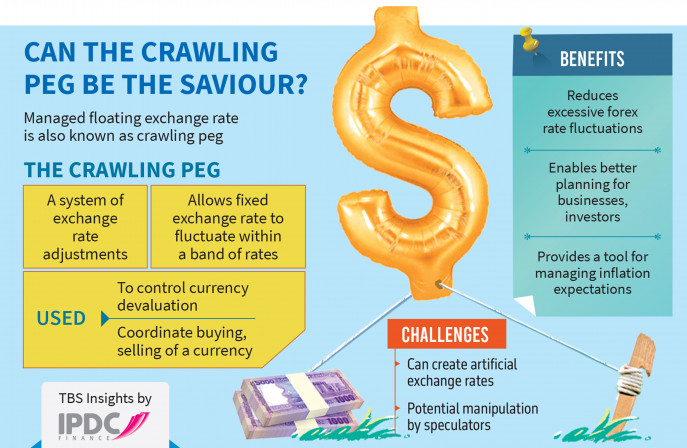

What is the crawling peg

The crawling peg is a system of exchange rate adjustments in which a currency with a fixed exchange rate is allowed to fluctuate within a band of rates. The par value of the stated currency and the band of rates may also be adjusted frequently, particularly in times of high exchange rate volatility.

Crawling pegs are often used to control currency moves when there is a threat of devaluation due to factors such as inflation or economic instability. Coordinated buying or selling of the currency allows the par value to remain within its bracketed range.

A crawling peg reduces excessive forex rate fluctuations, enabling better planning for businesses and investors. It provides a tool for managing inflation expectations, contributing to price stability and economic growth.

On the other hand, because the process of pegging currencies can result in artificial exchange levels, there is a threat that speculators, currency traders or markets may overwhelm the established mechanisms designed to stabilise currencies.

How exchange rate regime transformed in Bangladesh

Until August 2022, the Bangladesh Bank maintained a controlled exchange rate mechanism allowing currency appreciation and depreciation on a limited scale. For instance, taka was depreciated by only 14% from Tk75 to Tk85 from 2011 to 2021, when India depreciated their currency by 75% during the same period.

The Bangladesh Bank maintained a single exchange rate in the market during this period.

However, in September 2022, the Bangladesh Bank introduced a multiple exchange rate mechanism instructing bankers' association to set different rates for export, import, and remittance to control the rapid increase in dollar prices.

This mechanism failed to stabilise the forex market; rather it intensified reserve erosion as the dollar selling rate from the reserve was the lowest than other rates. As a result, all come to the central bank to buy the dollar from the reserve instead of purchasing from the market, depleting foreign exchange reserves faster.

Following the implementation of multiple exchange rates, the country's foreign exchange reserves decreased to $24.7 billion in June last year, down from $28 billion in September 2022.

In May last year, Moody's Investors Service downgraded Bangladesh's rating for the first time, citing heightened external vulnerability and liquidity risks amid a deterioration in foreign exchange reserves.

The multiple exchange rate regime was also taken into consideration in the country's downgrade, according to Moody's report.

Amid this situation, the Bangladesh Bank in June last year announced the adoption of a market-driven exchange rate regime. The central bank will no longer quote specific rates for buying or selling foreign exchanges, promoting stability in the foreign exchange market, it said in its monetary policy statement for the first half of the current fiscal year.

However, the central bank did not implement the unified exchange rate fearing an unusual rise in dollar prices and forex reserves depleted to $21.7 billion on 3 January.

What is the outcome of existing monetary policy?

The Bangladesh Bank in its existing monetary policy addresses multiple challenges including high inflation, exchange rate pressure, substantial erosion of foreign exchange reserves and high default loan burden.

However, the central bank could not ease any of those challenges in the last six months with its monetary policy.

For example, the highest priority was given to contain inflation, which has been rising since the monetary policy announcement in June.

The target was to keep the average inflation at 6% in FY24, while it increased close to 9.42% in November from 8.84% in May.

The rise in inflation is mostly attributed to the devaluation of taka.

Currently, the official exchange rate stands at Tk110. Importers get dollars for Letters of Credit (LC) at a rate exceeding Tk120, while the curb market rate surpasses Tk125, as reported by market insiders.

The central bank sold a record $6.7 billion to banks in the six months (July-December) of the financial year 2023-24. Forex reserve depleted by nearly $4 billion in the first six months of the current fiscal year.

In this context, the Bangladesh Bank is going to announce the monetary policy for the second half of FY24 keeping its contractionary stance to contain inflation, said a senior executive of the central bank.

In the new monetary policy, the central bank will also give a road map of reducing default loans, he added.

The central bank governor at the BIDS conference addressed three major challenges for the economy including an elevated level of inflation, exchange rate volatility and higher non-performing loans.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel