Berger now eyes fresh shares for public shareholders

Berger Paints Bangladesh now considers issuing fresh shares to increase public shareholding by 5% to maintain regulatory requirements of a minimum of 10%.

In a letter to the Bangladesh Securities and Exchange Commission (BSEC) earlier this month, the company requested a regulatory exemption to issue right shares among public shareholders, excluding sponsor-directors.

The letter, which was seen by The Business Standard, also sought approval from the market regulator to allocate 15% of the intended new shares for its employees.

The paint maker had previously tried to comply with the 2021 regulatory order by selling 5% of its current shares held by its sponsor-directors through block transactions on the Dhaka and Chattogram stock exchanges.

However, the effort was not successful because of insufficient demand at the given market price amid the uncertain global economic situation and poor market liquidity, Berger wrote.

The publicly traded multinational company, which dominates the Bangladesh paint market, is now exploring alternative ways to ensure that at least 10% of its shares are available for public investors.

Usually, companies opt for a repeat public offering (RPO), a method for listed firms to raise capital by issuing fresh shares, but it appeared to be inconvenient for Berger.

The public issue rules have no provision to prioritise selling new shares to existing shareholders, which would not guarantee the minimum free-float intended.

Besides, the price determination of fresh shares through RPO bidding will not ensure a specific percentage of dilution needed to comply with the regulatory order for 10% free-float shares.

Issuing fresh shares only to the general public is the way the company proposed to the BSEC.

New shares only for existing public shareholders: Private placement or right shares?

Private placement among existing public shareholders was an option, which was not preferred by the company as it had found problems there.

If any of the existing eligible investors do not participate in subscribing for new shares in a private placement, the intent to increase their stake in the company would not be achieved because there is no provision in the relevant rules for the underwriting of the unsold shares.

On the other hand, right-issue rules ask for a proportionate allocation of new shares among all existing shareholders.

If the regulator exempts Berger from this obligation, the company can offer shares to existing public shareholders so that only their stake in the company goes up.

Also, if any existing public shareholder skips subscription, the unsold shares could be sold to others as there is provision for underwriting.

Rupali Chowdhury declined to comment on the matter.

Two BSEC officials told TBS they got the letter from the company and were analysing the proposals.

"After an analysis, the commission will make decisions keeping shareholders' interests in mind," said one of the officials.

In September 2021, the BSEC ordered Walton Hi-Tech Industries, Investment Corporation of Bangladesh (ICB), and Berger Paints Bangladesh to ensure 10% free-float shares.

When the companies went public, it was not mandatory to maintain at least a one-tenth stake for public investors.

Currently, Walton has 1%, ICB 3.51%, and Berger 5% of free-float shares.

In May last year, Walton was granted a three-year period to offload additional shares held by its sponsors to ensure at least 10% free-float shares.

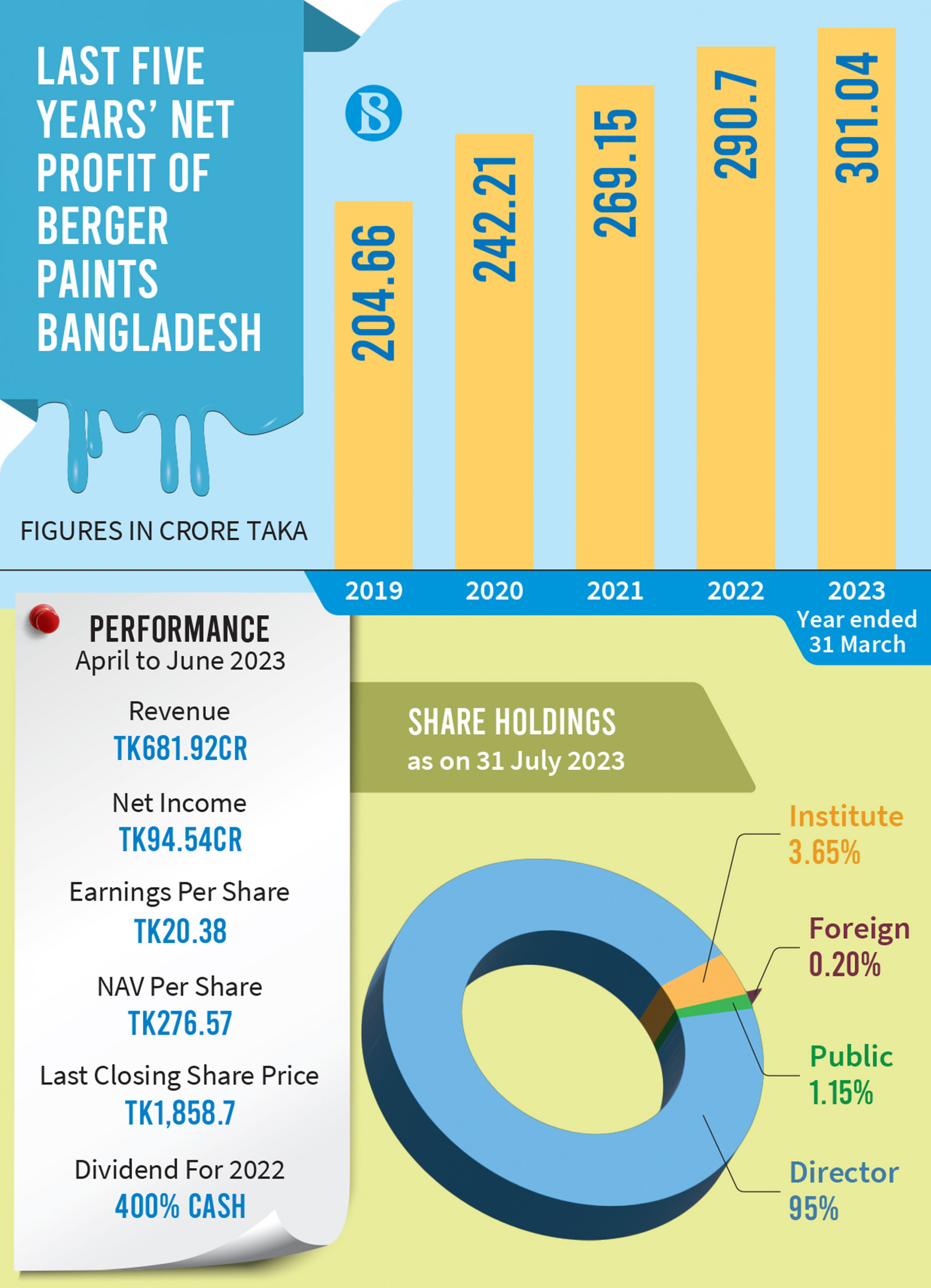

Berger, which holds over half of the paint market share in the country and became a publicly traded company in 2006, consistently reports substantial profits each year and also provides generous dividends to its shareholders.

From April 2022 to March 2023, its annual revenue was Tk2,555 crore and its profit was Tk292 crore.

Berger shares, which have a face value of Tk10, closed at Tk1858.70 apiece on the Dhaka Stock Exchange on Thursday.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel