BSRM firms repeat stellar growth in Jul-Sep

BSRM Limited and BSRM Steels – two listed companies belonging to the country's steel market champion BSRM – continued their stellar growth in the first quarter of this fiscal year both in revenue and profit.

The Chattogram-based steel manufacturers posted the highest ever sales and profits in the last fiscal year ending on 30 June 2021.

With the economic recovery since the first wave of the pandemic last year, the demand for construction rods and other MS products is growing steadily as both megaprojects and private constructions are running in full swing.

Meanwhile, BSRM companies with their market edge are outgrowing the industry.

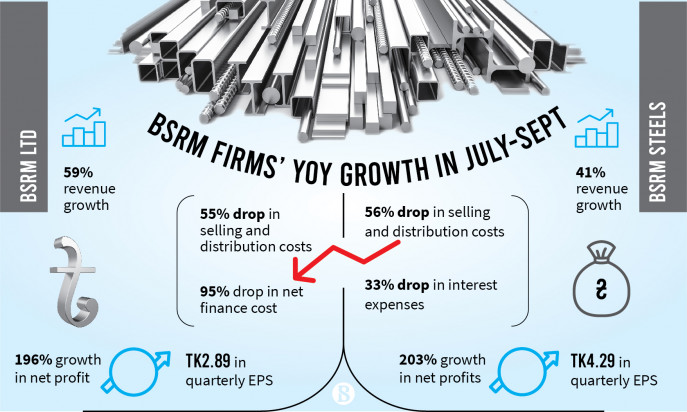

According to the latest financial statements, in the July-September quarter of fiscal 2020-2021, BSRM Limited's year-on-year sales grew 59% to Tk1,538 crore.

A 55% year-on-year drop in selling and distribution costs and a more than 95% fall in net finance cost helped the company nearly triple its quarterly profit to Tk128 crore, resulting in quarterly earnings per share of Tk2.89.

On the other hand, BSRM Steels, posting 41% revenue growth, and 56% drop in selling and distribution costs and a 32% drop in interest expense, more than tripled its quarterly profits to over Tk108 crore from less than Tk36 crore a year ago.

BSRM Steels posted an EPS of Tk4.29 for the July-September quarter.

The growth trajectory is intact

BSRM Limited and BSRM Steels posted record annual sales and profits for the 2020-2021 fiscal year ending in June and the quarterly figures kept the growth trajectory intact.

The annual revenue of BSRM Steels grew to over Tk5,498 crore from Tk3,868 crore and the company has revised up its planned investment size by 164% to Tk1,850 crore for expanding its production capacity.

In a telephone interview with The Business Standard in October when the annual figures were disclosed, BSRM General Manager for Finance and Accounts Shekhar Ranjan Kar said the company could sell much more had it the production capacity.

BSRM Ltd registered Tk6,987 crore in annual revenue till the end of June, up from Tk4,572 crore in the previous fiscal year.

According to Shekhar Ranjan Kar, against the 15% annual growth in the market demand for steel products, the BSRM companies' annual sales growth was more than one-third in terms of volume as the market leader successfully retained its edge.

He also had said products were sold off even before spending the planned amounts for sales promotion, marketing and the statement appeared to have been reflected in the latest quarterly result.

Dropped interest rates helped BSRM companies save around 75% in annual interest expenses in the 2020-21 fiscal year as banks' lending rates came below 9% cap in early 2020 from 11% in 2019.

The average interest expenses for BSRM dropped to 4% in late 2020 as the company availed subsidised stimulus loans from the government for working capital financing amid the pandemic disruptions.

The increasing cost and price

Shekhar Ranjan Kar had also said that the price hike for steel products resulted in higher revenue growth than the volume growth.

The raw material cost of the steel industry nearly doubled in a year up to mid-October 2021 while international maritime freight grew over 2.5 times in the same period.

To cope up with the escalated costs, the industry was increasing construction rod prices.

BSRM's construction rods were selling at an annual average rate of Tk63,000 per tonne in fiscal 2020-21, from Tk61,000 in the previous year.

In October, the price shot to Tk76,000 per tonne as the company was still in need to match prices with the increased cost.

The price has now risen to Tk79,000 per tonne for the BSRM rod.

Both companies make billets from imported raw material and consume the semi-finished raw material to manufacture construction rods.

Following the highest ever profits in the group's history, the two listed companies announced record cash dividends for their shareholders.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel