Bangladesh is not going to be a Sri Lanka: PMO

The size of Bangladesh economy and volume of exports are bigger than those of Sri Lanka and Pakistan put together, while foreign currency reserves are more than double the amounts held by these two South Asian countries, according to the PMO

Bangladesh is not at risk of defaulting on foreign loan repayments because of its cautious management of external debt which has a much higher portion of soft loan with longer maturity periods than that in Sri Lanka.

Besides, the size of Bangladesh economy and volume of exports are bigger than those of Sri Lanka and Pakistan put together, while foreign currency reserves are more than double the amounts held by these two South Asian countries.

This was how the Prime Minister's Office (PMO) explained Bangladesh's strength in external debt management amid concerns about the country's external debt sustainability at a time when Sri Lankan economy is near-collapse and Pakistan is under IMF's bailouts.

Sri Lanka will temporarily suspend foreign debt payments, the country's central bank governor on Tuesday said, adding to worries about realising $200 million of swap loan Bangladesh lent to the island nation.

In response to Prime Minister Sheikh Hasina's queries, senior financial bureaucrats on Tuesday made an elaborate presentation on the state of the country's overall external and internal financial situation.

The bureaucrats responsible for balancing macroeconomics policies, collecting revenue, managing foreign loans and forex reserves said on top of Bangladesh's strong position in repaying foreign loans, Dhaka cannot be compared to Colombo in terms of revenue collection policies.

After analysing the information for three hours, Prime Minister Sheikh Hasina was also satisfied with the overall economic situation of the country, Principal Secretary to the Prime Minister Ahmad Kaikaus told reporters.

"Earlier, we had repeatedly reassured the premier that Bangladesh is not facing any long-term risk stemming from foreign loans," he said.

Comparing Bangladesh with India, Bangladesh, Pakistan and Sri Lanka – four large economies in South Asia, Ahmad Kaikaus said Bangladesh's growth rate was more than 6% when India lodged negative growth last year amid the pandemic. The country's position in various socio-economic indices is the strongest in South Asia.

"There is no risk for Bangladesh not being able to repay its foreign loans in the next 5-10 years," Finance Secretary Abdur Rouf Talukder, adding the country's revenue growth has been 15% in the last eight months, private sector credit growth has been 11% and exports have also been witnessing tremendous growth. Therefore, Bangladesh cannot be compared to Sri Lanka in any way," he added.

Fatima Yasmin, secretary of the Economic Relations Division who is involved in foreign debt management, said the bulk of Bangladesh's foreign loan was taken from multilateral lenders. These types of loan have low interest rates, grace periods and long repayment periods.

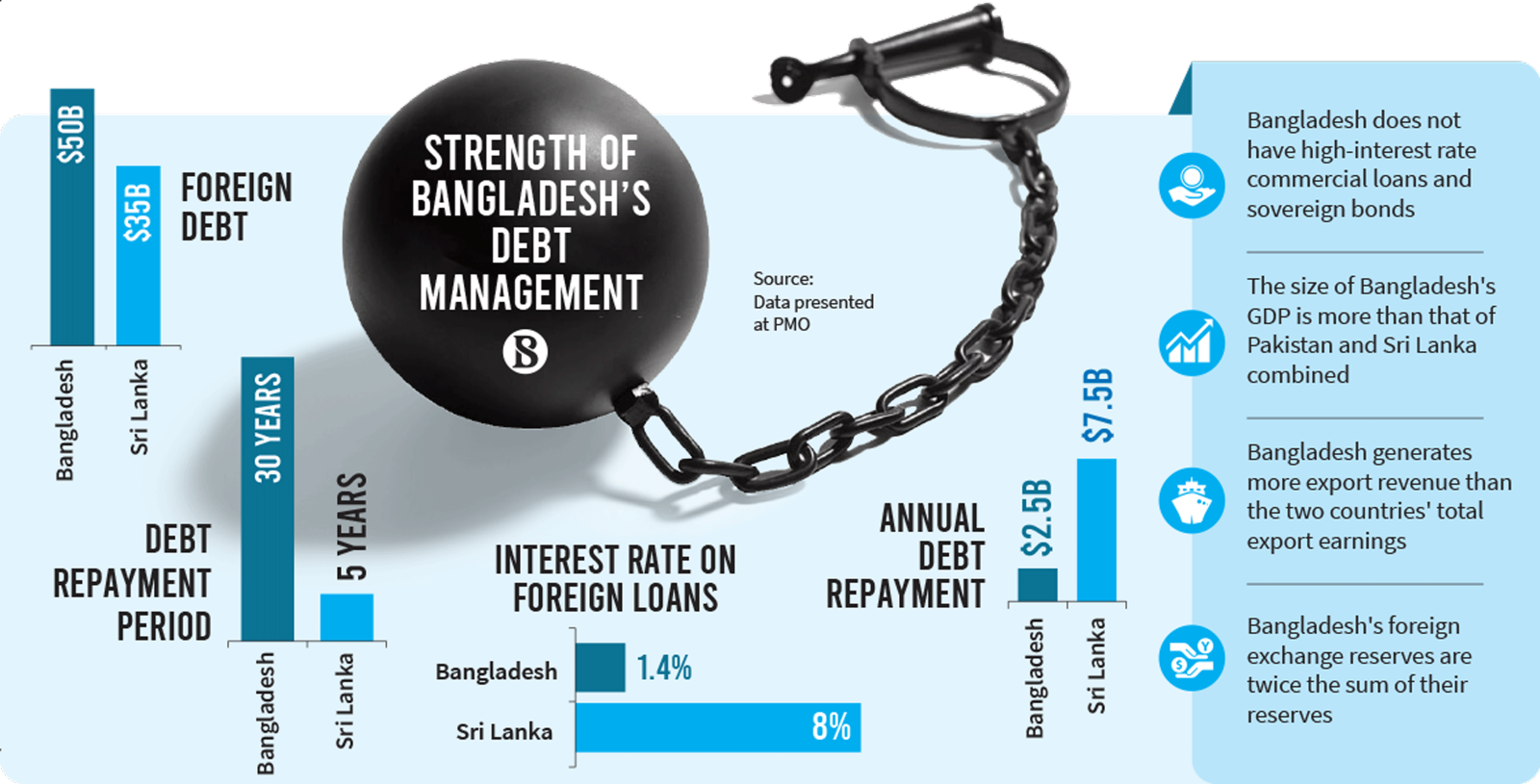

In contrast, commercial and sovereign bonds amount to the lion's share of Sri Lanka's debt, which have high interest rates and have to be repaid with interest in five years. The interest rate of those loans is as high as 8%, she said.

"On the other hand, Bangladesh's debt repayment period is 30 years. Bangladesh has no commercial or sovereign bonds. The interest rate on loans taken by Bangladesh is 1.4%," Fatima Yasmin said.

With economy already under stress, Pakistan saw an escalated political turmoil that forced embattled Imran Khan out of power. The new prime minister is now facing the daunting task of managing a stuttering economy with huge deficits, soaring inflation, depleting reserves and weakening rupee. After taking oath as the new premier on Tuesday, Shehbaz Sharif summoned an urgent meeting of economic experts to find ways out of the current financial challenges and decided to form a National Economic Advisory Council to suggest medium and long-term fiscal policies.

Worsening economic crisis caused political upheavals in Sri Lanka, leading to massive resignation of ministers amid price spirals and shortages of food, oil and medicines. As external debt moutned and foreign reserve depleted, Sri Lankan central bank on Tuesday announced suspension of repayment of foreign debt.

Unlike these two neighbours, Bangladesh's political front has been stable and its economy, despite an inflationary pressure, has so far fared well coping with external factors like Covid-19 and Ukraine war impacts.

Against these backdrops, Prime Minister Sheikh Hasina took stock of the country's financial situation as the budget for the next fiscal year is in the making.

Hearing the presentation, the prime minister directed all concerned to take necessary measures so that Bangladesh could maintain its current position in future regarding foreign debts, as the amount of foreign loan of the country is still far below the risk limit, according to a press release of the PMO.

The fact that Bangladesh is far ahead of Sri Lanka has been highlighted by the prime minister in her speech in the House a few days ago. Finance Minister AHM Mustafa Kamal also ruled out the possibility of Bangladesh ending up like Sri Lanka.

In on Tuesday's briefing, Finance Secretary Abdur Rouf Talukder highlighted the three strong pillars of Bangladesh's economy, saying RMG exports, remittance and paddy production have increased substantially over the past 13 years thanks to political stability. These three sectors as well as agriculture, industry and service sector have turned around from the pandemic fallout due to different government stimulus packages.

The finance secretary said the size of Bangladesh's GDP is more than the sum of Sri Lanka and Pakistan's GDP. Bangladesh's exports are more than the combined export earnings of these two countries and Bangladesh's foreign exchange reserve is twice the total of Pakistan and Sri Lanka.

According to the Economic Relations Division secretary, Sri Lanka's foreign debt is $35 billion and the country has to repay $7.5 billion per year. Bangladesh has a foreign debt of $50 billion, but has to repay $2.5 billion annually.

The ERD Secretary said Bangladesh spends more flexible loans in social development projects, while less flexible loans are used to develop profitable infrastructure so that those could fetch the government the required amount of revenue.

While replying to a query from The Business Standard, the principal secretary to the prime minister said Bangladesh will never fall into the Chinese debt trap.

"Only 7.8% of the total foreign loans of Bangladesh was taken from China. This issue is usually raised at different times due to some geo-political reasons," he commented.

"We had never been dependent on China, and are not now too. We selectively accept Chinese-funded projects. We only take China-funded projects that seem to be profitable," he added.

He said there has been a trend of making "everything got ruined" chorus in Bangladesh for a decade. When the action plan to overcome the power crisis was formulated, it was said that the country would go to the abyss, but it did not. The same thing happened when the World Bank withdrew from financing the construction of the Padma Bridge, but the government is completing the construction of the bridge with its own funds. Whenever a big project is taken up, a certain group opposes it.

"A group was vocal during the liberation war that Bangladesh would not survive if it became independent. But they were proved wrong then, they are still being proved wrong now," he added.

Kaikaus said, "Sometimes we can be wrong, we also can stumble. But our course has never changed."

"When we are proud and rejoicing over the achievements of Bangladesh in the 50 years of independence, there is nothing more embarrassing and ridiculous than comparing Bangladesh with Sri Lanka and suppressing national achievements in this way," he said.

Abu Hena Md Rahmatul Muneem, chairman of the National Board of Revenue, said many are comparing the revenue board's tax exemptions to the current situation in Sri Lanka. They say the situation in Sri Lanka has worsened because of the tax cuts.

"But I want to say the board is not exempting tax, instead it is adjusting the revenue. The NBR is cautiously approving tax exemptions in sectors where the facility will increase investment and employment ultimately resulting in more revenue later," he said.

"For electronics items, Bangladesh once was entirely import dependent. Tax cuts helped manufacture the products in the country now and meet 80% of the local demand," he said, adding the board is now collecting more revenue from the sector differently.

Subsidy adjustment when inflation cools off

Finance Secretary Abdur Rouf Talukder said subsidies will continue until the country's inflation rate, mostly propelled by global factors, does not cool off.

"Despite having the subsidy pressure, the government does not want to leave the inflation unguarded now. When inflation comes down, the government will gradually adjust the subsidy," he said.

Ahmad Kaikaus said spiked commodity prices in the international market will not put such any pressure that the country's economy would collapse. Prices of the products that have gone up in the international market have also gone up in the country. But the government has stabilised the local market by providing subsidised food items to 1 crore people.

"Fuel and gas prices have not risen in Bangladesh despite a jump in the international market following the war. The prime minister has provided us guidelines on fuel prices. If prices continue to rise every day, we will have to adjust at some point. But I am still not thinking about it."

Referring to the deficit in the balance of payments as a "trivial" issue, Kaikaus said the prime minister is not concerned about it at all. "Our balance of payments deficit has widened. But it is possible to meet the import cost for the next seven months with our reserve. As private sector credit growth continues surging, exports and reserves will increase further in the next one to two years."

Concerns over Bangladesh's future debt burden

Since Sri Lankan economy started to nosedive owing to depleting foreign exchange reserves, economists here have been expressing their concerns about Bangladesh's future debt servicing burden as a number of foreign-aided megaprojects are in progress.

Similar concerns were aired at a programme of the Centre for Policy Dialogue (CPD) on Tuesday.

Professor Mustafizur Rahman, distinguished fellow at the CPD, said, "Our economy is not comparable to that of Sri Lanka. We did not have such a situation. But there is a lot to learn from Sri Lanka. Our current situation is good. But the island nation has not plunged into such a deepening financial crisis overnight."

He, however, noted, "Since we are going to graduate to a developing country, the amount of our grant element in foreign debts will further be lowered. Our concessional loans will decline too. We will have to accept foreign loans at a regular market rate."

Taking a lesson from what Sri Lanka is now going through, the government should complete megaprojects in the infrastructure sector in a timely and cost-effective manner with good governance, he added.

CPD Executive Director Fahmida Khatun said the country's external sector, which was the strength of the economy, is now facing pressure in terms of foreign trade, current account and reserve of the foreign currency.

The foreign public debt is rising and continuation of such tendency would create pressure on external debt servicing, she warned as she noted that all components of the external balances – trade, current account and overall – have been under pressure.

BB may give Sri Lanka more time

Bangladesh gave Sri Lanka $200 million loan from the central bank's forex reserve to overcome the economic crisis. The loan was to be repaid through a "currency swap" arrangement.

Now there has been a concern about getting the amount back since Sri Lankan economic crisis started worsening. An announcement by the Sri Lankan central bank governor on Tuesday that Sri Lanka will temporarily suspend foreign debt payments caused further uncertainty.

Asked about the fate of Bangladesh's loan, Sirajul Islam, executive director and spokesperson of the Bangladesh Bank, said Sri Lanka was to repay $50 million on 18 May this year. The remaining amount was to be paid in two instalments – $100 million on 31 May and $50 million on 12 June this year.

"But since the country is going through a very tough time, the repayment period might be extended if Colombo seeks time officially," he added.

On 18 August last year, Bangladesh lent $50 million to Sri Lanka. Dhaka gave Colombo another $100 million and $50 million later.

Sri Lanka was given three months to repay the first instalment and the interest rate at that time was LIBOR+2%. LIBOR or the London Inter-Bank Offered Rate is the international conventional interest rate for short-term lending.

The repayment of the first instalment was extended by three months with an unchanged interest rate as Sri Lanka missed the first dateline. Later, the latest six-month extension raised the interest rate to LIBOR+2.5%.

The central bank spokesman said Sri Lanka recently asked for a fresh $250 million loan, but Bangladesh turned down the request by the island nation.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel