Lower budget deficit mirrors slower public spending

If the poor spending continues, the actual spending is feared to be negative at the end of the fiscal year

Forget the ordinary budget deficit, rather spend more on infrastructure: This was the message economists conveyed to the government before the budget to tackle the extraordinary Covid fallout.

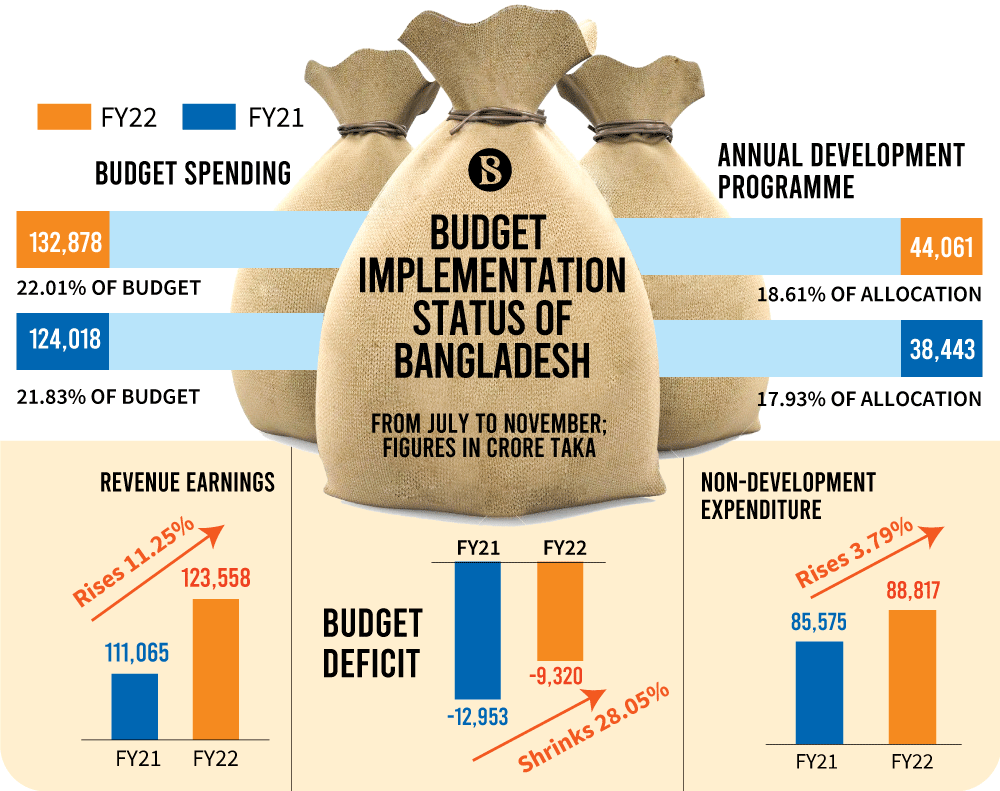

But the spending and revenue gap in July-November of this fiscal year suggest the recommendation was not heard as the year-on-year budget deficit narrowed to 28% thanks to the government's failures to enhance health spending, allocate more for learning loss recovery and map out other expenses aimed at saving life and livelihood from the pandemic funk.

The Finance Division in a report said the government spent Tk8,864 crore more in the first five months of the 2021-22 fiscal year than the corresponding period last year. The expenditure is just Tk9,320 crore more than the revenue collection in July-November this year.

The gap between expenditure and revenue in the first five months of last year was Tk12,953 crore, which suggests the deficit reduced Tk3,633 crore in the 2021-22 fiscal year.

Before the budget announcement for the 2021-22 fiscal year, economists had been advocating for driving up public investment, even by widening up the deficit. The finance ministry increased the size of the budget by 10% to around Tk6 lakh crore.

The Finance Division data show revenue earning posted a 11% rise in July-November compared to the corresponding period of last year.

A brutal surge in Covid infections coupled with a series of lockdowns impeded the Annual Development Programme (ADP) last year, limiting the budget spending 21.83% in the first five months.

With Covid slowing down its round-up this year, budget spending in the first five months logged around 22%, which is only 7% more compared to the corresponding period last year.

Economists fear the actual spending will be negative at the end of this fiscal year if the spending appetite by the ministries and other public offices does not improve.

They say there is no alternative to increase government investment for infrastructure to cushion Covid fallout, and suggest raising government spending fast even by shrugging off the deficit for the time being.

Budget revision too doesn't have spending boosting plan

In the face of low government spending, the finance ministry is now carrying out revisions to this year's budget. But the revision too does not have any plan to ramp up the spending.

Instead, the Finance Division has already warned the ministries not to demand more than the budgetary allocation.

In an austerity measure and to ride out the Covid fallout smoothly, the division in the 2021-22 fiscal year set a 50% ceiling of the allocations for cars and foreign trips. Recently, the division also reminded that unspent amounts in these two segments cannot be put in other sectors.

The finance ministry says there must not be any proposal seeking allocations for any unapproved scheme from the revised budget. Projects number in the revised ADP will have to be limited, and less important projects, if required, will have to be put on hold to prioritise the government's fast-track works.

Old habits die hard

Ahsan H Mansur, executive director of the Policy Research Institute (PRI), said several ministries are tackling the Covid fallout with their old spending habits though the ADP implementation now requires prompt execution.

Besides, he pointed the finger at mismanagement and corruption for slow ADP implementation.

"The revenue target set in the budget sees less than 20% collection in the first five months. The revenue shortfall compels the government to spend less, which ultimately will slow down the economic recovery," he added.

Prof Mustafizur Rahman, distinguished fellow at the Centre for Policy Dialogue (CPD), too blamed the failures of the ministries and divisions that are deterring the budget implementation.

He said the size of GDP in terms of money is growing at 15%. Now if the budget spending registers a 7% rise, the actual expenditure will decrease.

"There is no alternative to investing in the public sector to recover the economy from the virus shock. And there is no alternative to increasing the spending than the revenue earning," he noted.

Zahid Hussain, former lead economist at the World Bank's Dhaka office, observed the slight rise in revenue collection "a positive aspect of the economy", but said the deficit has narrowed down as the expenditure has not increased accordingly.

He said the government will have to spend heavily in the coming days to implement the budget. For this, revenue collection and spending capacity must be ramped up.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel