Legacy Footwear’s stock soars 76% in eight days

While most fundamentally lucrative shares of profit-making firms are lying buyerless, shares of a small-cap loss-making firm like Legacy Footwear Limited seemed to have drawn a good number of investors as they soared 76% in just eight trading days.

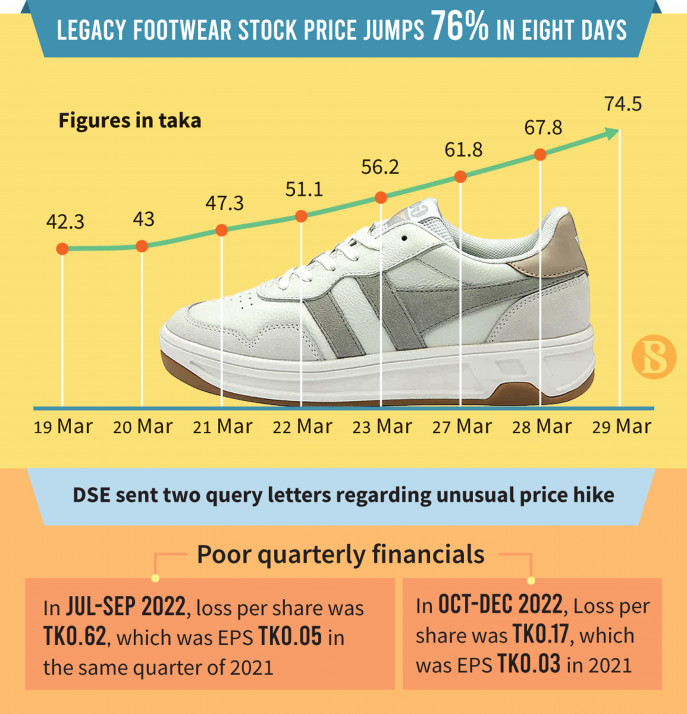

On Wednesday, the company's shares closed at Tk74.5 each, a 9.9% increase from Tk67.8 in the previous trading session. On 19 March, the share price was Tk42.3.

Legacy Footwear's shares saw no sellers at the Dhaka Stock Exchange (DSE), and in the last seven trading days, it was the best stock with the highest price appreciation.

Although the company's shares have been skyrocketing, its financial performance paints a different picture.

In the July to December period of 2022-23 fiscal year, the company incurred a loss of Tk1.03 crore.

Earlier, in FY22, it made a loss of Tk1.12 crore which is why it did not declare any dividend in that fiscal.

But in FY21, it made a profit of Tk52 lakh and paid a 1% cash dividend to the shareholders.

The DSE has sent two query letters to the company seeking explanations behind its unusual price hike, to which Legacy Footwear replied that it has no price sensitive information undisclosed.

Md Rezaul Karim, spokesman and executive director of the Bangladesh Securities and Exchange Commission said, "Legacy Footwear's recent share price hike has come to our attention."

"If any malfeasance is detected in share trading, the commission will take actions as per rules," he added.

Legacy Footwear is not the only one

Recently, the share prices of some other weak companies have increased abnormally.

Among the top ten gainers on Wednesday, five were loss-making small-cap companies including Legacy Footwear. GQ Ball Pen, Miracle Industries, Hakkani Pulp and Paper Mills, and Samata Leather Composite were the other four.

The share price of these firms rose around 10%, an upper limit of the circuit breaker.

Market insiders said institutional investors have remained inactive recently due to the liquidity crunch.

And, as some shares are stuck at floor prices, the trading of shares of good companies has decreased.

In this situation, investors are leaning towards shares of weak and risky companies for quick gains.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel