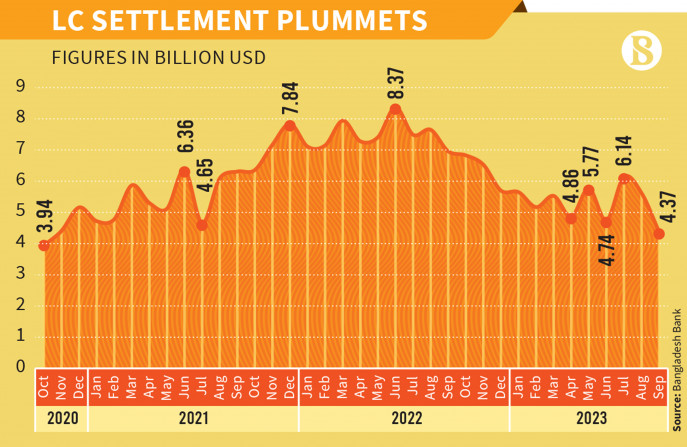

LC settlements hit 35-month low in September

LC openings also drop by 16.1% or $900 million

The country's letter of credit (LC) settlements registered a 35-month low in September, while LC openings also fell by about 16.1% compared to August, in line with the central bank's effort to discourage imports to ease pressure on dwindling forex reserves.

According to Bangladesh Bank data, LC settlements or import payments were $4.37 billion in September, lowest since October 2020 when the global economy was hobbling with Covid-19 pandemic.

In September, banks opened LCs amounting to $4.69 billion, from $5.59 billion in August.

Senior officials of several public and private banks said the banks have reduced LC opening for over the past one year to reduce payment pressure. As the trend of opening deferred LCs is less than six months ago, the pressure of these LC payments is also less now.

Zahid Hussain, former lead economist of the World Bank Dhaka office, said, "A glimpse of what may happen in the future in the economy of a country like Bangladesh can be seen by looking at the import LC opening. Due to the dollar crunch, LC openings for capital machineries, intermediate goods have reduced significantly. There is no indication that the economy will recover in the future. Banks also have nothing to do as they don't have enough dollars."

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said a large part of the payments being made now is deferred LC payments opened six months ago. Sight LCs are now almost non-existent. These LCs are subject to be paid within one month after opening. Banks now have the maturity portfolio of previously opened deferred LCs, according to which they are scheduling payments.

Noting that banks' ability to open LCs is decreasing due to the fall in remittances, the managing director of a private commercial bank, who preferred not to disclose his name, said, "Our dollar situation is not very good. Remittance inflow in September was $500-600 million less than the normal period. As a result we are not very comfortable about opening the LCs. Therefore, 90% of LCs opened in my own bank in deferred LCs."

Most of the banks are opening deferred LCs instead of sight LCs, said a bank policy officer. The banks do not have the dollars to open sight LCs as they have a deferred LC payment schedule, he said. "The banks are now opening deferred LCs to maintain dollar flow. In most cases, these LCs are opened for a period of 4-6 months. However, banks are opening deferred LCs with a longer term than this. As a result, the payments will become due in the future, which will increase the pressure on reserves."

Another banker said, "Dollar liquidity of banks was good in July and August. The liquidity decreased slightly in September, but considering the current situation, it is good. But banks are now very cautious about opening LCs. According to them, it is not clear how the dollar situation will be in the coming days." So banks have reduced LC opening, he explained.

"Now we are seeing deferred LCs open for 270 days or nine months," said a senior central bank official. He went on to say, "Payment of these LCs is to be made after 10 to 10.5 months. Due to late payment of these LCs interest has to be paid in US dollar separately and 20% tax on interest to NBR. As a result, this cost will also be added separately to the price of the products."

The interest rates in the international market are now linked to the Secured Overnight Financing Rate (SOFR) instead of the formerly LIBOR (London Interbank Offered Rate). Foreign loans are subject to an added interest (margin) of up to 3.5%. Deferred LCs are considered as short-term loans.

In light of the US Federal Reserve's policy rate increase, the SOFR already surged to 5.35% from as low as 0.25% during the Covid-19 pandemic and below 1% even in early 2022. Consequently, the interest rates for loans on the international market have experienced a corresponding spike.

Global interest rate has been on the rise and a 20% "withholding tax" imposed in the current budget on interest payment has made foreign borrowings costlier further. The cost of borrowing has now shot up to around 11%.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel