FBCCI for import duty cut to fit in post-LDC trade regime

FBCCI will send its recommendations to the Prime Minister’s Office within this month

The Federation of Bangladesh Chambers of Commerce and Industries has recommended gradually trimming tariff rates in keeping with WTO policies to fit Bangladesh to face possible challenges successfully after its graduation to a developing nation.

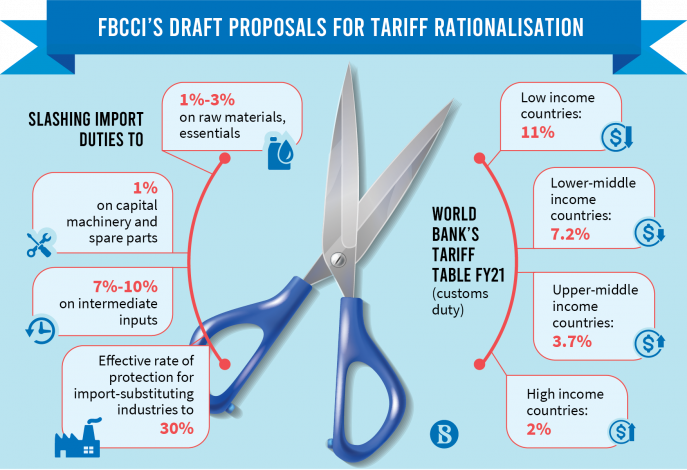

The apex trade body in its draft proposal suggests 1%-3% import duties on basic raw materials and daily essentials, 1% on capital machinery and spare parts, and 7%-10% on intermediate inputs.

The FBCCI, a part of a subcommittee on internal resource mobilisation and tariff rationalisation, will send its recommendations to the Prime Minister's Office (PMO) within this month.

The PMO formed the subcommittee to suggest ways to deal with post-LDC challenges.

The commerce ministry is also working on tariff rationalisation with the help of the National Board of Revenue and the Bangladesh Trade and Tariff Commission.

At present, businesses need to pay up to 25% in duty on imports of raw materials and commodities. Besides, the import duty on capital machinery is 1%, but in some cases, importers have to spend extra owing to the HS code-related complexities.

The average tariff rate in Bangladesh is more than 13.5%, while the rate is 11% in low-income countries and 7.2% in lower-middle income countries 7.2%, according to World Bank Tariff Table 2021.

The FBCCI also suggested keeping reduced VAT rates at up to 6% and cancelling advance tax and it also wants adjustment to tax and VAT deduction at source to stop double taxation.

Bangladesh will have to reduce many of the benefits offered to local industrialists in line with World Trade Organisation (WTO) rules once it becomes a developing country in 2026.

Currently, as a least developed country, Bangladesh can set a minimum import price on products for fixing duties. But after 2026, the country will lose the authority, which might result in the government's revenue losses and substantially hurt local entrepreneurs.

The FBCCI also recommended keeping the effective rate of protection for local import-substituting industries within 30%, which is more than 100% in some cases, and maintaining the existing rates of tariffs and para-tariffs on imports of finished products.

The FBCCI is also making a number of short, medium and long-term recommendations for tariff rationalisation. Apart from bringing down the tariff rates to a reasonable level, the organisation will also point out some ways to increase revenue.

It also proposes that the NBR separate its policymaking department and the implementing department.

On condition of anonymity, a FBCCI official engaged in preparing the proposals, told The Business Standard, "Bangladesh will be obliged to adjust its existing tariff rates after being a developing country. The recommendations have been made to protect local industries and to benefit export-oriented factories."

The FBCCI has cited several inconsistencies in income tax and recommended fixing those.

"Income tax ordinance states that accounts are to be maintained according to the International Financial Reporting Standard (IFRS). On the other hand, tax is imposed on 0.5% and 0.25 % of turnover ignoring the accounts. This is against the international standard and sends a mixed signal to taxpayers and investors. Where accounts are maintained according to the IFRS, tax should be imposed on a business only on net profit," according to the draft proposal.

Md Jashim Uddin, president of the FBCCI, told TBS, "The draft proposal has been prepared in consultation with the FBCCI members and representatives of the government's departments concerned. If this is implemented, it will be possible to retain the potential of local industries and export trade after LDC graduation. It will be finalised soon and sent to the government's department concerned."

Traders have been complaining for a long time that the tariff rate in Bangladesh is higher than other countries.

Economists have also at various times suggested rationalising tariff rates, but little progress has been made.

Dr Zaidi Sattar, chairman of Policy Research Institute, said, "It has become imperative to rationalise and modernise the tariff structure, not only because we need to be fully WTO-compliant by the time of LDC graduation in 2026. The FBCCI suggestions to rationalise all taxes and tariffs is a timely proposition."

"The crux of the problem lies in tariffs on consumer goods. Currently, average input tariff is at 13.5%, while average output tariff on finished consumer goods is 47%. This should be addressed," he said.

However, he disagrees with the FBCCI's recommendation of a 30% effective rate of protection for the benefits of local industries. The final proposal of FBCCI should revisit this issue, he said.

Earlier, in the first meeting of the sub-committee on tariff rationalisation, Zaidi Sattar said that supplementary tariffs should be maintained to discourage automobile and alcoholic beverage products. But, it should be reduced for other products.

He said the differences between input and output tariffs need to be reduced.

The Bangladesh Trade and Tariff Commission has already sent a draft of their recommendations for tariff rationalisation to the authorities concerned. In general, the tariff policy may be formulated in such a way that imports by paying applicable taxes are less than the cost of corruption in the form of under-invoicing and smuggling etc.

Besides, a high tariff is imposed on some products, which are not actually imported into Bangladesh, according to the tariff commission.

On condition of anonymity, a senior official at the commission said, "The average tariff has increased owing to higher tariffs on non-imported goods, which is sending a wrong message to the world market. We have expressed our views on tariff rationalisation considering these issues. Hopefully, the policymakers will consider it."

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel