Money whitening scope widened

The government incorporated an indemnity provision amending the Finance Act to bar relevant government agencies from asking any questions about the sources of such undisclosed money in income tax return

Undisclosed money holders have yet another year to legalise their dirty money without facing any question about sources of income through investments in almost all sectors.

Black money invested in new factories can now be whitened by paying only a flat 10% tax.

Retaining such an option, Finance Minister AHM Mustafa Kamal on Tuesday moved the Finance Bill for the fiscal 2021-22 in parliament in presence of leader of the house and Prime Minister Sheikh Hasina and it was later passed by voice vote.

The government has offered a special package allowing investment of untaxed money in the manufacturing industry in the next fiscal year on the condition of paying only a 10% tax.

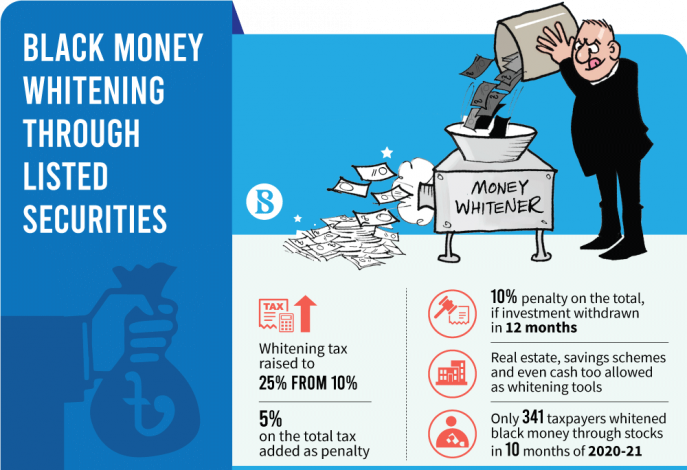

Besides, investment of such money will be allowed in the stock market subject to paying 25% regular tax plus a 5% penalty. The undisclosed money can also be parked as cash, bank deposits, and savings instruments on similar conditions, according to the Finance Act.

The black money owners will be required to pay Tk200-Tk6,000 per square metre to legalise investments in apartments and land.

The government incorporated an indemnity provision amending the Finance Act to bar relevant government agencies from asking any questions about the sources of such undisclosed money in income tax return.

National Board of Revenue (NBR) officials said in the first nine months of the outgoing fiscal year, 10,034 people have legalised cash and assets worth Tk142.95 billion under the scheme, paying Tk14.39 billion in taxes to the NBR.

Of them, a total of 9,693 people whitened Tk138.60 billion mainly in cash, fixed deposit receipts, savings certificates and assets, paying Tk13.90 billion in taxes against the disclosure.

At the same time, 341 people legalised Tk4.35 billion through investment in the capital market and paid Tk490 million in taxes.

There are currently no accurate statistics on the amount of black money in the country. But a finance ministry report in 2010 revealed that the amount would be around 37% of Bangladesh's GDP.

Commenting on the money whitening option in the bill, Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue said the opportunity to whiten black money is a big barrier to curbing corruption in the country.

He said the opportunity to whiten untaxed money is in conflict with the policy framework for tax collection. Observing that whitening black money is not justified in any way, he said this was discriminatory and an immoral decision

Under the Finance Act, the government also relieved mobile financial service providers from a higher corporate tax cutting it down to 30%, backtracking on the government's earlier decision to increase it up to 40% in the proposed budget.

In the budget for FY22, the finance minister had proposed increasing corporate taxes on MFS up to 40% from the existing 32.5%, to bring them into the category of banks, insurance companies and other financial organisations that have been paying a 40% tax.

Later, in the light of demands from MFS providers to consider them as service providers instead of financial institutions like banks, parliament has brought changes to the Finance Bill 2021 as per a proposal from the NBR.

As of March, the number of active MFS accounts is 3.46 crore, according to Bangladesh Bank data. Currently, there are 15 MFS service providers in the country, which have banking services too. At present, around Tk2,000 crores are transacted per day through MFS providers.

Restaurant businesses also got relief as the government reduced VAT on restaurant services. Now, a 10% VAT will be applicable for air-conditioned restaurants instead of the current 15%, while the rate has been slashed to 5% from 7.5% for non-air-conditioned ones.

Earlier, restaurant owners demanded a reduced VAT for all types of restaurants - lower, moderate and fine dining - in the proposed national budget for FY22.

Imran Hassan, general secretary of Bangladesh Restaurant Owner Association, said they wanted VAT to be divided into three slabs as per their class, 3-5% for lower and moderate categories, 7.5% for fine-dining restaurants, and 10% for five-star and four-star categories restaurants.

The government had made it mandatory for businesses to use formal channels such as banks and mobile financial services for transactions involving more than Tk50,000 from the proposed budget. It has moved away from this decision, transactions up to Tk5 lakh can now be made in cash with the purchase of raw materials by a company.

On the other hand, a salary of up to Tk20,000 can be given by hand in cash, which was limited to Tk15,000 in the proposed budget.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel