Union Bank irregularities: S Alam linked to Tk17,229cr in unpaid loans

The report, seen by TBS, revealed that no repayments have been made on these loans since they were issued to these entities

Under Sheikh Hasina's regime, Shariah-compliant Union Bank, controlled by the controversial Chattogram-based S Alam Group, extended Tk17,229 crore in loans to 247 entities affiliated with the group – making up 64% of the bank's total lending, mostly unsecured, according to a recent Bangladesh Bank inspection report.

The report, seen by TBS, revealed that no repayments have been made on these loans since they were issued to these entities. Additionally, the bank's Dhaka Panthapath branch issued a Tk118 crore loan to a customer without the head office's approval, with S Alam identified as the true beneficiary.

The report also underscored substantial irregularities at Union Bank involving S Alam Group and its affiliates.

Banking guidelines allow customers to borrow up to 80% against their Mudaraba Term Deposit Receipts (MTDR) in a Shariah-compliant bank. However, at Union Bank, 19 customers leveraged Tk79 crore in MTDR to secure loans amounting to Tk853 crore – far exceeding standard limits. This was facilitated by officials spanning from "managing directors to branch managers".

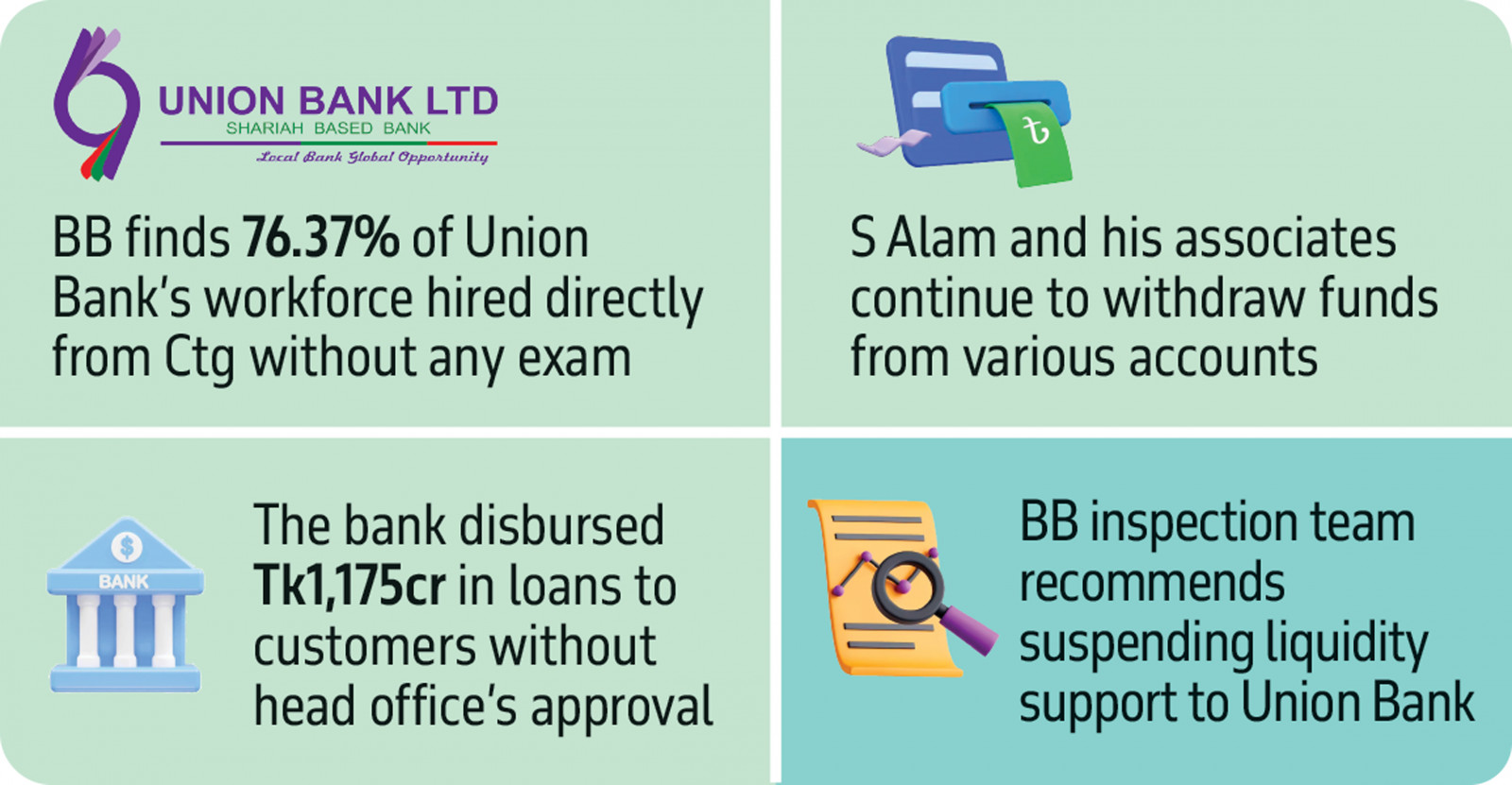

The central bank report says Union Bank also extended Tk1,175 crore in loans to various customers lacking the required MTDRs, bypassing necessary head office approvals.

Additionally, the bank's HR department data shows that 76.37% of its workforce was recruited directly from Chattogram without any examinations, the BB report says.

Although the previous board of the bank was dissolved by the central bank on 27 August, senior management appointed by that board and personnel hired under them remain in their positions, the inspection report says.

S Alam, associates keep withdrawing money from Union Bank

S Alam Group continues to withdraw funds from Union Bank branches with support from insiders, despite Bangladesh Bank restrictions following the ouster of Sheikh Hasina's government.

S Alam Group Chairman Md Saiful Alam, along with his brother Rashedul Alam, brother-in-law Arshad Mahmud, and other relatives, withdrew funds from their Union Bank accounts and transferred them to accounts registered under various entities. The report states that bank and branch management aided in these withdrawals.

According to the report, on 11 August, Saiful Alam transferred over Tk8 crore in Short Notice Deposit (SND) from Union Bank's Muradpur and Bandartila branches to his Khatunganj account, which was later transferred to an account under S Alam & Co at the Agrabad branch.

That same day, Tk4.20 crore was transferred to Russell Enterprises at the Chittagong DT Road branch, and the remaining Tk4 crore was turned into an MTDR for a company called Crobe Trading, a BahaddarHat branch client.

The report further notes that funds were also withdrawn from the accounts of Saiful Alam's brother Rashedul Alam and brother-in-law Arshad Mahmud, and later deposited into various accounts.

On 14 and 18 August, Tk8 crore of Rashedul Alam's MTDR at the Kadamtali branch was withdrawn and re-deposited as MTDRs under the names Ajijunnesa and Rashedul Karim Choudhury.

Similarly, Tk4.22 crore from Saiful's brother-in-law Arshad Mahmud's account was withdrawn on 28 August at the Litchi Bagan branch and issued as pay orders under various names.

The report reveals that on 11 August, S Alam's associate company Top Ten Trading House withdrew Tk12.29 crore of the Tk32.27 crore MDTS from the Khatunganj, Agrabad, and Muradpur branches via pay orders issued under various names at the Khatunganj branch.

From Tk32.27 crore in MTDRs across the Khatunganj, Agrabad, and Muradpur branches, S Alam's associate company, Top Ten Trading House, withdrew Tk12.29 crore through pay orders issued under various names at the Khatunganj branch. The remaining funds were utilized to establish 50 new MTDR accounts in the names of different individuals at the Agrabad and Muradpur branches on 15 August.

Additionally, it was found that the Top Ten was granted loans totalling Tk60.56 crore from the bank's Gulshan branch. Despite the huge outstanding debt, the company was given fast-tracked MTDR withdrawal privileges.

BB report recommends suspending liquidity support to Union Bank

Last August, the Bangladesh Bank restructured the board of Union Bank and dissolved the boards of seven other banks controlled by S Alam Group. The central bank appointed five independent directors to Union Bank.

To help address liquidity issues, the central bank permitted Union Bank to borrow from interbank sources on 22 September, with Tk150 crore already approved under this facility.

The central bank's inspection report found direct involvement of Union Bank's former MD ABM Mokammel Haque Chowdhury, HR head, chief risk officer, investment processing team, head of treasury, CFO, chief anti-money laundering compliance officer, and other senior branch officials in misappropriating depositors' funds.

The report, signed on 23 September, suggested that suspending liquidity support would be in the best interest of depositors and protect Bangladesh Bank's reputation.

Union Bank, along with eight other banks, was approved in 2012 under the Sheikh Hasina administration, reportedly due to political considerations.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel