Outdated policy a major barrier to insurance penetration

Insurance penetration had been decreasing consistently from 2010 until 2021, when it started to turn around a little

Outdated policy is a major reason behind the declining insurance penetration in the country, according to industry insiders.

While consumers are taking insurance policies, most are not completing the terms. And those who are completing the terms are not getting returns on time, leading to them losing confidence in the insurance providers. As a result, insurance penetration is not increasing.

From 2010, insurance penetration has been decreasing consistently until 2021, when it started to turn around a little, thanks to the Covid-19 pandemic which played a role in changing people's perception on insurance policies.

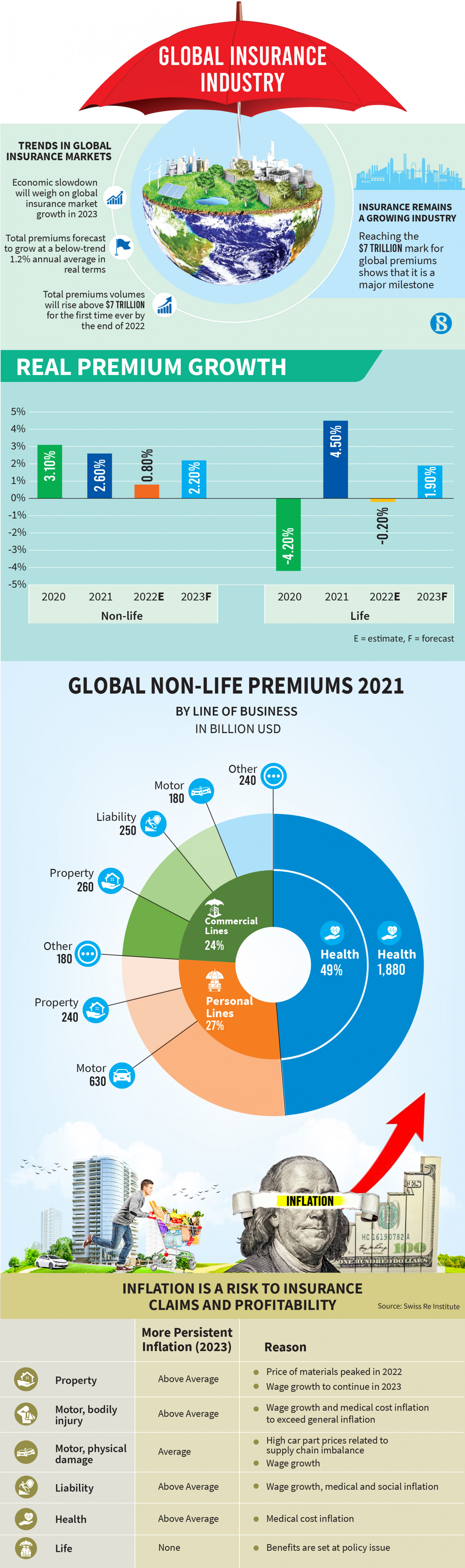

The 2021 report of the Swiss Re institute showed that Bangladesh has the lowest position in insurance penetration among the Asia-Pacific countries; Macao tops the list with 7%, insurance penetration, followed by Thailand at 5.4%, Malaysia at 5.3%, India at 4.2%, China at 3.9%, Vietnam at 2.3%, Philippines at 2%, Indonesia at 1.6%, and Sri Lanka at 1.3%.

According to the report, premiums collection in 2021 was Tk16,928.6 crore, of which premium collection for life insurance was Tk13,218.2 crore while Tk3,710.4 crore was collected for non-life insurance.

Sector insiders say local companies are failing to grow due to a lack of customers' trust, irregular insurance policies, harassment in getting money, lack of product diversification, low use of technology, misleading information from agents and lack of skilled agents.

SM Ibrahim Hossain, director of the Bangladesh Insurance Academy said that about 60% of the policies taken in life insurance are outdated. Customers are discontinuing one or two years after taking policies. This is mainly because of the field workers, who do not explain the process properly to customers. They tend to entice customers, not enlighten them. When the customers realise such policies are not valid, they end the policy.

He said when these customers do not get the benefits of insurance, they tell others about it.

The World Bank is working on a project to ensure transparency. Under the project, a message will be sent to the mobile of the policyholder when the instalment amount is deposited — the process is controlled centrally through integrated software.

Ibrahim said initiatives have been taken to launch bancassurance in the country very soon — in which the commercial banks will sell the products and services of insurance companies.

Of our 170 million people, 13 million are covered under insurance. But bancassurance will widen that coverage net, he added.

"Moreover, the government has made insurance compulsory for expatriate workers. Bangabandhu Education Insurance has also been introduced. Overall insurance penetration will increase. But it will take time," Ibrahim further said.

Sheikh Kabir Hossain, chairman of the Bangladesh Insurance Association (BIA), said that due to lack of proper laws and its compliance, companies get involved in various irregularities. As a result, the trust of the general public on the companies of this sector decreases.

However, as a result of various initiatives of the government regarding insurance, now common people are getting involved with insurance. Regulatory agencies are forcing companies to create new laws and comply with them. As a result, insurance claims are paying much more than before.

"I believe it will move forward. But it will take some time. The sector will move forward if companies do business with compliance; The country's economy will prosper," he added.

Ala Ahmad, CEO of MetLife Bangladesh, the only foreign insurance company in the country, said, "A country's insurance penetration depends on several factors, including its economic development, level of integration with other financial services and people's lifestyle, and mass awareness. Bangladesh's low insurance penetration can be attributed to the fact that many people are still unaware of the functionality and benefits of insurance."

He also said, "The good news is both the Bangladesh government and insurers are actively working towards increasing insurance penetration in the country. National Insurance Day is now being celebrated to recognise the sector's contribution to saving lives and in making the economy resilient. Insurers today are striving towards providing more convenient services to customers and raising awareness about their products and services. Combined efforts like these will help strengthen our insurance sector in the coming days.

SM Nuruzzaman, CEO of Zenith Islami Life Insurance Ltd, said the entire life insurance sector is suffering because of 5 to 6 companies. They are not paying customers on time.

He said the affected customers are making negative campaigns about insurance through social media. As a whole, life insurance is decreasing. Besides, a negative perception is being created towards life insurance.

"Our curriculum needs to have a basic understanding of insurance. So that the subject of insurance is familiar from a young age. Skilled human resources should be developed in the country with insurance. Students will be interested in building a career in the insurance sector if the sector's potentials are highlighted," he added.

Insurance Development and Regulatory Authority of Bangladesh (IDRA) spokesperson MD Jahangir Alam said various initiatives of the government are working on boosting people's confidence.

"Now common people are benefited by insurance. If this rate increases, insurance penetration will increase," he added.

Sheikh Rakibul Karim, chief executive officer of Guardian Life insurance Limited said Insurance penetration is predominantly proportional to the health of the economy. Now that Bangladesh is on the highway to becoming a middle-income country, many experts predicted that the insurance penetration is now bound to go up and we have seen a reflection of that in 2021.

"Another crucial business channel is Bancassurance, we have been a key advocate of this innovative insurance distribution model and are eagerly looking forward to its implementation. With the advent of Bancassurance, the banks will open up their branches to sell insurance to walk-in customers and that would largely increase the insurance penetration further," he said.

"Another point worth mentioning here is the overall insurance literacy, since the literacy is low, there is always a chance of misinterpretation stemming from a lack of knowledge on insurance products. This aggravates the situation further. Our regulator is working hard to drive insurance literacy and national insurance day is definitely a testament to that," he added.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel