A stock market intermediary can borrow Tk2cr from stabilisation fund

The CMSF seeks applications from intermediaries interested to avail the loan.

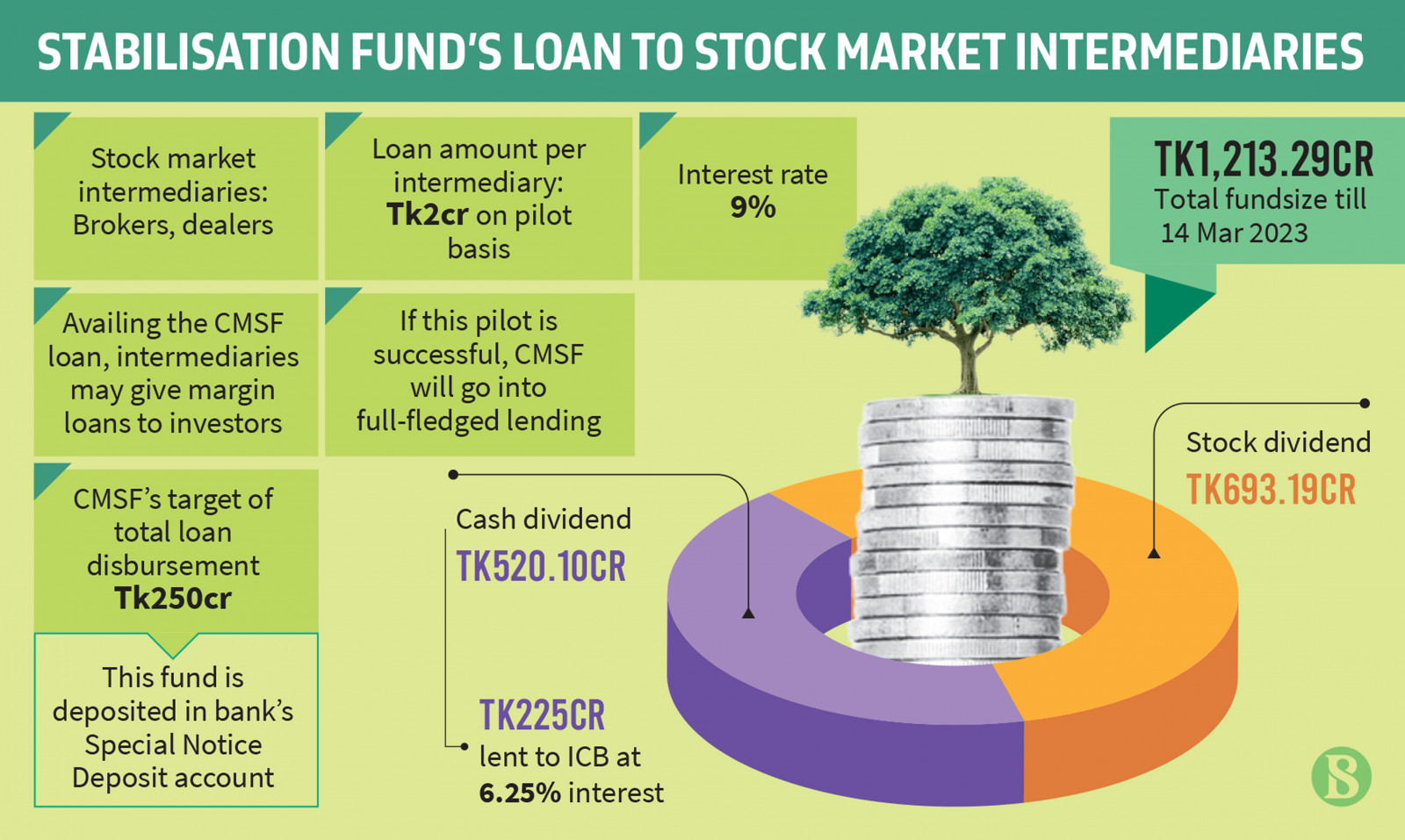

The Capital Market Stabilisation Fund (CMSF) has decided to disburse loans of Tk2 crore to each applicant stock market intermediary, enabling them to make investments in the capital market.

The loan disbursement amount was finalised at the fund's board meeting held on 11 October, where the loan interest rate was set at 9%.

In May this year, the Bangladesh Securities and Exchange Commission (BSEC) had set loan disbursement targets not less than Tk5 crore and not more than Tk20 crore for each intermediary.

But the CMSF will disburse Tk2 crore loans on a pilot basis. After successful implementation of the test case, the CMSF will increase lending as per demand from the intermediaries.

The CMSF, which was formed in 2021, acts as a custodian of undistributed cash and stock dividends, non-refunded public subscription money and un-allotted rights shares from the issuer of listed securities. It has around Tk250 crore in its Special Notice Deposit account allotted for loan disbursement to intermediaries.

Now, the CMSF seeks applications from intermediaries interested to avail the loan.

After scrutiny, the eligible intermediaries will be able to avail the loan within 21 working days. The tenure of the loan will be 180 days, renewable upon successful use of the loan amount and full payment of loan interest to CMSF.

The CMSF will give preference to intermediaries who are involved in the financial literacy program, providing training to small investors, involved in social welfare activities, working with disabled people, protecting the environment, and following other corporate social responsibilities.

Any stock broker or intermediary, which has deficiency in consolidated customers' account (CCA), not compliant with risk based capital adequacy and/or has had any punishment from the authorities in the last five years, will not avail the loan.

Also, an intermediary or any director of intermediary, who is a loan defaulter through CIB report, will not be eligible for the loan.

The market intermediaries — stock brokers, dealers — can use their borrowing from CMSF to invest in stocks that have been in the 'A' category for five consecutive years.

Also, they can provide margin loans to their clients as per policy. The single borrower exposure will be a maximum 5% of the total available fund for loan.

Officials at CMSF said the decision of lending will help the intermediaries to invest fresh funds in the capital market, when the market really needed a fresh investment.

Seeking anonymity, a brokerage house official said the market is currently almost stagnant due to the floor price. There is negligible price movement observed in fundamental stocks, while certain junk stocks are soaring."

"The decision to disburse loans is undoubtedly positive. However, the lingering question is how intermediaries will manage to repay this high-interest loan amidst the bleak market outlook," he added.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel