BSEC steps to bring back Aman Cotton’s IPO fund go in vain

BSEC has decided to form a new investigation team to bring back the IPO money

It seems no measure taken by the market regulator to bring back the initial public offering (IPO) fund of Aman Cotton Fibrous Ltd is working.

None of the various initiatives taken in the interests of the investors have yet seen success. Rather, the company has been taking "unethical" benefits from IPO funds for several years.

The Bangladesh Securities and Exchange Commission (BSEC) has decided to form a new investigation team to bring back the IPO money.

Seeking anonymity, senior officials at the commission said the committee will be formed soon and it will work to determine the location and current status of the money and how to get it back.

It will also look into the business conditions of the company.

This correspondent called Company Secretary Shariful Islam for comment, but he did not answer his mobile phone.

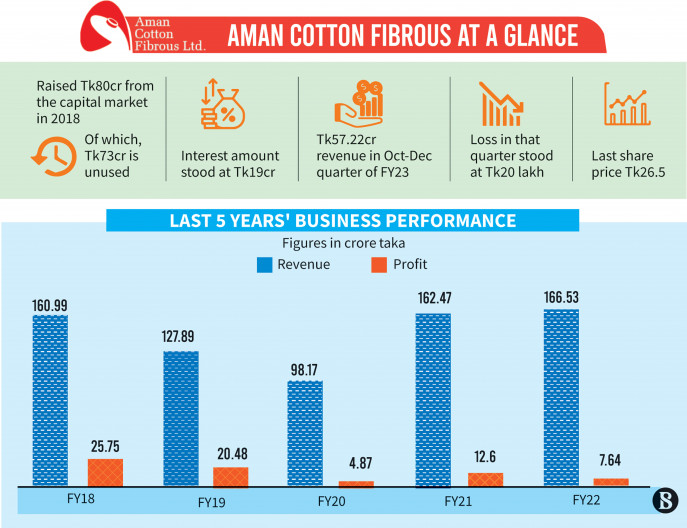

Back in August 2018, Aman Cotton raised Tk80 crore from the stock market through an IPO to buy new machinery and repay loans.

But instead of buying machinery, it pledged Tk73 crore of the IPO fund as security for credit facilities for two of its sister concerns – Akin Carriers Limited and Aman Food Limited.

Akin Carriers enjoys a credit facility of Tk38 crore as an overdraft on the balance in its fixed deposit receipt (FDR) in Meghna Bank and of Tk15 crore in Al-Arafah Islami Bank.

Aman Food also enjoys a similar facility of Tk20 crore in the Commercial Bank of Ceylon PLC.

In June 2020, the regulator appointed a special auditor – Howladar Yunus & Co – to investigate the utilisation of IPO proceeds and audit the financial statements of the company.

The company's directors were fined a total of Tk12 crore by the regulator for irregularities in its IPO fund utilisation plan and financial statements. And also directed the cancellation of the company's lien of Tk73 crore in fixed assets within seven days.

The regulator also fined its auditor, ATA Khan & Co. Chartered Accountants, Tk10 lakh for failing to raise concerns with the company about false information.

But the company sought time from the commission until July 2023 to use its IPO proceeds in the original project. And the company has obtained a stay order from the court on the BSEC fine.

In order to recover Tk73 crore in investor funds, the BSEC directed those banks to cancel their lien with Aman Cotton Fibrous Ltd.

But the regulator has not yet been able to bring the IPO funds back.

Besides, the company gave loans to one of its sister concerns without the approval of its general investors. As a result, investors were deprived of gains and lost a lot of capital.

From the October to December period of 2022, Aman Cotton's revenue stood at Tk57.22 crore.

But the company incurred a loss of Tk25 lakh and the loss per share stood at Tk0.02.

As of 31 January 2023, sponsors and directors jointly held 49.58%, institutions 14.24%, foreign investors 0.10%, and the general public 36.08% of the company's shares.

The last trading price of each share of the company was Tk26.50 on Wednesday at the Dhaka Stock Exchange.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel