Govt to raise Tk15,000cr for three projects through sukuk

Low revenue collection and high project costs push government into going for Islamic bond financing

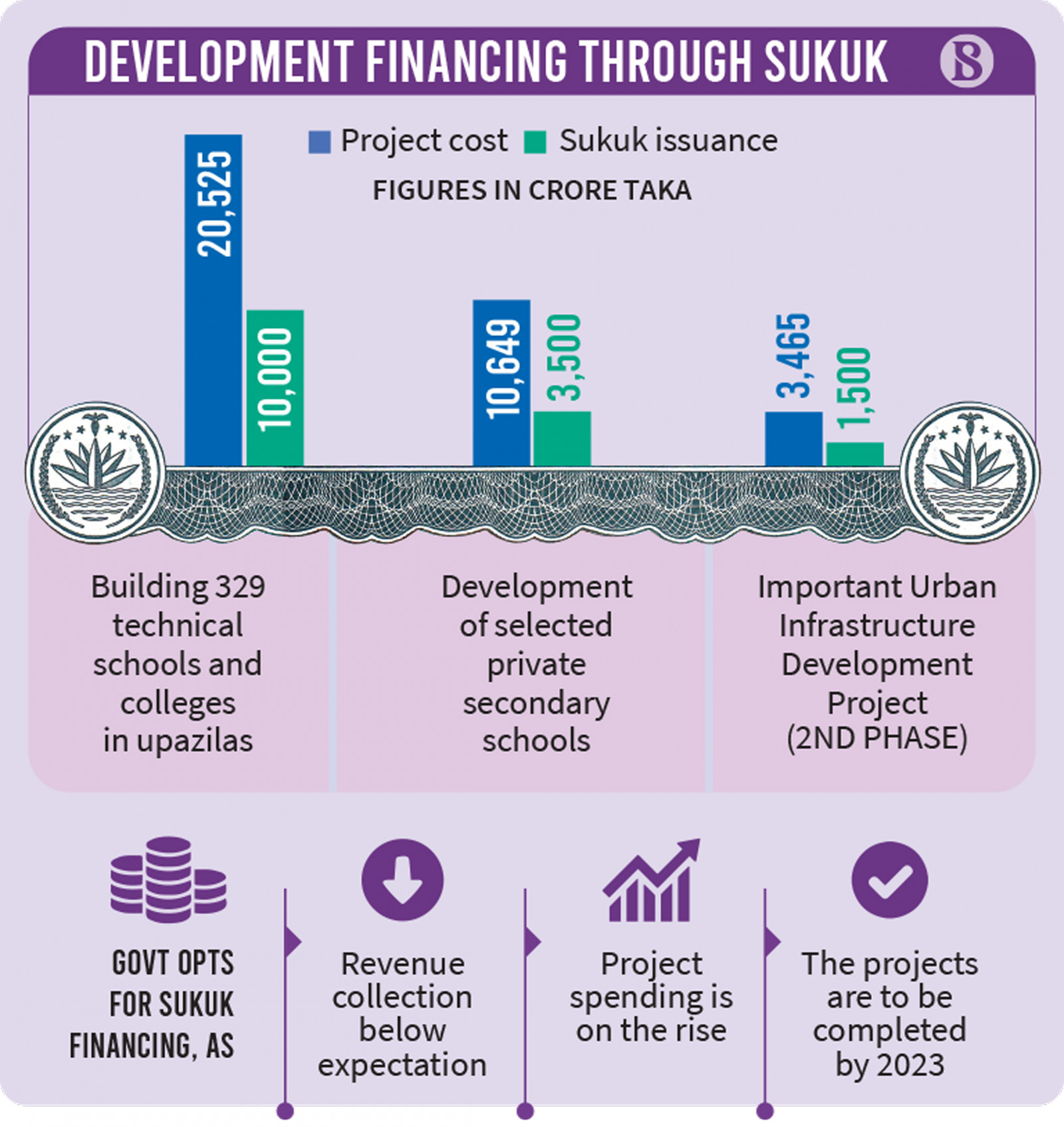

The government will raise Tk15,000 crore by issuing Islamic bond sukuk to finance three ongoing development projects, according to officials.

The finance ministry has initially selected the projects, which will be completed by 2023. Ministry documents show that implementing agencies of the projects have recently been asked to review the project plans for the Islamic financing.

The projects are: setting up 329 technical schools and colleges at upazilas, development of selected private secondary schools, and key urban infrastructure development project (2nd Phase).

According to sources, the total cost of the projects has been estimated at Tk34,500 crore, with nearly half the cost to be financed through the Islamic bond.

Sukuk is a long-term financing instrument without traditional banking channels. Against the investments, sukuk investors are offered profits instead of a fixed interest, which is prohibited in Islam.

To meet budget spending, the government depends on revenue collection, treasury bills and bonds, bank loans and savings certificates.

Officials have said they are now looking for long-term financing of major projects through sukuk as revenue collection has not been up to expectations, while project costs are on the rise.

Islamic banks and other financial institutions can come for long-term investment through sukuk. In his FY23 budget speech, Finance Minister AHM Mustafa Kamal mentioned that the introduction of the sukuk instrument has created huge opportunities for Sharia-based banks to participate in the governmental development process.

Earlier in the 2020-21 fiscal, the government issued Tk8,000 crore sukuk bonds for a massive water-supply project. The next year, more sukuk bonds to the tune of Tk10,000 crore were issued, with Tk5,000 crore of the amount being invested in the government primary school development project.

The project to build 329 technical schools and colleges, which will use the highest Tk10,000 of the sukuk raised fund this time, was approved by the Executive Committee of the National Economic Council (Ecnec) in January 2020.

The cost of the project has been estimated at Tk20,525 crore as the government is to fund the entire work from its own resources.

The project includes land acquisition, development, administrative building, teachers' dormitory, 200-bed student dorm, shaheed minar, memorial, purchase of vehicles, machinery and teaching and learning materials.

Project Director Sayed Masum Ahmed Choudhury said the process of land acquisition is now going on. The authorities have already acquired land for five schools. The construction of one educational institution has got underway.

"Land acquisition and construction of the remaining schools will begin gradually," he told The Business Standard.

The government intends to finance one-third of the "development of selected private secondary schools project" through sukuk. The estimated cost of the project is Tk10,649 crore, as the government wants to mobilise Tk3,500 crore through sukuk.

With the Education Engineering Department as the implementing agency, the project deadline is 2018-203.

Under the project, four-storied academic buildings are being constructed in remote areas, six-storied in urban areas and five-storied academic buildings are being constructed, leaving the ground floor vacant in haor areas.

Till June 2021, the average progress of the project was 56%, with spending amounting to about Tk6,000 crore.

The government in 2019 commissioned the "Important Urban Infrastructure Development Project (2nd Phase)" involving Tk3,465 crore at 281 municipalities. The government wants to finance about half the cost through sukuk.

The Local Government Engineering Department is implementing the project with a December 2023 deadline.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel