India’s wheat ban a kick for those already down

Even before the start of the Russia-Ukraine war, the price of a packet of bread of different brands weighing 325-350 grams was Tk35, which is now Tk40

From the first bite of the day of a roti at home or a naan at a roadside eating place, to a midday snack of oven baked bread or a pack of biscuits with a cup of sweet milk tea, food items made from wheat have been some of the top choices of consumers. But those days are past now as the market of wheat is about to get unsavoury.

Major business sectors and almost all consumer segments now look at a very unsure future after the sudden ban on wheat exports by India on Friday.

But it is the poorest who will be hurt the most, despite another generous round of food security assurances given by government officials.

India's Directorate General of Foreign Trade on Friday announced the ban on wheat exports, which came soon after Bangladesh had already imported 27.15 lakh tonnes of wheat till 1 March of the current financial year.

Food traders say that despite the imports, there still remained a demand gap of three million tonnes this year.

Similar to the price hike of other essentials, wheat prices have already started rising in the country's market immediately after the announcement of the export ban.

On Saturday, the price of wheat in the wholesale market increased by Tk150 per maund, with traders implying a further increase if the international wheat market is destabilised.

Meanwhile, Secretary to the Food Ministry Mosammat Nazmunara Khanum said the ban will not affect the three lakh metric tonnes of wheat already contracted for import by Bangladesh.

Talking to the UNB, the secretary said a third of the amount, 1 lakh MT, is already onboard

In the short term, the Indian embargo would have no effect on food security in Bangladesh, as enough wheat to meet domestic demand has already been imported or is in the pipeline.

The secretary further assured that at the moment the country's stock of wheat is enough to last through August, and there would be no need to import any wheat before that.

There would still be scope to import wheat from India at government to government (G2G) level, as mentioned in the Indian wheat export ban notification, Nazmunara also pointed out.

This assurance, however, hasn't stemmed the rise in prices of wheat.

Nazmunara further said that Bangladesh had also signed a deal with Bulgaria to import wheat and is looking at other exporters including Australia, Canada, Ukraine and Russia.

Although wheat can still be imported from Canada, America and countries in the European Union, those are commonly used for high value food products including chanachur, pasta, burgers, pizza, and cakes.

These products are not considered major part of the diet, while the wheat from India goes towards more widely-consumed and staple items such as bread and biscuits.

Md Shafiqur Rahman Bhuiyan, president, Bangladesh Auto Biscuits & Bread Manufacturers Association, said the wheat from India is used by low-income persons.

An increase in wheat prices would thus directly impact the most economically-disadvantaged group in the country.

Even before the start of the Russia-Ukraine war, the price of a packet of bread of different brands weighing 325-350 grams was Tk35, which is now Tk40.

The price of noodles has increased by more than 10% depending on the brand with biscuit prices already having risen.

Even a cursory glance at restaurant prices show that the price of a basic item like paratha has almost doubled while the Tk5 parathas vanished from the menu.

Taslim Shahriar, senior general manager of Meghna Group, another giant in the country's consumer goods market, told TBS that in this situation people's food habits may change, with more consumers reverting to fruits from snacks.

The manager also said that the rice production in the country was good so it could be seen as an alternative.

According to the food ministry, Bangladesh's annual demand for wheat is around 7.5 million metric tonnes (MT), of which just one million MT is produced locally on average in a year.

The remaining demand is met by importing wheat from India, Russia, Ukraine, Canada, Argentina and the USA, the overwhelming portion by the private sector.

The government imports just half a million tonnes, with the private sector accounting for the other six million MT, the secretary said.

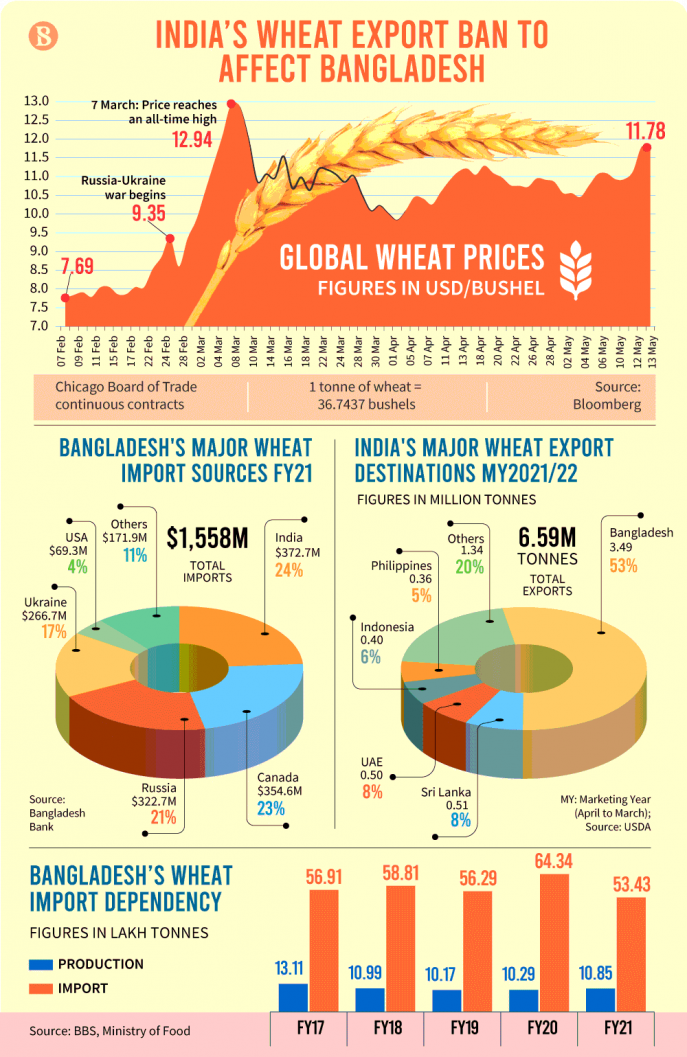

Bangladesh - the second fastest growing wheat importer in the world - procures around 36 lakh tonnes of wheat from India to meet its demand for 65 lakh tonnes of wheat per year.

Bangladesh also emerged as the top destination of wheat exports from India, having the largest share of more than 54% in both volume and value in the 2020-21 fiscal year, according to data from the commerce ministry.

The remaining comes from Russia and Ukraine, among others.

Ukraine, Russia, Canada, Argentina, and the US were the top five countries exporting wheat to Bangladesh in FY 2019-20.

A supply crunch in the offing

India's sudden ban on wheat export has raised concern over the staple's future supply as half of Bangladesh's need for wheat is being sourced from its next-door neighbour since the Russia war snapped supplies from Ukraine.

India halted new shipments of wheat from Friday citing a decline in yields due to drought which has put its own food security at risk, says Bloomberg.

Bangladesh's G2G agreement to purchase the staple to meet food security needs and shipments with irrevocable letters of credit, issued before 13 May, will, however, still be allowed, according to the latest notification of India's commerce ministry.

Meanwhile, India's decision, the latest in the global spate of food protectionism, was a quick about-turn from the country's ministry's plan announced just the day before to send trade delegations to a number of countries to explore export markets.

International traders have already contracted to export four million tonnes so far in 2022-23, while the full year export target is set at a record 10 million tonnes, India's food ministry said on 4 May.

India, the world's second largest wheat grower after China, had emerged as an alternative source after wheat supplies were cut from the two Black Sea breadbaskets- Ukraine and Russia after the war.

Russia and Ukraine used to account for a fourth of the world's wheat shipments before the war cut the supplies from late February.

But India's domestic challenges have come into sharper focus in recent weeks amid reports of wheat crop damage due to hot temperature in March, prompting the export ban.

Bangladesh had started to reduce dependence on Ukraine and rely more on Indian wheat even before the war.

The latest ban, however, will put Bangladesh into a race with top buyers like Egypt and Turkey which are recently choosing India as their new source of wheat.

"Our sourcing space is dwindling," Biswajit Saha, director of CityGroup, one of the country's largest commodity suppliers, told The Business Standard.

"This means that global supply is declining. Now we have to spend more to buy wheat. However, there are further concerns whether supply will even meet demand," he said.

Saha said the rise in wheat prices due to the Russia-Ukraine war had already impacted the prices of many commodities, but it was difficult to say how much the price would go up now that India had banned exports.

Bangladesh is the fifth largest importer of wheat in the world.

In FY 2020-21, Bangladesh imported more than half its wheat from Russia, Ukraine and India, all of which are now no longer options.

The country also imported 23% from Canada, 4% from the USA and 11% from several countries, including Australia.

As a global supplier, India exports 6.59 million tonnes of wheat to several countries including Bangladesh, Indonesia, Philippines, UAE and Sri Lanka. Bangladesh alone imported 53% or 3.49 million tonnes of these exports.

Redwanur Rahman, general manager, Bashundhara Food and Beverage Ltd, said a closed source would mean lower supply. If demand for a good which isn't easily available doesn't fall then the prices will go up.

Greed or need?

Although India's ban has just been announced, the price of wheat has already gone up.

The Indian Pratiman variety was being sold for Tk1,550 for 37.32 kg on Saturday in Khatunganj, a wholesale market for consumer goods. The same was priced at Tk1,400 on Thursday.

Canadian wheat was being sold for Tk1,950 on Thursday, but is now being sold at Tk2,100 per quintal (equal to 100kg).

Earlier, before the start of Russia's military operation in Ukraine on 24 February, the market price of Indian and Ukrainian wheat was Tk1,050 per quintal and Canadian wheat was Tk1,500 per quintal.

As such, the price of wheat in the wholesale market has gone up Tk500-600 in the last two-and-a-half-months.

Mohammad Selim, owner of Messrs. RM Store, a wheat trader in Khatunganj, said that the price of wheat in the market has been on the rise since the Russian invasion of Ukraine.

In the last two-and-a-half months, the prices of essential commodities have gone up by 30-60%, he said.

Abul Bashar Chowdhury, chairman of BSM Group, a wheat importer, said, "We have been meeting the country's demand by importing wheat from India since the beginning of Russia's military invasion of Ukraine. But on Friday, India banned the export of wheat."

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel