Electricity bills: Our neighbours pay less. Why can't we?

To find the answer, we need to take a look at our energy mix — and beyond

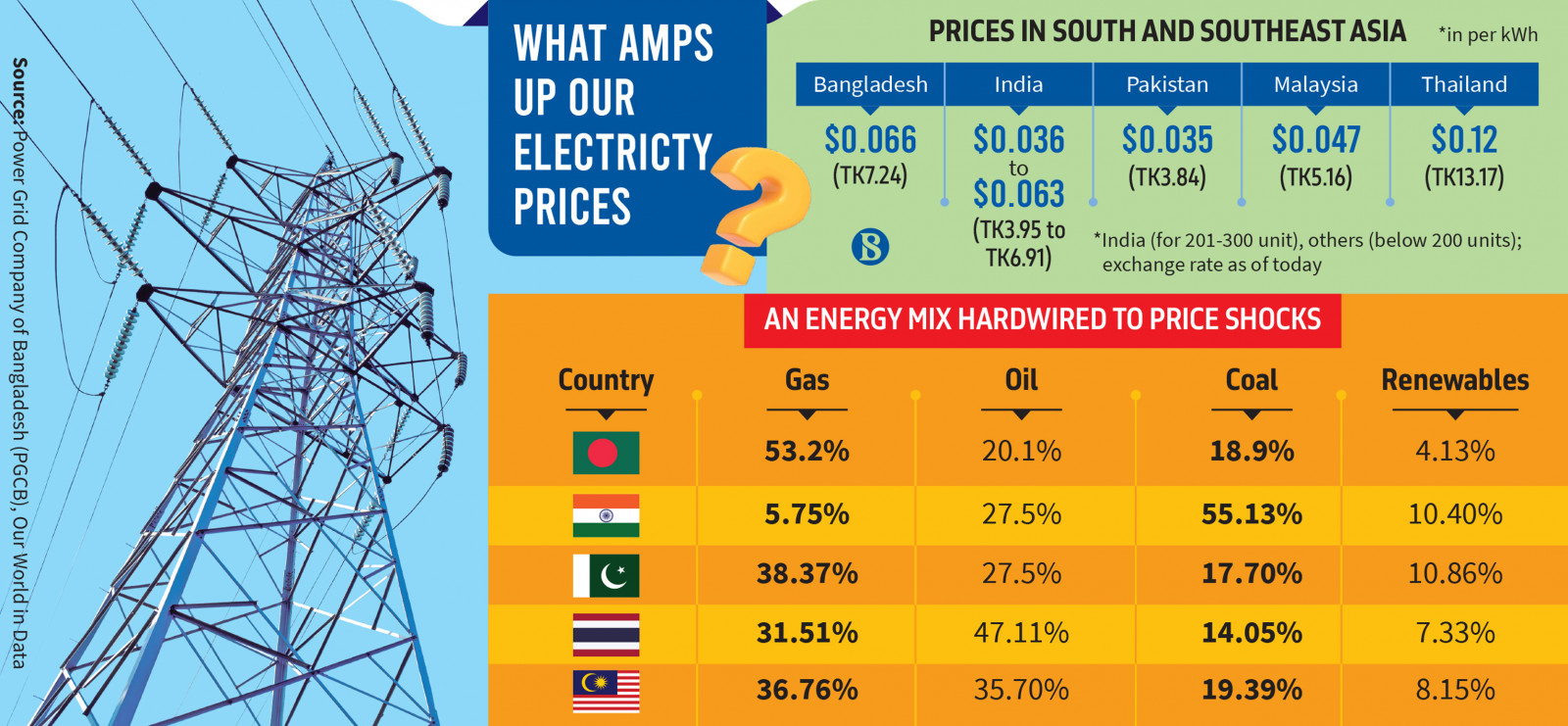

Following a recent surge in gas prices, the government of Bangladesh announced an 8.5% increase in average electricity tariffs on 27 February. This resulted in a hike from Tk6.70 to Tk7.04 per unit at the wholesale level and from Tk8.25 to Tk8.95 per unit at the retail level ($0.082 per kWh).

Bangladesh is heavily dependent on its fossil fuel-based thermal power plants, several of which it has opened in the past few years. Though thermal power plants have lower upfront costs, they incur ongoing expenses for fuel purchases.

The way a country balances these costs within its energy mix influences the overall cost of electricity generation and, ultimately, the price paid by consumers.

But to better gauge Bangladesh's energy prices, let us check if our neighbours also pay such high electricity bills.

Our electricity pricing is multi-tiered. So, for comparison, let us take two tiers — domestic consumption between 76-200 units and 201-300 units.

For 76-200 units, the cost is Tk7.20 or $0.066. And for 201-300 units, the cost is Tk7.59 or $0.069.

In neighbouring countries, electricity costs vary considerably.

In India, prices fluctuate due to factors like fuel prices, government regulations and regional variations ranging from $0.036 to $0.063 (for 201-300 units).

Pakistan charges $0.035 per unit for electricity consumption under 200 units. Moving to Southeast Asia, Malaysia sits at $0.047, while Thailand stands at $0.12 per unit for electricity consumption (below 200 units).

So why are our prices so high?

Energy mix and electricity pricing

Prominent energy expert Dr Mohammad Tanzimuddin Khan, professor at the Department of International Relations, Dhaka University, thinks that the energy mix of Bangladesh plays a major role in our energy pricing.

"A nation's electricity prices are demonstrably influenced by the composition of its energy sources. First and foremost is fuel cost. Traditional fossil fuels, such as coal and natural gas, are susceptible to price swings based on the global market and geopolitical tensions. This volatility translates directly into fluctuating electricity prices."

When we look at other countries mentioned before, we will see a very interesting difference compared to Bangladesh — our heavy dependence on natural gas and the minute share of renewables in our energy mix.

It is quite evident that countries with more renewable energy in their energy mix can afford lower electricity bills. Bangladesh stands alone on the list with such low renewable energy production and a high electricity bill.

Moreover, Bangladesh is not only depending more on gas, but half of it is imported.

The cost of importing energy

Two decades ago, Bangladesh generated 90% of its electricity needs from domestic fuel. However, the figure has dwindled to approximately 75%. Projections estimate that the use of domestic fuel for power generation will see a further drop to 10% by 2030.

Meanwhile, around 70% of the land remains untapped for oil and gas exploration. It is a common notion that Bangladesh's gas reserves are running out, but if such a huge part of the country is unexplored, the concern seems unreliable.

In 2018–19, Bangladesh began importing LNG for the first time. Since then, LNG imports have supplied the majority of the country's gas needs. At $4.55 billion, the nation imported 5.06 million tonnes of LNG from Qatar Gas, Oman Trading and the Spot Market in 2022. From 2.53 million tonnes in 2018–2019, import of LNG has doubled.

Heavy import dependency makes a country vulnerable to external shocks. This phenomenon was seen widely around the world in 2022 when the Ukraine-Russia War broke out and fuel prices went off the roof in Bangladesh. The shock has remained strong, and the strain it is putting on our reserve is immense.

Dr Khondaker Golam Moazzam, research director of the Centre for Policy Dialogue (CPD), says global price fluctuations affect domestic electricity prices.

"When the price of fuel increases in the global market, it adds to the pressure on government subsidies. And then, the government has to increase electricity prices to adjust the pressure. So, global price fluctuations cause our electricity price hike."

And such import dependency in the LNG sector has spiked energy bills.

"When Bangladesh became import-dependent for LNG instead of sourcing the natural gas locally, it directly added more pressure on the price of electricity," Dr Tanzimuddin Khan noted.

Also, Bangladesh's 2017 gas sector master plan prioritised domestic exploration over expensive LNG imports. The plan estimated that $3 billion would be spent on LNG by 2030, highlighting the cost-effectiveness of indigenous resources. Despite this, government action has been limited.

The 2022 gas crisis spurred Bangladesh Petroleum Exploration and Production Company (Bapex) to accelerate exploration efforts, exposing past neglect in this area. Bapex's success in drilling nine wells and saving over Tk1 lakh crore on LNG imports by spending only Tk800 crore demonstrates the stark cost difference between domestic gas and spot market LNG.

"If we ramped up gas exploration and focused more on our natural gas reserves, we would not see such high electricity bills."

The average cost of electricity generation in Bangladesh increased significantly from 2020-21 to 2021-22. The average generation cost per unit increased by 33.74% from Tk 6.61 to Tk 8.84.

There is a significant difference in the cost of electricity generation between different sources. The PDB's power plants and state-owned power plants are the cheapest at Tk5.02 and Tk4.47 per unit, respectively. Private sector rental power plants are more expensive at Tk9.80 per unit, and independent power producers (IPP) are the most expensive at Tk11.55 per unit.

There's more to the story. Bangladeshi gas-powered power plants sit idle, as at least 15% of the country's 71 independent power producers were sitting idle for 80% of the time last fiscal year.

"We have excess power production capacity than what is needed for us, and capacity charge for that has to be paid. About 42%-50% of our capacity is excess, and all that cost is added to the consumer's electricity bill," said Dr Moazzem, "and there are many plants which have very low efficiency. Yet, they are still operational and being paid for. This all adds up to our bills."

An eye-watering Tk90,000 crore was paid as capacity charges to private power plants over the past 14 years, all of which had to be in dollars. And this puts stress on both our foreign reserve and electricity bill.

"So much capacity payment would not have to be paid if there were not so much excess capacity. Both the consumers and the government are bearing the burden."

At the same time, while paying for capacity charges for quick rentals, the government imports electricity from India; citing the fact that the imported electricity is cheaper than the quick rental ones. This is a clear sign of a faulty policy. On one hand, the government is paying such a high capacity charge to quick rental companies, and on the other hand, it is importing electricity from India.

"It is not logical to import electricity from India just because it is cheaper," Dr Moazzem said, "We have excess capacity. Why did we even need it?"

When relying heavily on imports, Bangladesh loses significant control over its electricity pricing structure. Unlike domestically sourced fuels, where governments might have some influence on pricing, the cost of imported fuels is determined by external market forces. This limited control can make it challenging to implement policies aimed at stabilising electricity prices.

About a third of plant capacity remains idle. But then it still imports 1,160 megawatts (MW) of electricity from India. According to the Power System Master Plan 2016, the government aims to import more 2,336MW by 2030. The reason is that domestic LNG-based electricity is costlier than Indian coal-based electricity.

"We have the capacity to meet our electricity demand, yet we import electricity from outside," Dr Tanzimuddin Khan said, "It is not logical. Monetary value alone can not determine the justification of electricity imports since it is also a matter of national interest."

"High dependence on imported fossil fuels increases a nation's vulnerability to supply disruptions and political instability in exporting countries. This can pose a threat to energy security and potentially lead to power outages or rationing during critical situations. And we have seen that happening to European countries during the Russia-Ukraine War," he added.

A heavy reliance on imported fossil fuels can create a disincentive for investing in domestic renewable energy sources. This can lead to missed opportunities for long-term cost savings, environmental benefits, and increased energy security.

This begs the question — Who is paying for all the costs? The answer is — Us. Hence, the electricity bill keeps hopping, yet load-shedding occurs daily even in February.

This is bad news, since renewable energy sources like wind and solar power boast lower fuel costs, though they necessitate a significant upfront investment in infrastructure. A country with a higher proportion of renewables in its energy mix experiences less dramatic fluctuations in fuel costs, potentially leading to greater stability in electricity pricing.

The Integrated Energy and Power Master Plan (IEPMP) 2023 has forecasted the share of renewable energy in the final power generation mix at merely 11% and 16% in 2041 and 2050 respectively. The value is about the same as that of our neighbours, India and Pakistan, at present.

"Tax structure design is important to promote renewable energy," Dr Tanzimuddin said, "We do not have the tax cuts necessary to incentivise renewable energy. If we can promote renewable energy, then our electricity bill will come down significantly."

Bangladesh's energy mix has complex economic consequences for electricity pricing. Reliance on volatile fossil fuels can lead to price fluctuations, while a higher share of renewables can offer stability and potentially lower costs in the long run. However, upfront investment needs and government policies add further layers of complexity to the relationship between the energy mix and electricity pricing.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel