Islamic Finance lends Tk373cr without collateral

Islamic Finance and Investment Limited – a non-bank financial institution – has disbursed loans of Tk372.70 crore without any eligible security, such as a mortgage or a lien on shares, according to its independent auditor.

In the audit report for 2022, Kazi Zahir Khan and Co mentioned that the collateral-free loans represent 31% of the company's total leases, loans, and advances.

According to the Bangladesh Bank guidelines, collateral is an asset pledged by a borrower to a lender until a loan is paid back. If the borrower defaults, then the lender has the right to seize the collateral and sell it to pay off the loan.

The hesitation of a borrower to provide collateral could signal to the financial institution that the borrower is fully aware of the implications of making this pledge, and if he does provide collateral, then he is likely to do everything to avoid the loss of the pledged asset, it added.

A central bank official said there is scope to provide collateral-free loans to small entrepreneurs in some emerging sectors, such as women entrepreneurs and agriculture.

"However, it should not be more than Tk5-10 lakh. There is no scope to provide a bigger loan without collateral," he added.

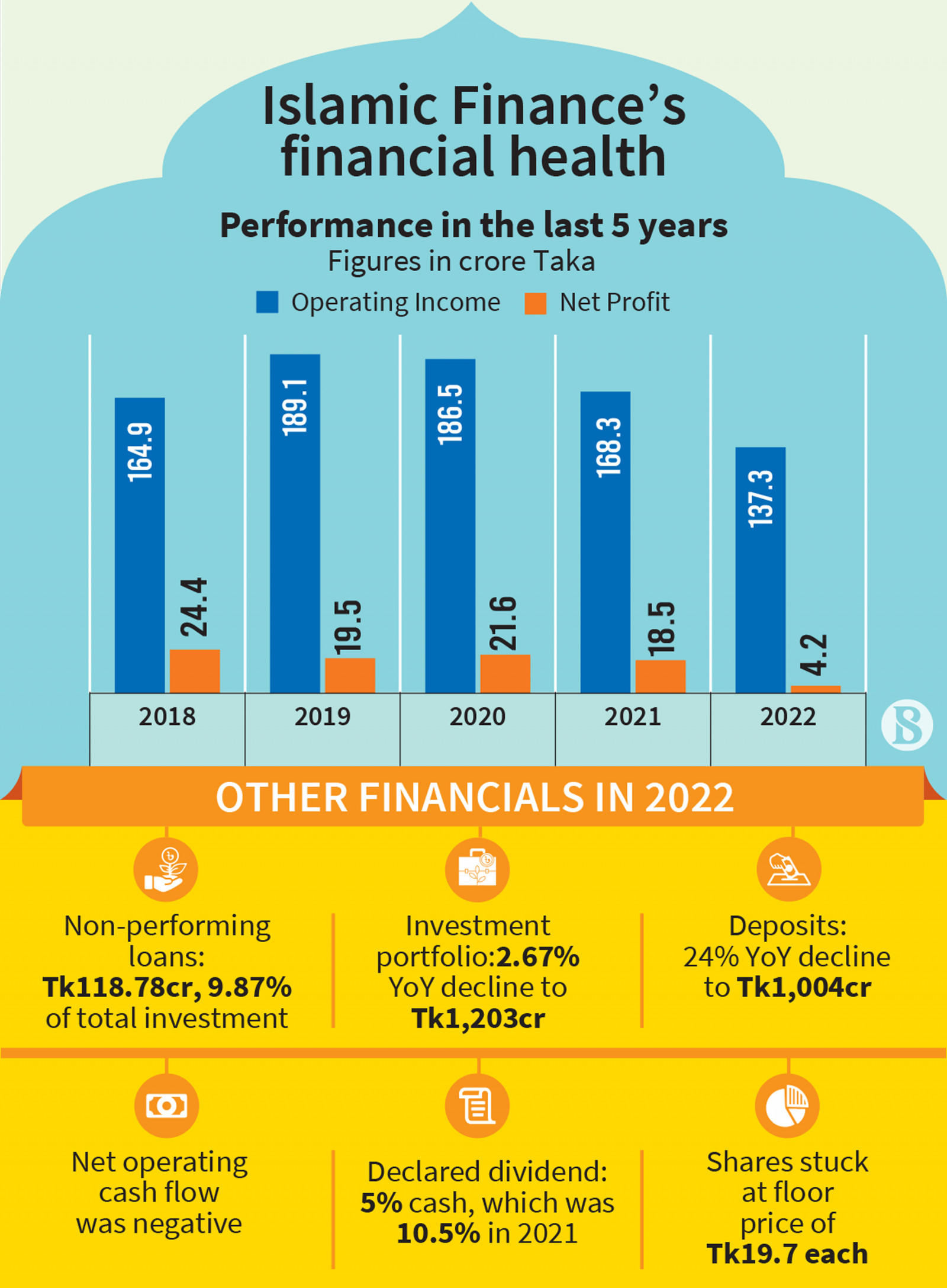

Besides, Islamic Finance's non-performing loan jumped by 140% to Tk118.78 crore year-on-year, which was 9.87% of its total disbursement in 2022. The classified loan ratio was 4% a year ago.

Mohammed Mosharaf Hossain, managing director of Islamic Finance, told The Business Standard, "There has been no violation of the Bangladesh Bank guideline in disbursing loans without collateral. And these loans are given through corporate and personal guarantees and advance check issues."

"We have several borrowers in the market whose reputation is good, but they have been given loans on the basis of guarantees," he added.

However, he said that there is a risk in disbursing loans without collateral. "So we are now more cautious about this."

And as the reason for the increase in defaulted loans, Mosharaf Hossain said, the Bangladesh Bank had given a deferral facility to pay the loan instalments during the coronavirus pandemic, but the facility has ended.

"Now we are not extending time for loan rescheduling or instalment payment. We have been strict with those who could not pay their instalments on time. And this is why defaulted loans have increased," he added.

Mosharaf Hossain said, "Currently, we are focusing on the recovery of defaulted loans. Debt collection is improving despite high inflation and the crisis in the country. Because the stagnation that was created in business during Covid has ended now."

Although Islamic Finance's profit from investment decreased by 19% to Tk134.51 crore in 2022 compared to the previous year. Its net profit also dropped over 77% to Tk4.21 crore year-on-year.

In the first quarter of this year, its net profit declined by 79% to Tk0.87 crore.

Mainly due to an increase in provisioning against defaulted loans and a higher cost of funds due to runaway inflation, the profit decreased significantly.

Meanwhile, depositors in the company withdrew their funds significantly. As a result, its deposit dropped over 24% to Tk1,004 crore in 2022 compared to the previous year.

Again, the company's net operating cash flow is negative in 2022 due to lower investment income. At the end of 2022, its net operating cash flow was Tk237 crore negative.

Meanwhile, in the monetary policy announced for the first half of the upcoming fiscal year, the interest rate for lending has been determined in a new way. Sharia-based financiers will also calculate the profit based on the new interest rate.

The Bangladesh Bank has declared a reference lending rate of 7.13% for July, projecting an increase in interest rates for all types of bank loans.

The reference lending rate, known as "SMART" (six-month moving average rate of Treasury bills), applies a margin for both banks and non-bank financial institutions.

Banks can apply a margin of up to 3%, while non-bank financial institutions can apply a margin of up to 5% over the SMART rate.

Mosharaf Hossain said, "It will give us some relief."

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel