Govt bonds boost DSE market cap-to-GDP ratio by 47%

Treasury bonds contributed Tk3.14 lakh crore to the market valuation

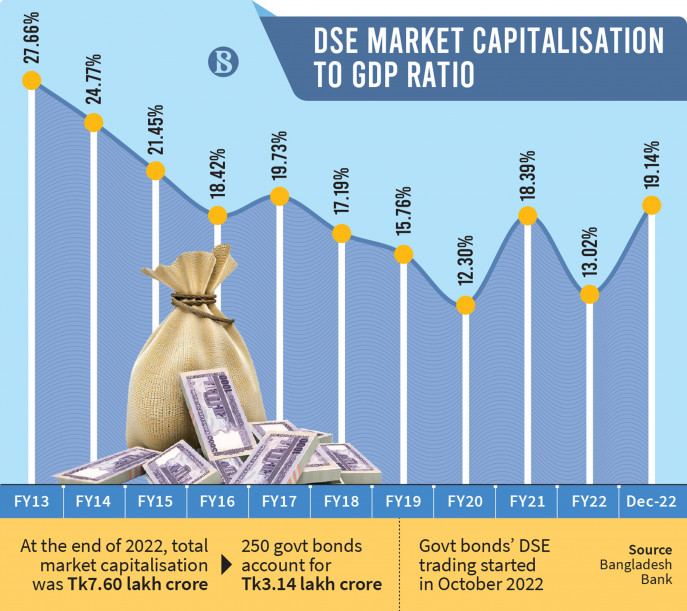

The market capitalisation-to-GDP ratio of the Dhaka Stock Exchange (DSE) surged by 47% following the listing of 250 government securities, known as treasury bonds, on the secondary market on 10 October last year, according to a central bank report.

The financial stability report for 2022 showed that until 6 October, the market capitalisation was following a downward trend. However, there was a significant increase on 10 October, primarily due to the listing of treasury bonds, which contributed Tk3.14 lakh crore to the market valuation.

At the end of 2022, the market's overall capitalisation was Tk7.60 lakh crore.

The total market capitalisation-to-GDP ratio is a vital indication of the depth of a country's capital market, said the money market regulator.

According to the financial stability report, the market capitalisation-to-GDP ratio dropped to 13.02% in FY22 from 18.39% a year ago.

However, the ratio spiked to 19.14% at the end of December 2022, mainly due to a substantial increase in market capitalisation buoyed by the listing of government securities, the report noted.

EBL Securities said in its report that since the inception of their trading, government bonds on the stock exchange have failed to generate any momentum.

There have been interests among retail investors to purchase and trade the bonds, but banks and financial institutions, as their major unitholders, have remained reluctant to sell them on the stock exchange, EBL Securities added.

According to DSE data, only 18 trades amounting to Tk5.41 crore have taken place since the inception of government bond trading on the country's premier bourse. The largest volumes of trades, amounting to Tk4.81 crore, were executed on 16 April and 18 April 2023.

EBL Securities said government bond trading on the Dhaka bourse has had a lacklustre start so far. The liquidity crunch among market participants, the falling DSE Index, and low turnover have made it challenging to attract investors to this new asset class.

It was also challenging to educate the market participants about the new instrument and the operational procedures, and many capital market intermediaries have yet to consider the bonds as a viable asset for their portfolios and their clients, it added.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel