Non-resident Bangladeshi investment potentials lie untapped

A report proposed measures to boost investment from non-resident Bangladeshis in 2018, but there has been very little progress in this regard so far

Nearly 2.4 million Bangladeshis are estimated to be living abroad permanently, either as citizens or on long-term permits, but there has been very little effort by the government to tap this huge source of investment.

In 2018, a report by the Economic Relations Divisions (ERD) and the United Nations Development Programme (UNDP) proposed a set of measures to attract investment from the NRBs, but there has been very little progress in this regard so far.

According to the report, India, China, the Philippines, Lebanon, Sri Lanka and some other countries have focused on engaging the diaspora communities in economic development and brought about widespread and meaningful economic reforms to attract diaspora investment, but Bangladesh lags far behind in this regard.

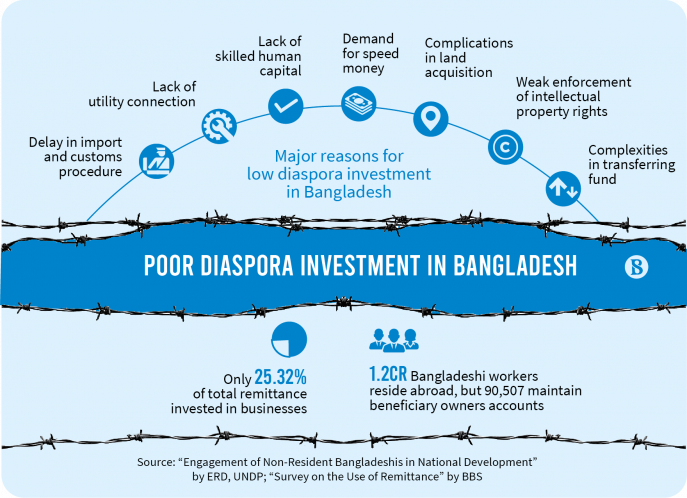

The report titled "Engagement of Non-Resident Bangladeshis in National Development" identified delay in import and customs procedure, lack of utility connection, lack of skilled human capital, demand for speed money, complications in land acquisition, weak enforcement of intellectual property rights, complexities in transferring fund as the major reasons behind the low level of direct diaspora investment in Bangladesh.

The report recommended formulating a national level steering committee headed by the prime minister, a specialised diaspora engagement wing and three sub-units for philanthropy, investment, and expert engagement, but there has been very little progress in this regard in around four years since it was published.

It also proposed a plan to establish a central coordinating unit for boosting diaspora investment at the Prime Minister's Office, but that did not make much progress either.

"We conducted an in-depth study and recommended a coordinated way to utilise our NRB's prospects. But after the research, the follow-up activities were not satisfactory," said Dr Mobasser Monem, professor of public administration at University of Dhaka, who conducted the study.

Amal Krishna Mandal, chief of the United Nations wing of the ERD, told TBS, "We conducted the study under the Knowledge for Development Management Project funded by the UNDP. Later we found that the ERD has no functions to deal with the NRBs to attract investment. That is why we did not follow up further."

"Survey on the Use of Remittance," conducted by the Bangladesh Bureau of Statistics in 2013 found out that only 25.32% of received remittance in Bangladesh were invested in businesses while remaining 74.68% were spent for consumption.

SM Parvez Tomal, chairman of the NRB Commercial Bank Ltd in Bangladesh, told TBS, "There is a potential of foreign direct investment made by the NRBs worth $2-3 billion, but the environment in Bangladesh is not appropriate for operating businesses from abroad. Potential investors from abroad become victims of fraud in most of the cases."

Explaining the experience of establishing and operating his own bank, he said, "The banking system is a space of compliance. It was considered that all procedures would be completed within a few visits to Dhaka, but the reality was different."

"We had to stay in the country, leaving our own businesses abroad. Five among nine of our directors are living in Bangladesh, which is not possible for all the NRBs," said SM Parvez Tomal, who currently lives in Russia.

He identified the lack of provision to operate a bank account from abroad as a major obstacle behind the low investment from the diaspora communities.

Poor NRB investment in Capital Market

Currently, over 1.2 crore Bangladeshi workers reside abroad, but only 90,507 beneficiary owners accounts are maintained by NRBs for investing in shares and bonds in the capital market.

Previously NRBs enjoyed a 10% quota facility for buying Initial Public Offerings (IPO), but this year the Bangladesh Securities and Exchange Commission has decreased the quota to 5% as the expatriate Bangladeshis have not shown much interest in investing in the capital market here.

Experts said the government offers various opportunities for NRBs to invest here, but most of them are not utilising those.

"The NRBs can invest in the stock markets anywhere in the world. So, they would not be interested in investing in Bangladesh as we could not develop our stock market up to that level," said Professor Abu Ahmed, a stock market expert.

Facilities for investing in bonds shrink

The government launched the Wage-Earner Development Bond in 1981 for ensuring risk-free investments by the NRBs.

The NRB investment in the bond was Tk1,341.26 crore in FY20 while it was Tk1,902.61 crore in the previous fiscal year.

Earlier, NRBs could invest a maximum of Tk50 lakh separately in three savings bonds – Wage-Earner Development Bond, US Dollar Premium Bond, and US Dollar Investment Bond. But the government lowered the maximum investment limit to Tk1 crore or its equivalent in foreign currency in these bonds last year.

Bonds provided a scope of secured investment for the NRBs, but the government has fixed the investment limit in these bonds at Tk1 crore. This has made the NRBs very unhappy, because they could have invested their money in Bangladesh, said SM Parvez Tomal, chairman of NRB Commercial Bank.

Besides, the NRBs are not much aware of these bonds due to a lack of a well-designed and robust publicity campaign, said experts.

NRBs want special economic zone

During the "Investor Summit: Bangladesh Capital Markets" in New York organised by Bangladesh Securities and Exchange Commission (BSEC) in July this year, the non-resident Bangladeshis demanded a special economic zone for them.

Moreover, during Commerce Minister Tipu Munshi's visit in the United Arab Emirates on occasion of the "World expo 2020" in Dubai last month, Bangladeshi business communities raised a demand for a special economic zone.

At that time the commerce minister told the media that the government would sincerely consider the proposal for a dedicated economic zone for the expatriates.

Tipu Munshi also said the government would form a committee to provide assistance to expatriates for making investment and operating businesses in the country.

The committee will be headed by the commerce ministry and include the Ministry of Industry, Bangladesh Investment Development Authority (BIDA) and the Bangladesh Economic Zone Authority (BEZA).

BIDA Executive Chairman Md Sirazul Islam told TBS, "NRBs can invest in any special economic zone. They have been demanding a particular economic zone, but they do not have a united global platform."

However, he acknowledged that more coordinated efforts from the government bodies are needed to utilise the NRBs' potentials.

Project to promote diaspora investment

The Ministry of Expatriates' Welfare and Overseas Employment has recently taken up a pilot project to promote diaspora investment in Bangladesh in the agriculture sector. The project is funded by the International Fund for Agricultural Development (IFAD).

The pilot project involving Tk9 crore will work in four upazilas to engage diaspora communities in various agricultural production, says Zahid Anwar, deputy director of WEWB.

During her recent visit in the United Kingdom, Prime Minister Sheikh Hasina urged the expatriate Bangladeshis all over the world to invest more in Bangladesh as investment opportunities for them have increased in all sectors.

Regarding allegations made by some expatriates that they are facing problems in investing in Bangladesh, the prime minister said, "We'll find out the barriers, if any, in this regard and I assure you all of solving those problems for your convenience to invest, which will be beneficial for all."

The prime minister also said the government has already given necessary directives to the Bangladesh Development and Investment Authority (BIDA) to remove all obstacles in the process of investments.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel