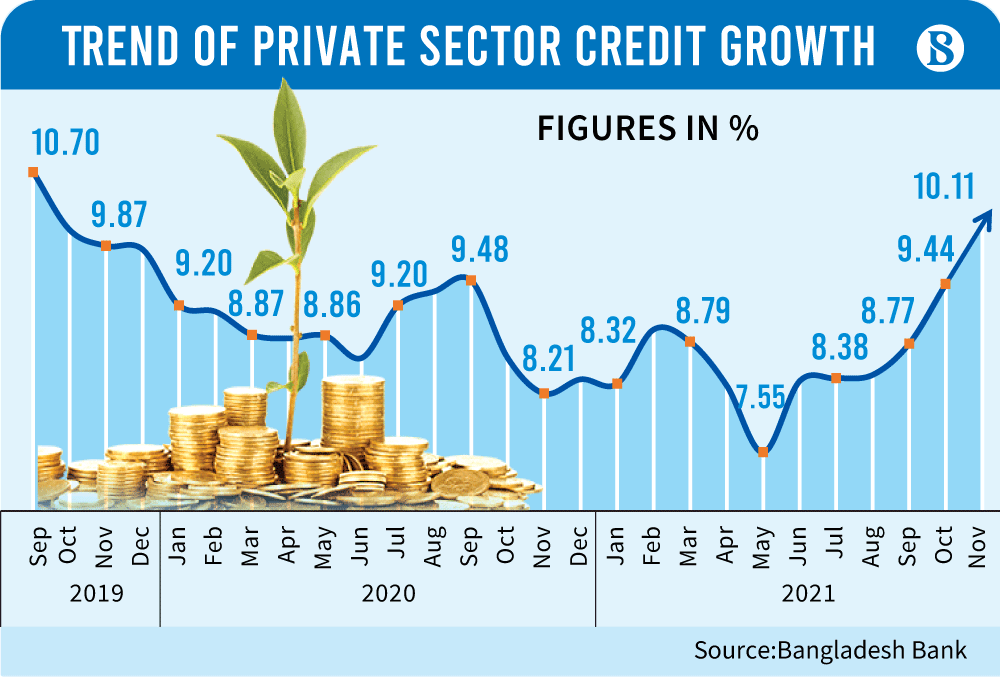

Private sector credit growth returns to pre-pandemic level after two years

The banking sector saw 10.11% growth in private sector credit

The private sector credit growth came back to pre-pandemic level in November, thanks to strong rebound in economic activities from pandemic-induced stresses.

The banking sector saw 10.11% growth in private sector credit, highest in the last two years, according to recent data of the Bangladesh Bank. However, the growth is still far below the monetary target of 14.8% set for the current fiscal year.

The credit growth was 10.7% in September 2019, and since then it remained depressed, coming down below 10% amid lending rate cap pressure and rising pandemic tension.

High import expenditure, mainly because of significant growth in capital machinery import, reflects that investment is picking up, contributing to an uptick in credit growth, said industry insiders.

Bangladesh's import payments surged by around 54% in the first five months of the current fiscal year compared to the corresponding period of last year – indicating a strong and steady economic recovery in keeping with a sharp fall in coronavirus infections.

Imports of yarn, capital machinery and intermediate goods had a major contribution to the bills, which means production lines are alive and kicking and there has been a strong consumer demand at home.

In the first five months of this fiscal year, capital machinery import saw 30% growth, the central bank's latest data show.

During the period, import growth of intermediate goods was 70%, chemical fertiliser 105%, yarn 103% and drugs and medicines more than 1,000%, central bank data show.

Even though rising import cost and pent-up demand is putting pressure on inflation raising concern for global central banks, the Bangladesh Bank is not concerned yet.

When globally central banks are hinting to go for contractionary monetary policy to curb inflation, the Bangladesh Bank still sticks on its expansionary policy to keep flow of cheap money uninterrupted to support investment.

In the latest quarterly report for July-September period, the Bangladesh Bank expected to continue the expansionary and accommodative monetary policy in coordination with the government's expansionary fiscal policy for FY22 because the economic recovery from the slowdown is a key priority.

Therefore, the BB did not withdraw the relaxations of various policy rates; rather used its monetary tools to control any situation deriving from excess liquidity.

On the other hand, it is expected that since the economic activities are being rebounded in recent periods after a significant improvement of Covid-19 situation in the country, it would subsequently ease the pressure on excess liquidity, increasing private sector credit growth by strengthening economic activities, said the report.

"Here, the Bangladesh Bank's policy is to flow the funds to the productive sectors, including agriculture, SMEs, export-oriented industries and the informal sector, which have been hit hard by the pandemic. Providing adequate supply of credit to productive and manufacturing sectors would help faster recovery of economic activities and achievement of the growth target in FY22."

"We see strong demand for credit as investors started to expand their business seeing good recovery of all economic indicators," said Md Arfan Ali, managing director of Bank Asia.

He hoped that the current uptick in credit growth will continue in the coming year and banks will see good business opportunities out of rising credit demand.

The Bangladesh Bank observed that economic activities continued to recover in the July-September period of the current fiscal year largely driven by activities in the agriculture and industry sectors in response to supportive monetary and fiscal policies, improved business confidence, declining Covid-19 infection rate, and increasing coverage of vaccination across the country.

The industry sector rebounded in FY21 by registering 6.12% growth after declining to 3.25% in FY20.

The industrial production in the first two months of the current fiscal year posted 7.33% year-on-year growth driven mostly by large and medium scale industrial production, according to the central bank data.

While large and medium scale industries performed well with government policy support and stimulus packages, the central bank in coordination with the government would continue appropriate support to the CMSME sector to facilitate an even and broad-based economic recovery, said the Bangladesh Bank in its latest quarterly report.

However, it sees risk for rising Omicron variants and feels the need of contingency plans to counteract downside risks such as a fresh wave of Covid-19 infections and upside risks such as international commodity price hike.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel