Defaulters allowed 3-year exit facility with 10% down payment

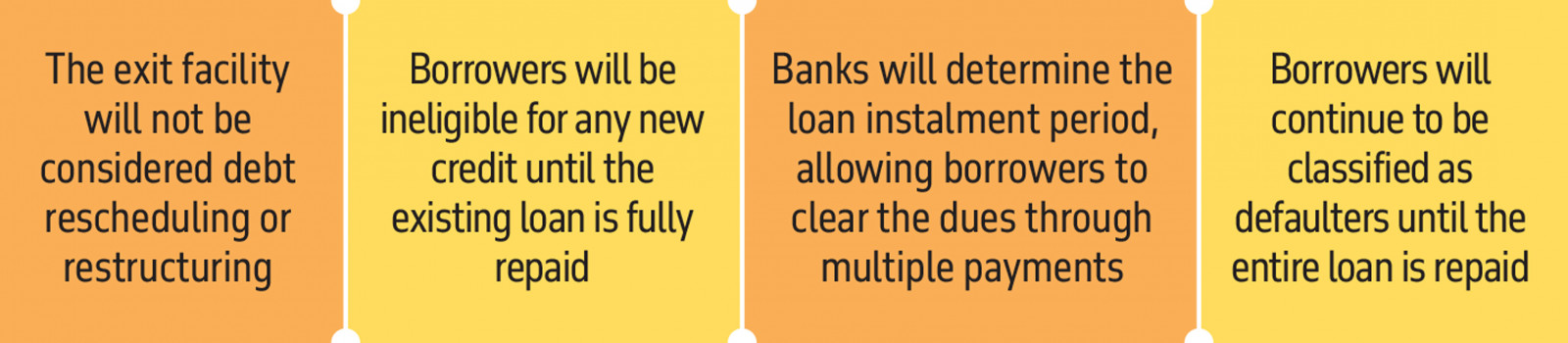

The exit facility will not be considered debt rescheduling or restructuring, and borrowers will be ineligible for any new credit until the existing loan is fully repaid

For the first time, the Bangladesh Bank has introduced an exit policy allowing defaulted borrowers up to three years for loan repayment with a 10% down payment, aimed at maintaining liquidity flow and reducing toxic loans in the banking sector.

The exit facility will not be considered debt rescheduling or restructuring, and borrowers will be ineligible for any new credit until the existing loan is fully repaid, according to a central bank circular issued today.

Banks will determine the loan instalment period, allowing borrowers to clear the dues through multiple payments within three years, the money market regulator stated in the circular, directing managing directors of banks to implement the policy.

In the absence of a policy, banks used to follow different criteria for the exit mechanism for the collection and adjustment of loans, according to central bank officials.

A Bangladesh Bank official said even if defaulting borrowers utilise the exit facility, they will continue to be classified as defaulters until the entire loan is repaid. Banks will annotate the exit status next to these customers' statuses (classified under three types of non-performing loans) in the Credit Information Bureau.

The managing director of a private bank told TBS, "Defaulted borrowers will receive some benefits through the exit facility. If they manage to pay 10% of their defaults, they can repay the remaining amount over a period of three years."

He also mentioned that previously, there was a one-time exit policy for top borrowers, but many borrowers exited their loans under this facility without fully repaying them. Consequently, a significant portion of these loans remains in default.

Another official of the Bangladesh Bank mentioned that all types of small and large borrowers will benefit from this policy. Under this policy, both regular and defaulting borrowers can take advantage of the exit facility.

"This policy has been a long-term plan for us. Until now, each bank followed different rules. Now, with the specific policy in place, no customer above the specified limit will receive this benefit," he added.

According to the circular, the regular loan exit facility can be provided in cases where the project or business is closed due to uncontrollable reasons or by the borrower's decision to close the project or business.

Banks will settle applications within 60 days after receiving them from borrowers. The exit facility must be approved by the board of directors of each bank, although bank management will have the authority to grant the exit facility for loans up to Tk10 lakh.

Under this facility, interest can be waived according to the policy of the central bank. However, if the loan is not repaid within the stipulated time, the waived interest will accrue, and the exit facility will be cancelled. The instructions of the central bank will be followed in the recovery of the debt mortgaged under the exit facility.

Proper provisions must be maintained against the loan, and the security taken against the loan cannot be released before the loan is fully adjusted. However, the loan can be adjusted by selling the mortgaged property, with customer-negotiable loans against the bank.

According to data from the Bangladesh Bank, as of the end of March 2024, the total amount of disbursed loans in the banking sector stood at nearly Tk16.41 lakh crore. Out of this, over Tk1.82 lakh crore had become defaulted, which is 11.11% of the total disbursed loans.

In 2019, the central bank issued a special policy regarding a one-time exit for customers with loans over Tk500 crore. According to the policy, the loan is to be repaid over 10 consecutive years with a grace period of one year, at 9% simple interest, with a 2% down payment.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel