Banks overspend by 73% on disaster management, bypassing CSR directives

According to a Bangladesh Bank report, banks spent Tk629 crore on CSR during January-June, up from Tk298 crore in the preceding six months, which was 111% higher

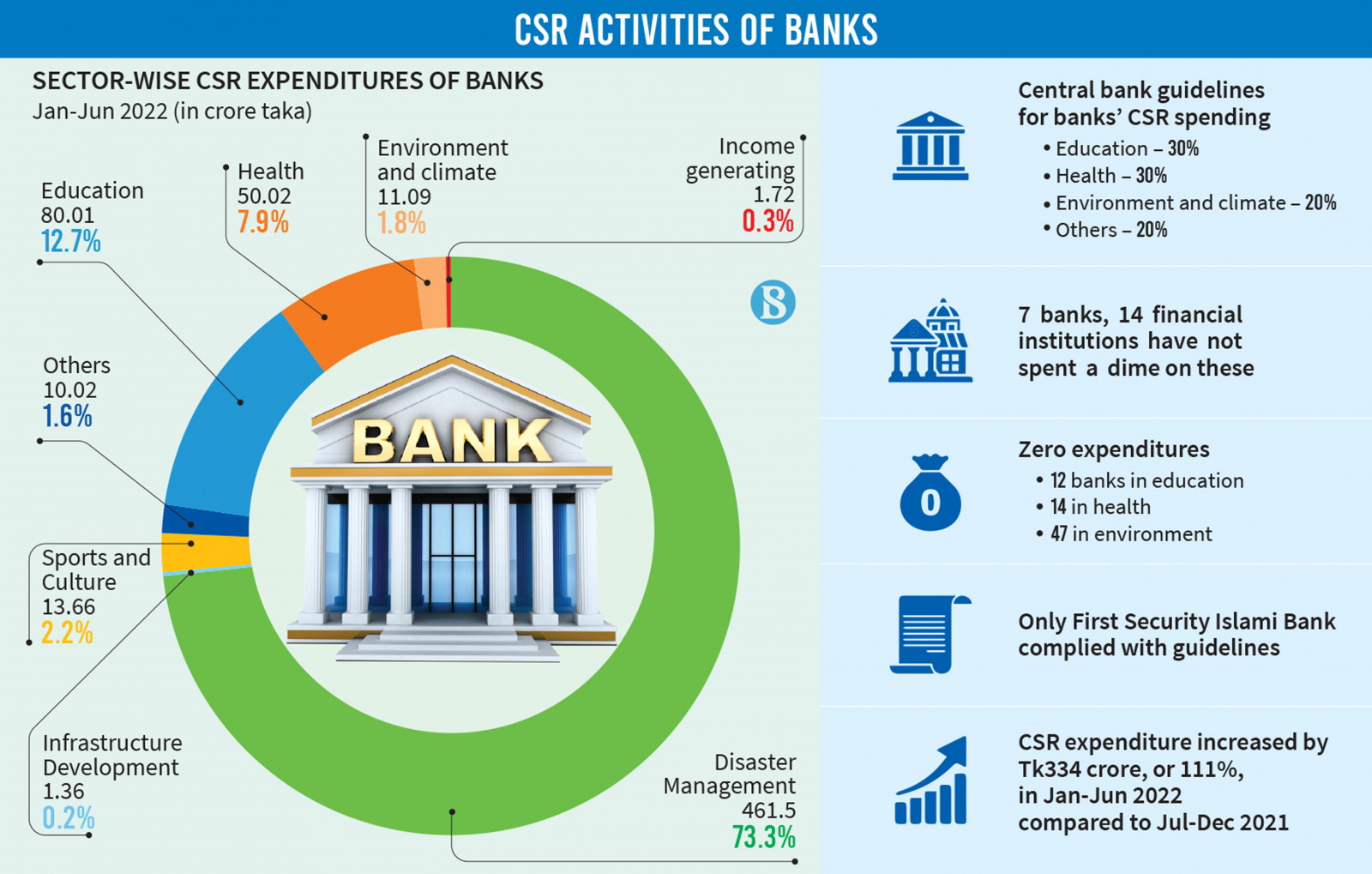

Violating rules set by the central bank, banks have spent 73% of their CSR (corporate social responsibility) fund on disaster management instead of the maximum 20%.

According to the latest Bangladesh Bank guidelines, 30% of CSR expenditure can be spent on education, 30% on health, 20% on environment and climate change mitigation and adaptation, and the remaining 20% on other sectors, including disaster management, sports and culture.

Earlier, total spending on CSR was set as: 30% on education, 20% on health and 10% on climate risk funding. But these were not adhered to either.

According to a Bangladesh Bank report, banks spent Tk629 crore on CSR during January-June, up from Tk298 crore in the preceding six months, which was 111% higher.

Of the total, however, Tk429 crore was spent on disaster management in the first six months of this year, up from Tk132 crore in the previous six months.

This registered a growth rate of 249%.

The report said that in the first half of the year, food and relief materials were distributed among the people affected by severe floods in various districts of the country, including Sylhet and Sunamganj, while blankets were distributed among the poor in colder regions in the northern part of the country.

The majority of these were donated to the Prime Minister's Relief Fund by banks, and accounted for their expenditure on disaster management under their CSR.

A senior official of the central bank told The Business Standard, "Our instructions are that each bank will make its own CSR policy, which will be approved by the board of the respective bank."

According to the rules, if a bank does not have an after-tax net income, it does not need to have a CSR budget.

The fund in the CSR, however, has to be spent on the sectors determined by the central bank, he said.

The central bank does not determine what percentage of a banks' net income has to be spent on CSR activities. Some banks spent 28% of their net income, while some spent nothing. These costs, however, affect a bank's management efficiency, which can be seen using the CAMELS ratings, he added.

The breakdown

Apart from the First Security Islami Bank, none of the others fully complied with the Bangladesh Bank policy.

The central bank report also shows that seven out of 61 banks did not spend on any CSR activities in the first six months of the year.

These are: the state-owned Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank and privately-owned Bangladesh Commerce Bank Limited, Bengal Commercial Bank Limited, Citizens Bank PLC, Community Bank Limited and the foreign National Bank of Pakistan.

Also, 12 of the banks operating in the country had no expenditure in the education sector, 14 others didn't spend on the health sector and 47 in the environment and climate sector.

According to the central bank report, compared to July-December 21, the CSR expenditure of banks decreased overall in the first six months of the year, except in the disaster management, education (rise by 2.5 times) and income generating sectors.

Banks spent Tk759 crore in 2021 and Tk968 crore in 2020 on CSR, according to data from the Bangladesh bank.

Non-bank financial institutions (NBFI) also came under scrutiny in the central bank report.

According to it, 14 out of 34 NBFIs in the country have not spent any of their CSR fund.

The rest have accounted for a CSR expenditure of Tk4.36 crore, which is 29% higher than in the previous six months.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel