August import LC openings highest in last 5 months

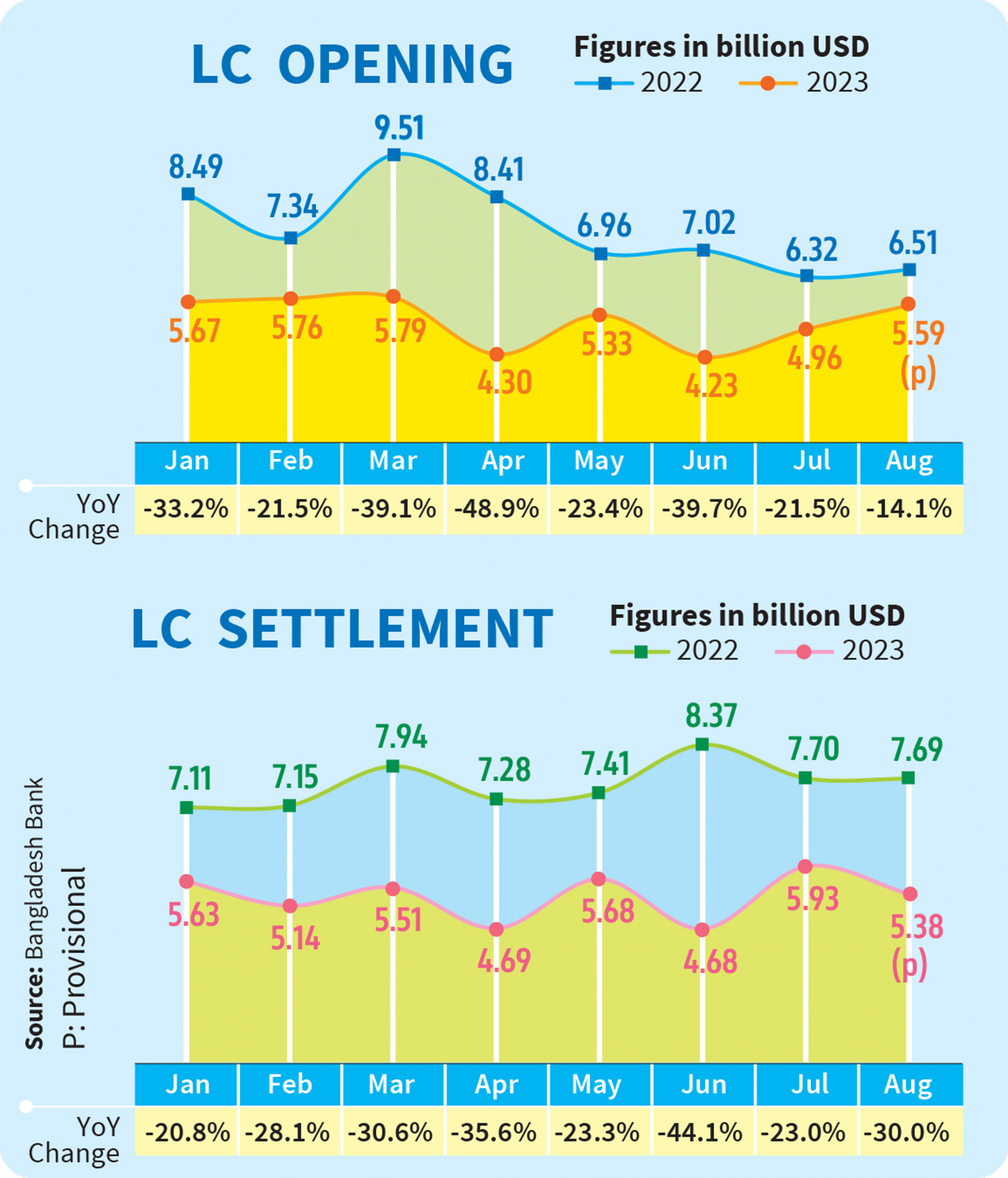

According to central bank data, import LCs worth $5.59 billion were opened in August, the second month of the current fiscal year.

The opening of import letters of credit (LCs) in August was the highest in the last five months even though settlements decreased due to the ongoing dollar crisis.

According to central bank data, import LCs worth $5.59 billion were opened in August, the second month of the current fiscal year.

LC opening has been dwindling since March, which saw $5.79 billion worth of LCs, hitting a three-year low of $4.23 billion in June, the last month of the last fiscal year. But imports started to pick up in the new fiscal year.

Ali Reza Iftekhar, managing director and CEO of Eastern Bank Ltd (EBL), told The Business Standard, "LCs for importing raw materials for various industries and making export products were opened in August. Traders are opening more LCs as inflationary pressure eases a bit. They need raw materials to continue production. Without production, they will face hurdles to repay bank loans."

When asked whether LC opening is on the rise due to the good liquidity situation of the dollar, he said, "No…the liquidity situation is the same as the previous few months. We have not seen much improvement here. Most of the LCs opened are deferred LCs. That is, we are importing goods on loan now, and we will pay the price later."

In order to keep the economy running, LC opening should be increased further, added the seasoned banker.

However, when compared year-on-year, LCs opening fell by 14% in August. LCs worth $6.52 billion were opened in August 2022.

When asked why year-on-year LC opening has decreased, an official of the central bank said, "The central bank is currently monitoring import LCs worth over $3 million. This surveillance has led to a decrease in incidents of over-invoicing, which has contributed to the reduction in the overall LC opening."

A managing director of a private bank, wishing not to be named, told TBS, "We have greatly reduced the opening of LCs for importing capital machinery compared to previous times. We exercise caution and open LC only when it is absolutely necessary."

He said one of the reasons for this is the need to establish a payment schedule when opening an LC. "Our dollar inflow is not robust, and overall, LC openings declined year-on-year," the official said.

Expressing concern over the negative repercussions of reduced capital machinery imports on investment and employment, the banker said despite a favourable Nostro position, the challenging dollar liquidity situation hampers the initiation of new LCs.

Acknowledging the reduction in LC openings for luxury goods, Syed Mahbubur Rahman, managing director of Mutual Trust Bank, stressed the need for a careful review of the situation to facilitate as many LCs as possible, noting that banks tend to favour deferred LCs due to the scarcity of sufficient dollars.

Meanwhile, LC settlements for imports declined more than 35% in August compared to the corresponding month last year. From $7.69 billion in LC payments in August 2022, the figure fell to $5.38 billion in the same month this year. In July, payments totalled approximately $6 billion.

Anis A Khan, former chairman of the Association of Bankers Bangladesh (ABB), said the reduction in LC openings naturally results in decreased settlements.

He attributed this downward trend to constraints on increasing payments within the banking channel, causing many LCs to be deferred.

Khan emphasised the importance of a market-based exchange rate for the dollar to boost incoming dollar flows, suggesting that a market-based rate could initially range from Tk120-130 and eventually stabilise. Non-market rates for the dollar were impacting both LC openings and settlements.

The managing director of another private bank told TBS that settlements have decreased due to restrictions on opening LCs. As a result, the country has reduced its trade deficit.

Still, the country faces a widening gap in the balance of payments as remittances fell by over 21% in August, he noted.

Amidst these challenges, Bangladesh's foreign exchange reserves have dipped below $23 billion, with the central bank selling $2.3 billion from reserves in the first two months of the current fiscal year.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel