Energy prices fall as import arrears reduced to $700–800m: Adviser

Previously, we had to pay $16-17 per unit for LNG. Now, because we've cleared much of the backlog, the price has dropped to $12-13, he says

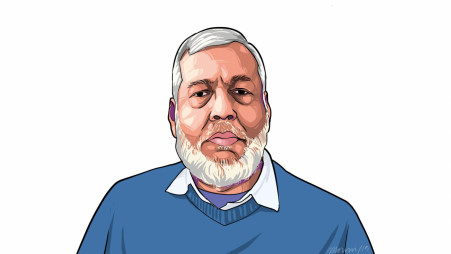

Bangladesh has reduced its energy import arrears from $3.2 billion to around $700–800 million, resulting in a drop in energy prices, according to Energy Adviser Muhammad Fouzul Kabir Khan.

"Previously, we had to buy LNG at $16–17, but after settling arrears, the price has come down to $12–13," he stated.

The adviser was speaking at a seminar titled "Debating Budget and Beyond," organised by the Bangladesh Economic Association at the Cirdap International Conference Centre in Dhaka today (21 June).

Talking about the challenges in the power sector, Fouzul Kabir said that due to declining domestic gas reserves, the country has become increasingly dependent on imported LNG, which is pushing the government to provide large subsidies.

To overcome this, he mentioned plans to install solar power systems on all government buildings, adding that the electricity generated can be fed into the national grid. He also noted that at least 2,000 megawatts of electricity could be generated from rooftop solar panels in the private sector.

He further stated that wastage, corruption, and inefficiency are major obstacles to Bangladesh's economic development. "A power plant was built six kilometres from the water source just to serve the interests of a minister. Roads have been built unnecessarily. Public funds have been wasted due to mismanagement."

On the interim government's stance, he said, "We want to leave behind an example of governance where no relatives are appointed and no business favours are extended– something that will serve as a positive precedent for the future."

The adviser also pointed out, "Subsidies in the power and energy sector stand at Tk66,000 crore. This cannot continue. We are charging the public much less per kilowatt-hour than what we are paying to the power plants."

Speaking as a discussant, Abdul Awal Mintoo, chairman of National Bank, said, "A budget is essentially a policy statement for the future. Over the past 10-15 years, politicians, business elites, and bureaucrats have collectively taken control of all constitutional and other institutions in the country. The interim government is pursuing reform, and these issues must be addressed."

He emphasised that although revenue from VAT is increasing every year, direct taxes are not, leading to inequality in wealth distribution. "Interest rates are being raised under a contractionary monetary policy, squeezing the private sector, while government expenditure continues unchecked. A large share of bank deposits is being borrowed by the government. How can this be sustainable?"

He added, "Investment requires certain prerequisites: social stability and capital. No investor will invest if it takes 20 years to resolve financial disputes."

Abu Ahmed, chairman of ICB, said: "Everyone talks about increasing the tax-to-GDP ratio. I support it too, but the money is going into the revenue budget. Departments are hiring more people than needed– where 10 are sufficient, they are appointing 15, and many are drawing salaries without work. If the increased revenue were spent on development, I would support it."

Professor AK Enamul Haque, director general of Bangladesh Institute of Development Studies (Bids), suggested that Bangladesh needs a comprehensive tax policy, considering investment, social justice, and other priorities.

"The budget should have targeted investment and employment, with a special focus on innovation. Rather than printing money, we should consider how to strengthen the banking sector. We also need to think seriously about how to bring unbanked money into the financial system."

While presenting his paper, Sajjad Zahir, executive director of the Economic Research Group, emphasised the need to establish a clear relationship between the country's fiscal and external financial balances.

"On the one hand, domestic expenditure must be aligned with tax revenues, non-tax revenues, and debt servicing; on the other, net additions from remittances, exports, imports, and foreign loans should be reconciled through the banking system," he said.

Zulfikar Ali, research director of Bids, commented that despite new initiatives and allocations in the education sector in this year's budget speech, they remain largely conventional.

"In reality, improving education requires more attention. About 75% of children in classes 3 and 4 struggle to read their Bangla textbooks properly," Zulfikar said.

He stressed the need to increase allocations in the education sector but emphasised that the spending must be effective. "Just building infrastructure won't improve the education system. The teacher-student relationship has deteriorated. Teachers now fear their students and hesitate to discipline them because of mob threats."

On the health sector, Shafiun Nahin Shimul, director of the Institute of Health Economics at Dhaka University, said, "Just 1.7% of GDP and 5.3% of the budget being allocated to health is insufficient to improve outcomes, drive growth, or unlock human capital. Health is an engine of growth, not just a line item in the finance ministry's budget. Every dollar spent on essential health services yields a 3–10 times return in productivity, resilience, and cost savings."

The seminar was moderated by Professor Dr Mohammad Helal Uddin, member secretary of the Interim Committee of the Bangladesh Economic Association and Executive Head of the Microcredit Regulatory Authority. Closing remarks were delivered by Dr Kazi Iqbal, Convener of the Seminar Sub-Committee.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel