India’s billionaire race sees one tycoon pulling away

Gautam Adani has added $30 billion more to his wealth this year. His rival Mukesh Ambani, however, isn’t as deeply fueled by debt

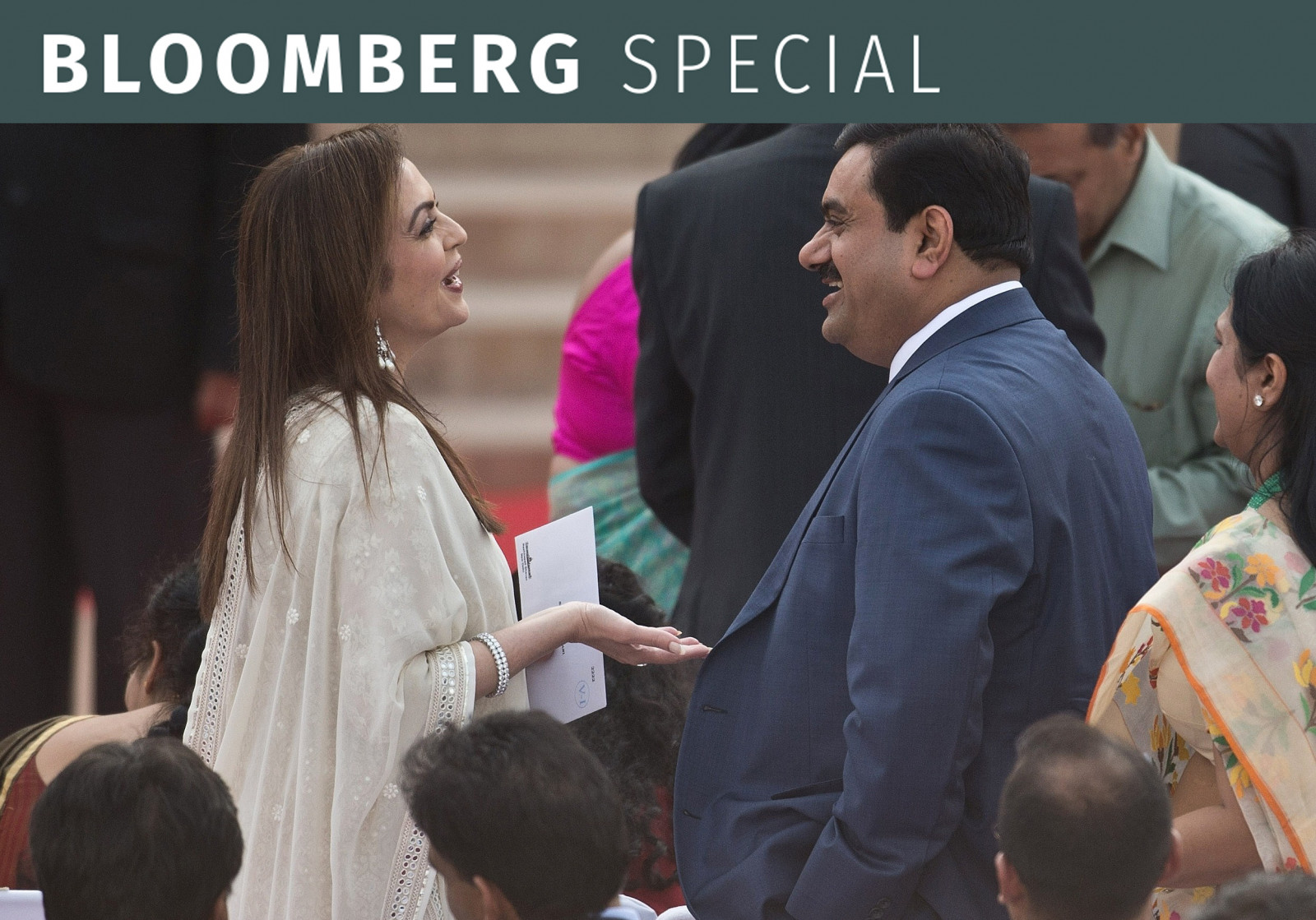

Going into the pandemic, the Indian tycoon to watch was Mukesh Ambani. Coming out of it, all eyes are on Gautam Adani.

Adani, the world's sixth-richest person, has added almost $30 billion to his wealth this year, more than any other billionaire. His net worth of $106 billion is only about half of Tesla Inc. co-founder Elon Musk's, but $10 billion more than Ambani's. While both would like markets to reward them for scripting India's future in renewable energy, what's ticking for them right now is all the polluting stuff in short supply: coal, palm oil, gasoline and building materials. Investors are loving Adani more — simply because he's the bolder of the two.

Ambani, who turned 65 last month, was the toast of the global M&A market with his $27 billion fundraising in the middle of the 2020 Covid-19 disruption — first from the likes Facebook (now known as Meta Platforms Inc.) and Alphabet Inc. for his digital business and then from Silver Lake Partners, KKR & Co. Inc. and others for his retail chain. That zeal seems to have now transferred over to Adani, who'll celebrate his 60th birthday next month as India's newly anointed cement king, having just picked up Holcim Ltd.'s business in the country for $10.5 billion.

In just the past year, Adani has spent $17 billion on 32 acquisitions, according to Bloomberg News, and is showing no signs of slowing down even though the combined net debt across his listed companies stands at almost $20 billion, or more than four times annual earnings before interest, taxes, depreciation and amortization (Ebitda). That's a high leverage burden to carry through a tightening global interest-rate cycle.

Contrast this with Ambani's flagship, Reliance Industries Ltd. At an estimated $13 billion, its planned annual capital expenditure isn't low. But the data Ambani sells has gotten pricier as competition in India's telecoms market has shriveled. The natural gas he produces in India has seen a 62% jump in its state-mandated price cap. A fuel shortage is lifting margins at his refinery complex in Jamnagar, the world's biggest. All this may keep Reliance's net-debt-to-Ebitda at a comfortable 0.7 this financial year, says Fitch Ratings, which assesses the conglomerate's foreign-currency creditworthiness at BBB, a notch higher than India's sovereign debt.

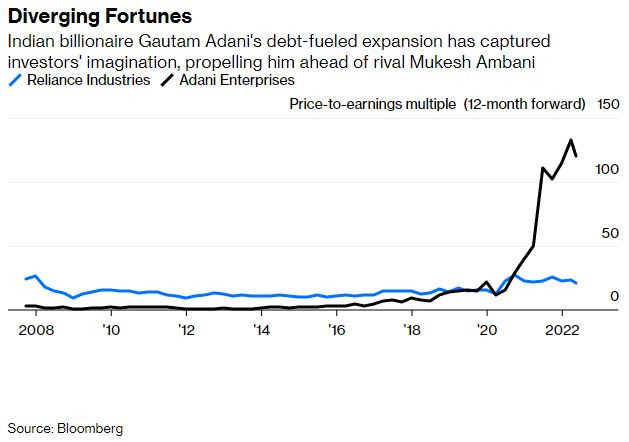

Yet, Ambani's fortress-like balance sheet isn't exactly setting the equity market on fire: The Reliance stock, which shot up to 29 times forward 12-month earnings in 2020, is now available at a multiple of 21. Shares in Adani Enterprises Ltd., which closed the valuation gap with Reliance around the time of Prime Minister Narendra Modi's 2019 reelection, now trade at a PE ratio of 124.

Adani and Modi have a relationship that goes back two decades to when the latter was chief minister of Gujarat. As he was being pilloried by other business leaders in the wake of the deadly 2002 Hindu-Muslim riots, Modi got the backing of the little-known, first-generation Gujarati entrepreneur. Adani had only a few years earlier set up what would become the fulcrum of his empire: the Mundra port on India's west coast. Now he controls 24% of India's port capacity, and has a similar lock on airports. The stock market admires how Adani has extended his hold on transport infrastructure to other parts of the economy's humdrum plumbing: coal mining; power generation and distribution; city gas; edible-oil refining; storage for everything from crops to data; and now cement.

This, too, is a very different strategy from Adani's older rival who's now accelerating his succession plan. The petrochemicals empire Ambani inherited from his father has diversified into consumer-oriented businesses and acquired a more glamorous sheen, including a $1 billion commercial center in Mumbai packed with international brands and a possible move into cricket telecast and streaming this summer. His clout is still indisputable, as Amazon.com Inc. discovered in a takeover battle where Ambani scooped up the stores of a bankrupt Indian retailer from right under the US giant's nose.

But while Ambani is going for the consumer, Adani is sticking mostly to infrastructure. That's useful to New Delhi, not only to generate fiscal resources by monetizing public assets but also as a foreign-policy tool. When Sri Lankan President Gotabaya Rajapaksa wanted to cozy up to India last year after annoying its neighbor with his pro-China tilt, he awarded a 51% stake in a new western Colombo port terminal to Adani.

Adani, too, should be happy if more people buy into the narrative that he's running a business with a nationalist purpose. "A greater India must be an India that is visibly a more 'aatmanirbhar' India," he said in a speech last year, using the Hindi word for self-reliant. "A greater India must be an India that is visibly a more muscular India."

The muscularity was on display even in the Holcim transaction. Ambuja Cements Ltd. and ACC Ltd., the two units controlled by the Swiss firm, had a couple of other Indian billionaires willing to pay more. But Ambuja and ACC are currently fighting a $300 million antitrust award for alleged price fixing in India's Supreme Court. In taking them over, Adani offered Holcim full indemnity, according to media reports. Since Adani wasn't in cement before the deal, which is structured entirely overseas, there's unlikely to be lengthy scrutiny by India's monopoly buster or a capital gains demand slapped on Holcim.

Going into the pandemic, Ambani gave Google and Facebook a promising entry into India. As the virus retreated, Adani offered Holcim a hassle-free exit. Both are useful services in an economy that's starting to resemble the Monopoly board game. But perhaps only one of them, or none, is worth $100 billion and change — the difference in wealth between the two Indian billionaires and Musk.

Andy Mukherjee is a Bloomberg Opinion columnist covering industrial companies and financial services in Asia. Previously, he worked for Reuters, the Straits Times and Bloomberg News. @andymukherjee70

Disclaimer: This article first appeared on Bloomberg, and is published by special syndication arrangement.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel