Taking agent banking a step further to speed up financial inclusion

The economic landscape of rural areas is changing rapidly as the number of customers and transactions are constantly increasing due to agent banking. Moreover, agent banking serves as a facilitator in creating new jobs, as well as encouraging rural women entrepreneurs

Agent banking is one of the most crucial catalysts of financial inclusion in Bangladesh. It offers financial services to the underserved and unbanked across the country through agent outlets.

This plays a significant role in boosting the national economy; especially in rural areas. Since its inception in 2013, agent banking has garnered enviable response from the banking community with its high growth potentials.

Agent banking offers banking services outside of the traditional branch banking by engaging agents under a valid agency agreement.

According to Bangladesh Bank, agent banking has registered 46% growth in accounts, taking the number of users to 14.047 million. Deposit growth has surged 53.34% to Tk240,547 million, while loan disbursement has increased by 14.34% to Tk5,524 million. However, inward remittance flow has shown a downward move by 13.69%.

In 2010, under the leadership of former governor and prominent economist Dr Atiur Rahman, Bangladesh embarked on its journey to build a financially inclusive society with a view to ensure inclusive economic growth. Agent banking as a new avenue has taken financial services to peoples' doorsteps. Due to this, the volume of transactions through agent banking has more than doubled in the last Fiscal Year of 2020-21.

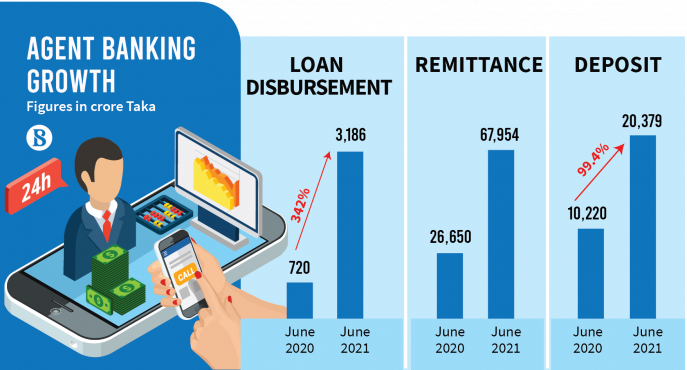

Transaction volume has registered 47% growth to Tk4,908,760 million from December 20, 2020 to December 21, 2021. The volume of deposits surged by 100%, which reached Tk202,180 million from June 20, 2020 to June 21, 2021. Loan disbursement through agent banking has increased to Tk26,826 million in FY21, which was Tk4,888 million in FY20. Rural customers have received 58.40% of the total disbursed loan in FY21, stimulating the rural economy, where access to financial service is one key impediment of developing countries.

In line with the Global Findex database of the World bank, only 40% of people above the age of 15 in rural areas possess a bank account or avail mobile financial services. Agent banking plays a leading role in bringing this unbanked segment of the population under the financial net.

About 86% of total agents and 88% of total outlets are operating in rural areas. The number of accounts in rural areas posted a significant growth of 49.33% from December 20, 2020 to December 21, 2021, whereas the number of accounts growth in urban areas is about 32%. Higher growth in opening accounts in rural areas have resulted in financial services reaching the doorsteps of the unbanked population.

Women participation in financial inclusion has increased significantly through this channel, especially in rural areas. The data of Bangladesh Bank shows that the number of female accounts in agent banking reached 6.25 million on December 21, 2021, of which females in rural areas hold 5.38% accounts.

During the lockdown brought about by Covid-19, agent banking continued to grow in all dimensions during the entire quarter of September 2020. In that period, the number of agents increased by 15.96% and number of outlets increased by 12.59%. The volume of deposit has registered a growth of 27.60% and the volume of loan surged by 50.85% during this quarter. The amount of inward remittance registered a significant growth of 43.84% during this quarter.

It is obvious that agent banking is an important tool for inclusive economic growth for a country like Bangladesh. In order to harness its growth potential and expedite financial inclusion in the country, pursuing these following policies might be helpful.

Firstly, commercial banks should select the individual or institution who are locally known and acceptable as an agent and can facilitate convincing local people to open bank accounts and encourage them to participate in the formal financial system.

Secondly, cross banking transactions can be adopted, in which customers of a bank are allowed to transact through any outlet close to their location, which promotes more participation in the formal financial transaction system. Bangladesh Bank should relax the restriction on cross banking transactions with a view to developing a centralised server system that simplifies agent banking on the retail end.

Thirdly, the major portion of the labour force in Bangladesh is working in the informal sector, who are left with insufficient options for saving and getting loans. Agent banking should capitalise this option by engaging this segment of population in formal financial services and assisting them to save and get access to credit facilities for entrepreneurial ventures.

Fourthly, collaboration of agent banking and MFS can make it easier for the clients to avail financial services more conveniently. Agent banks can scrutinise the client's MFS account transaction details at the time of discerning the eligibility for credit worthiness. On the other hand, MFS can promote different sorts of services provided by agent banks, and be directly involved in monetary transactions at the retail end on behalf of agent banks. Collaboration of both parties can strengthen the availability of formal financial service.

Lastly, the post office can be a good option to integrate with agent banking. This will ensure financial services are accessible to the farthest part of the country.

The economic landscape of rural areas is changing rapidly as the number of customers and transactions are constantly increasing due to agent banking. Moreover, agent banking serves as a facilitator in creating new jobs, as well as encouraging rural women entrepreneurs. It also plays a key role in making them stronger both economically and socially.

Agent banking is not only a tool to bring the unbanked under the formal financial system. It similarly plays an active role in economic expansion. A concerted effort by the government, Bangladesh Bank, commercial banks and MFIs will encourage people to use agents to avail financial services. This will both boost financial inclusion and accelerate financial activity.

Golam Sarowar Rasel is a Finance graduate from the University of Chittagong.

Tanzina Yeasmin is a Management information systems student at Noakhali Science and Technology University.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the opinions and views of The Business Standard.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel