Does our market liquidity match up with the macroeconomic reality?

In Bangladesh, money market liquidity is artificially created, which means the next economic crisis may potentially arise from the asset liability management segment

In macroeconomics, the relationship between consumption, savings, and investment as a percentage of gross domestic product (GDP) is important in understanding an economy's overall health and growth.

Consumption refers to the total amount of goods and services purchased by individuals, households, and the government. On the other hand, savings refers to the amount of income that is not consumed but instead put aside for future use.

Investment, in economic terms, refers to the purchase of capital goods, such as machinery, buildings, and equipment, to increase future production and productivity.

In a stable and growing economy, there is typically a balance between consumption, savings, and investment. When consumption is high, it can stimulate economic growth and demand for goods and services, but it may also lead to inflation if supply cannot keep up with demand.

When savings are high, they can provide funds for investment, which can, in turn, stimulate economic growth and productivity.

Investment is a key driver of long-term economic growth, as it leads to increased productivity, higher wages, and greater overall prosperity. However, for investment to occur, sufficient savings must be available to finance it.

As a result, the relationship between consumption, savings, and investment as a percentage of GDP is important in understanding an economy's overall health and growth potential. In general, a higher level of investment as a percentage of GDP is a positive sign, as it indicates that the economy is investing in its future productivity and growth.

A high level of consumption as a percentage of GDP can also be positive, as it can stimulate demand for goods and services, but it must be balanced with sufficient investment and savings to ensure long-term growth and stability.

From FY16 (the base year) to FY22, consumption as a percentage of GDP at the current price of the Bangladeshi economy showed a positive growth trend, specifically in private consumption.

Domestic consumption is mainly driven by private consumption. From FY20, private consumption increased immensely. Covid-19's impact, as well as the increase in supply due to the Russia-Ukraine war pushed up the inflation rate, adding fuel for private consumption to grow rapidly.

At the same time, savings declined drastically. Due to post-corona socio-economic issues, high inflation, etc., domestic savings converted to consumption immediately.

Domestic savings decreased heavily in FY21. Domestic savings growth in the percentage of GDP as the current price stood at negative 14.92%, which was negative 0.92% in FY17. A decline in domestic savings can hurt an economy by reducing investment, increasing borrowing costs, and limiting economic growth.

On the other hand, the investment percentage of GDP at the current market price barely changed over the period from FY16 to FY22, with a growth rate of 2.35% to 2.13%, respectively.

This is visible in FY20, when there is no coherence among consumption, savings, and investment. According to this classical theory, savings get equated with investments automatically, which otherwise alters the interest rate. If savings exceed investment, the excess supply of funds brings down the rate of interest, or vice versa.

Here, consumption is increasing while savings are decreasing heavily, and the apparently steady investment could lead to several economic consequences that already negatively impact the Bangladesh economy. Some of these are discussed below:

High Inflation: The increase in consumption without a corresponding increase in savings and investment could lead to an increase in demand for goods and services. This increase in demand can cause prices to rise, leading to inflation. At the Jun-20 endpoint to point, inflation was 6.02%, which is 9.33% at the Mar-23 end. Now the country is facing heat from inflation, and if it continues for another twelve months, the consequences will be severe.

Trade deficit: The increase in consumption is not matched by an increase in investment; the economy imports more goods to meet the increased demand. This led to a trade deficit, where the value of imports exceeded the value of exports. The trade deficit in FY22 was USD 33.25 billion negative, compared to USD 17.85 billion negative in FY20. This is a reflection of our higher consumption than investment.

Reduced economic growth: Decreased investment leads to a lack of funds for businesses to invest in new projects, research and development, and infrastructure. This results in reduced economic growth in the long run. The GDP growth rate in FY22 was 7.25%, in FY20 it was 3.45%, and in FY17 it was 6.59%. ADB also predicts that in FY23, GDP is expected to grow by 5.30%. This projection also shows the sluggishness of the economy.

Interest Rate Hike: Lower savings compared to what is required might create demand for credit. Also, high inflation will increase the nominal interest rate. Currently, in Bangladesh, the credit interest rate must not be less than the current inflation rate. The money market looks very liquid, which helps the economy hide all kinds of wounds that might cause cancer in the coming days.

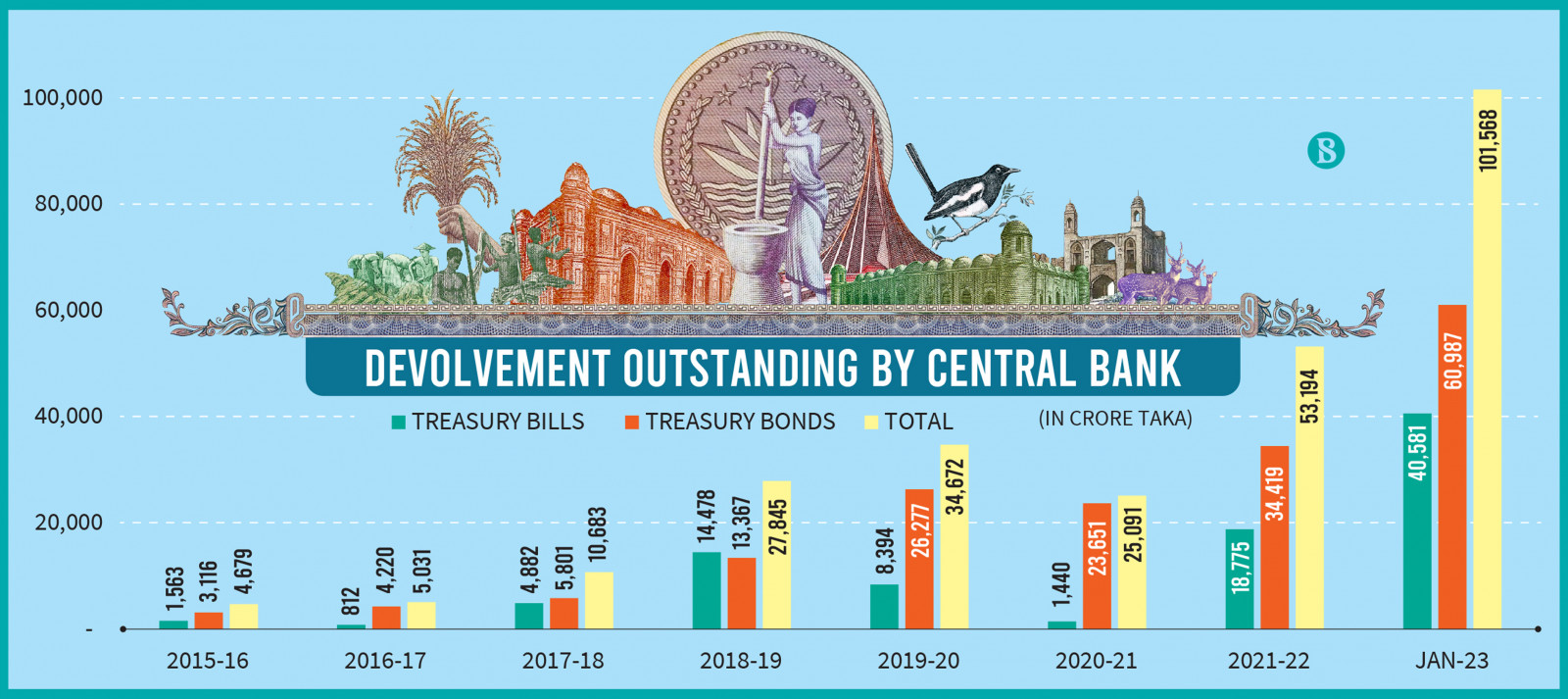

The money market is fluid, with a large amount of devolvement by the central bank. In the last seven fiscal years, central bank devolvement has increased drastically to keep the market artificially stable.

In FY23 up to January, total devolvement was only Tk101,568 crore, compared to Tk4,679 crore in FY16. If the development and government stimulus funds are withdrawn from the market, then the market might face a turbulent situation in terms of liquidity as well as the interest rate.

Overall, our current economic activity relies too heavily on consumption without corresponding savings, and investment could face long-term economic challenges. All indicators and facts express a bearish outlook for our economy. Also, money market liquidity is artificially created, which implies the next crisis may arise from the asset liability management segment.

Mohammad Shahazadul Alam khan is the head of Asset Liability Management at a reputed private commercial bank.

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the opinions and views of The Business Standard.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel