A huge headroom for Bangladesh insurance industry

Insurance was concentrated to a very few large businesses and urban savers until private ventures were allowed to operate in 1985

Insurance that offers financial protection against the risks associated with one's life, health or assets had been here long before independence. Then, with the nationalisation of all firms, the industry started its journey in independent Bangladesh with two state-owned corporations — life insurer Jiban Bima Corporation and non-life insurer Sadharan Bima Corporation.

In the private sector, the American Life Insurance Company, which is now Metlife, has been present here for a long time, leading the life insurance market. In the general insurance business, foreign firms are still just interested in reinsurance.

However, insurance was concentrated to a very few large businesses and urban savers until the private sector insurance ventures were allowed to operate in 1985.

Gradually, new licences were awarded among entrepreneurs in every decade, and new companies competing among each other kept penetrating the market, especially in the life insurance sector. Soon, life insurance agents reached even the remotest villages for client hunting.

In 2010, the government enacted two acts and set up the Insurance Development and Regulatory Authority (IDRA) to develop and regulate the sector. The industry now has 81 companies — 35 in life insurance and 46 in non-life.

However, insurance still appears to be a negative-demand product in Bangladesh as the majority people and businesses tend to be reluctant in paying non-mandatory sums for insurance coverage, while the industry has yet to be strategic or innovative enough to change the behaviour.

According to the IDRA, less than one in every 17 people hold life insurance policies in the country.

In developed countries like Canada, Japan, Sweden, Australia, and New Zealand, almost everyone had insurance coverage even a decade ago. Neighbouring India and Pakistan ensured insurance coverage for 27% and 12.5% of their population, respectively, more than a decade ago as well, while Sri Lanka, with its full literacy rate, had almost everyone insured.

In terms of insuring assets, most businesses are reluctant until insurance coverage is mandatory to continue working with banks, ports and state authorities.

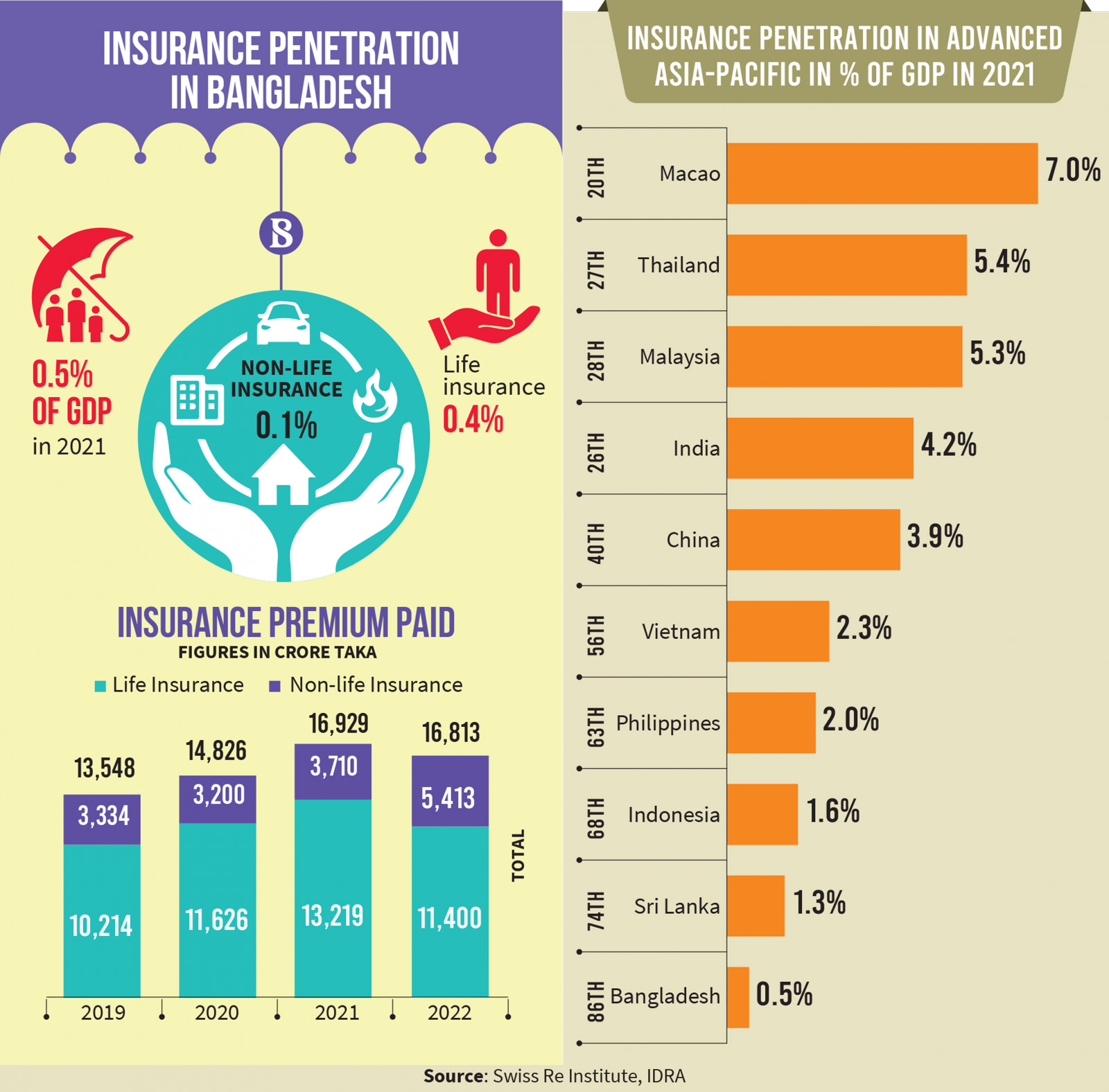

And this is why insurance is only around 0.5% of the country's GDP, ahead only of Nigeria among other comparable countries.

According to the Swiss Re Institute, the ratio was 3.69% in India, 2.1% in Vietnam and 1.16% for Sri Lanka in 2017 and more than 10% in countries like the United Kingdom and Hong Kong, and over 8% for the gigantic economies like the US and Japan.

From an industry perspective, the backwardness of Bangladesh has its bright side too.

With the economic development of the country, the life insurance market has headroom to grow by at least 17 times through covering every citizen, while encouraging people to spend more of their annual income for a better insurance coverage would only boost the industry.

In Bangladesh, the insurance industry earned Tk16,812 crore in premiums in 2022, of which Tk11,399 crore went to the life insurance industry.

So, in the non-life segment, the headroom is even bigger if insurers can effectively offer and communicate the financial risk protection proposition related to assets, health, crops and so many things, while they also will need some policy pushes that gradually make more and more types of insurance a must.

For instance, natural calamities hitting Bangladesh often drastically hurt farmers' financial lives and affordable crop insurance can cover the risks.

With the improved life expectancy and risking out of pocket spending of patients, a large number of people go broke for medical treatment every year and some health insurance premiums can help them survive both from the health perspective and financially.

More than 56 lakh vehicles are registered with the Bangladesh Road Transport Authority and after the ineffective third-party insurance being repealed a few years back, no insurance is mandatory against vehicles. Stolen or accident-damage — nothing would remain as headaches for vehicle owners if automobile insurance coverage was made mandatory like that in India.

Hundreds of thousands of real-estate properties can also be under insurance.

The question frequently arises as to why insurance is so underpenetrated across the burgeoning economy. Majority of the insurers say their premium income vs costs discourage them to struggle in new product segments commercially.

Technology has already emerged to give a big hand to them.

Artificial intelligence, scanning the face of every cow in a cattle farm, can separate them while a small device can even track them with the help of satellites. When farmers will learn the benefit of insurance protection the business should flourish.

Fintech, already adopted by insurers to collect premiums, has made insurance transactions hassle-free and transparent.

A unified messaging platform (UMP), started by the IDRA, developed and operated by a vendor firm, made every single insurance transaction traceable, transparent in 2019 and analysis of the aggregate data is helping everyone.

Insurtech is collaborating with various industries in micro areas and can revolutionise insurance. For example, no insurance official would be interested in a Tk2-20 premium to insure one's single bus trip or bike ride. With the use of technology, this is possible now.

The best part of technology adoption is that much-needed trust is being strongly built among people due to the transparency brought by it.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel