The economy failed the success of power generation capacity

The power sector of Bangladesh is taking heavy criticism because of the sudden deterioration in power generation capacity, which seems perplexing after relatively better service in the past decade. So, can we expect the power sector to thrive when the country’s economy is in dire straits?

Since the beginning of the summer of 2022, load shedding has put the planning, performance and general direction of the power sector of Bangladesh under severe scrutiny. The sudden deterioration, after relatively better service since 2012, has perplexed the uninformed. To understand the current state of affairs, one needs to look into the reality on the ground, previous planning and implementation schemes and preparation for the future. A five-year outlook and analysis can provide sufficient insight into this matter.

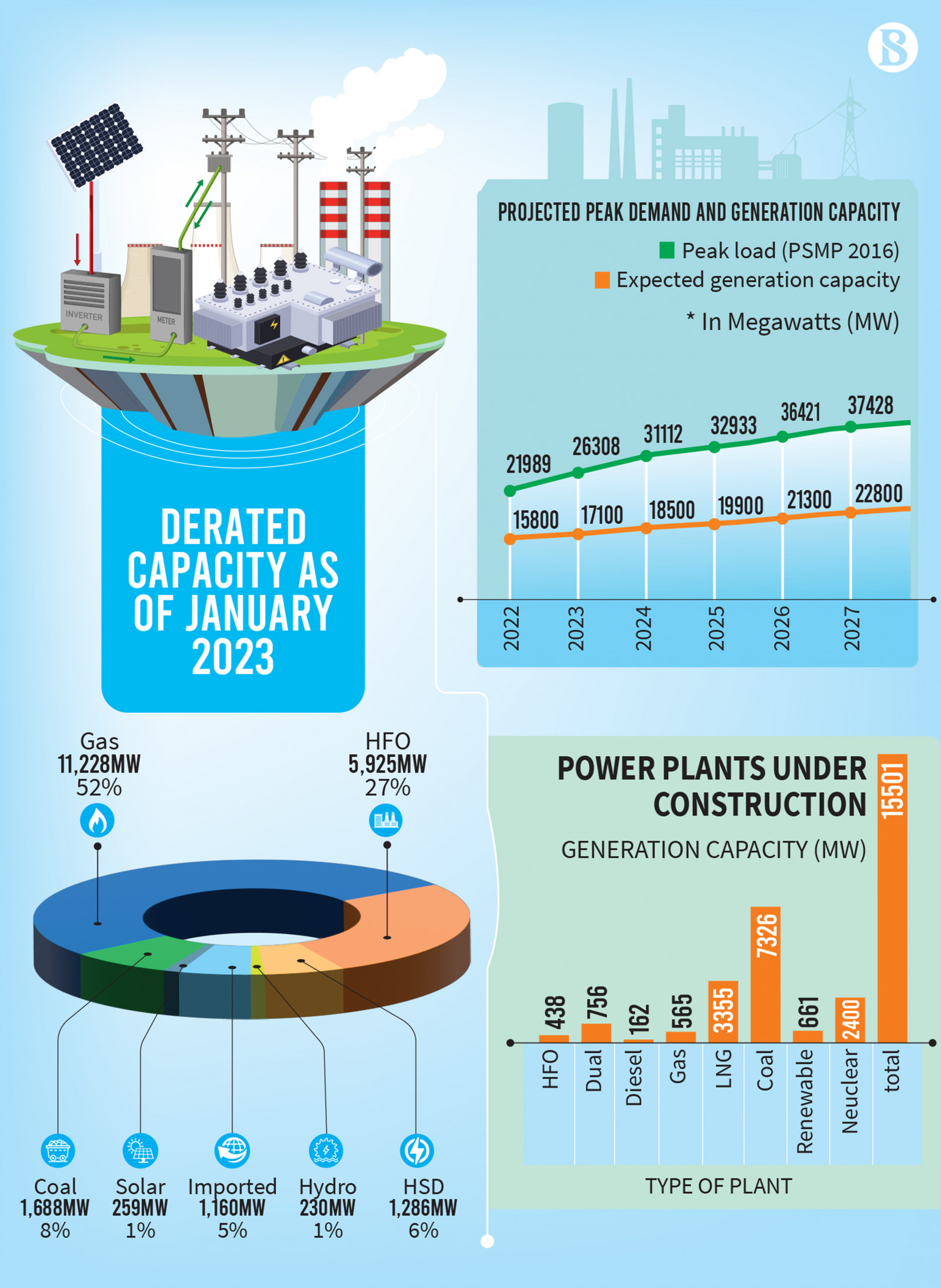

As of 20 January 2023, the total derated (reduced performance due to ageing) grid generation capacity was 21,776 MW. The average peak production has been about 14,000 MW in summer and 10,000 MW during the winter.

The highest recorded production was 14,782 MW on 16 April, 2022. On that day about 4,000 MW capacity was shut down due to maintenance, or fuel shortage reducing the true generation capacity to 18,000 MW. At 85% plant availability, the actual generation capacity was 15,300 MW.

Among the plants that have been shut down, about 2,000 MW are old, very inefficient or completely inoperative. They should have been decommissioned and written off a long time ago.

If there is no restriction on fuel availability, Bangladesh is capable of producing a maximum of 17,000 MW of electricity with its current power plants. This is adequate to meet the demand in 2023. The fuel mix and cost of production, however, is a different issue.

The PSMP 2016 generation plan was dominated by, and equally divided between, the gas (LNG/local) and imported coal to meet the base, intermediate and peak load. However, the pre-Covid/Ukraine war was not anticipated at the time of the planning. The principal consideration was to replace expensive and inefficient oil-based power plants, which were extensively used as base load, with more affordable coal and LNG.

The demand forecast by PSMP 2016 was much more reasonable than any other previous plan under the then anticipated economic growth projection. The major drawback of the plan was its import dependency on the primary energy supply and lack of renewable options. In 2016, it was estimated that by 2030, 90% of primary energy would have to be imported at an estimated cost of $20 billion per year. PSMP 2016 and the subsequent adjustments were based upon the assumption that Bangladesh's economic growth would be able to sustain such an import bill.

The current state of the economy is in dire straits. As a result, the planning and projects of the power sector are being criticised.

However, blaming power sector planning for the economic woes is unfair and misplaced. If the current crop of coal and LNG plants, which are at different stages of completion, were to come online about three to four years back, the sector would have been in a much better position. The completion of long-term base load plants has become a cause of great concern due to financial indiscipline in the banking sector and the consequent economic distress.

The plan to shift from oil to coal or LNG is well in place. The dual fuel plants are diesel and gas. If adequate LNG can be imported, it can be run with gas. The gas plants (565 MW) are repowering Ghorashal Units 3 and 4, which will not require additional gas supply.

The main concern now is the supply of coal and LNG. By June this year, about 2,000 MW LNG capacity will be ready and 2,600 MW coal power plants (including Rampal) are almost ready to start operation now.

By 2027, 500 MMcf/d LNG will be required to operate 3,300 MW (0.182 tcf per annum) and 7,000 MW coal-fired power plants will require 25.5 million tons of coal per year. This would cost $2.2 billion (12/MMBtu) and $5 billion ($200/ton) respectively.

The spot gas price will cost $5 billion ($27.5/MMBtu) for the same. The immediate requirement for 2023 is about $7 billion per annum just for the additional LNG and coal. Failing to supply primary energy to these plants will incur a huge amount of capacity payment that would dwarf all the previous capacity payments.

With 1,600 MW of power imported from Adani's Jharkhand plant in addition to the nuclear fuel import, the primary energy bill for the additional capacity would be well over $10 billion per year by 2027. This is a grave concern due to the current economic distress.

The Rampal first unit has been shut down due to fuel shortage and the same is going to happen to Payra unless emergency steps are taken in arranging the coal import payment. The LNG import capacity is only 1,000 MMcf/d. After satisfying the existing unmet demand, it may not be physically possible to import additional LNG irrespective of price. Moreover, the spot purchase of LNG was halted in July 2022 due to a foreign currency shortage. Repeated calls for gas exploration and examining indigenous coal mining was disregarded, favouring imports.

The success of the power sector is entwined with the economic success of the country. The import-dependent plan was drawn on that hope and promise. The economy failed to capitalise on the success of generation capacity.

The author is an energy expert and professor of BUET

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel