We need a digital usage law to make Facebook accountable, pay taxes

A sweet shop pays VAT and taxes for selling sweets. The shoe vendors pay taxes. Even the local online sellers are paying 5 percent VAT. Everyone pays except for Facebook and Google. Why? Because we do not have a law defining the usage of digital space commercially

If you want to open a business entity in any country, you have to register your entity with the government and abide by certain rules and regulations. And, of course, you pay some form of taxes – unless you are exempted for some reasons by the law. When you are doing a business without registration or paying any taxes, you are committing a crime.

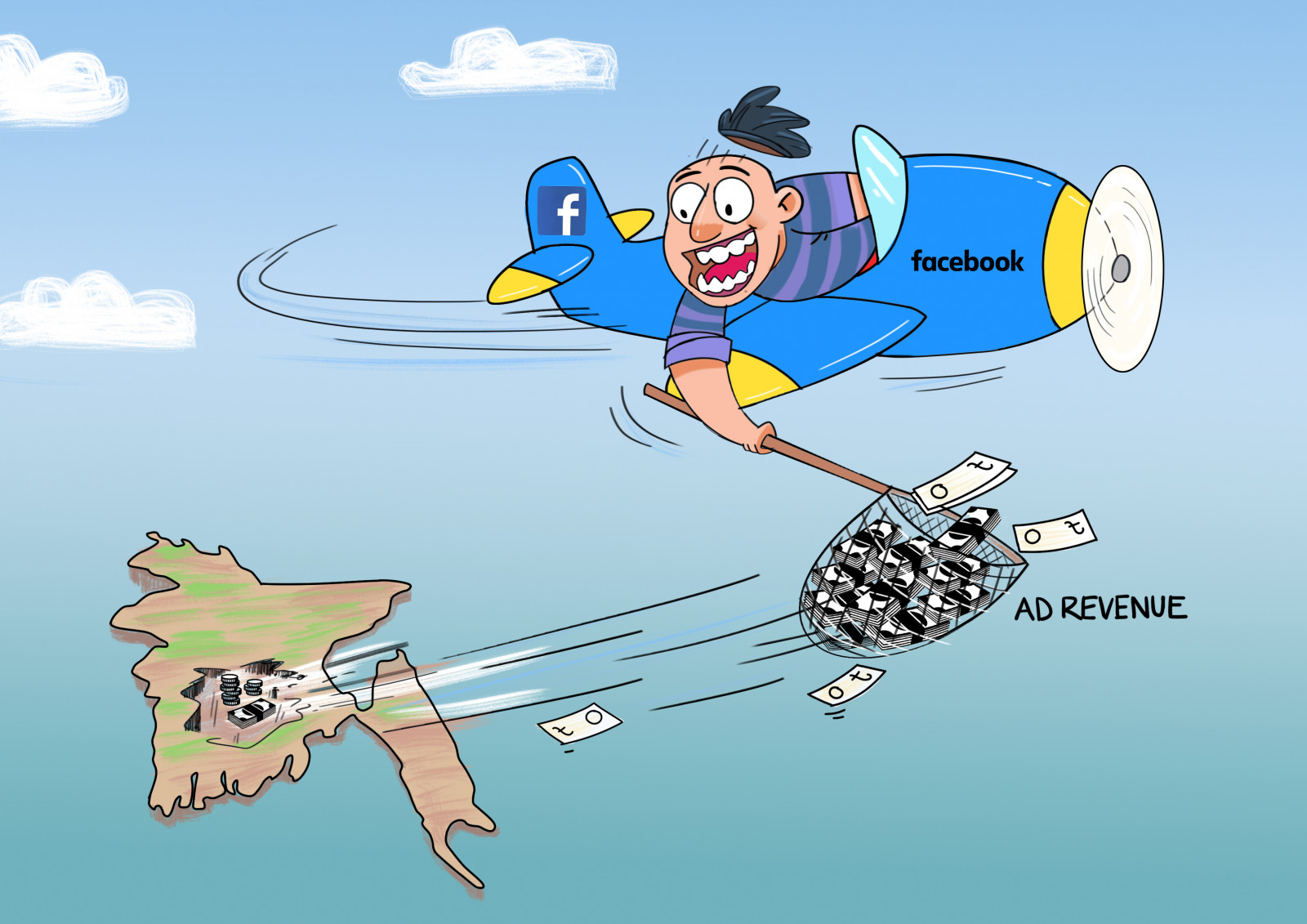

But does it apply to the digital space? Does it apply to Facebook or Google, which are now making more money in Bangladesh through advertisements than any media platform in Bangladesh? In fact, Facebook and Google may be raking more advertisement money than all other media platform (TV, radio, print) combined.

But all media houses pay the government taxes and VAT from their earnings from advertisements. They are bound by the law.

The Bangladesh Telecommunication Regulatory Commission (BTRC) on Monday held a meeting with a Facebook delegation where the social media giant said they "will not pay any taxes on their earnings from advertisements".

Facebook has over 35 million users in Bangladesh and earns about Tk1,200 crore a year.

The Facebook delegation advised the authorities "to open a new wing with the commerce ministry where advertisers will pay for campaigns they run on the tech giant's platforms. Advance income tax and VAT will be charged at the time of submitting the advertisements."

This is a kind of suggestion that the government should challenge, instead of feeling happy, that Facebook gave a great money-making suggestion without shouldering their responsibility.

A sweet shop pays VAT and taxes for selling sweets. The shoe vendors pay taxes. Even the local online sellers are paying 5 percent VAT. Everyone pays except for Facebook and Google. Why? Because we do not have a law defining the usage of digital space commercially.

We cannot forget how fanatics used Facebook to spread hatred against bloggers and "atheists", against writers, thinkers and in general all good values of our society. We saw violence, gory deaths amid deep political conflicts. Thousands were arrested, hundreds were tried and our social-political fabric changed forever.

We can "arrest" a local online seller because he is physically available in Bangladesh. Since Facebook and Google are not physically present in Bangladesh, the government shrugs off the issue.

Worldwide Facebook and Google are both under various probes and penalties for unethical practices, promoting fake news, trading personal data that you typed in, tapping your conversation and monopolising part of the Internet.

Facebook and other tech giants pride themselves as "disruptive" technology that threatened conventional business. Actually, what they did was "disrupt" the legal system to make a business without accountability. For instance, most countries still do not have laws defining commercial usage of digital space. Therefore, Facebook or YouTube can make advertisement revenue without being present in our country while enjoying no legal binding.

We have a Digital Security Act – which mainly aims at cyber policing without targeting the social media platform themselves. In other words, you can be arrested or jailed for posting a derogatory comment, fake news or instigating religious hatred etc. But you cannot book Facebook or YouTube for allowing fake, derogatory or hateful contents.

But if a newspaper or TV published a fake news or derogatory comment, they can be shut down. An editor can be jailed.

Facebook is now facing an anti-trust probe in the USA and being fined $5 billion over privacy violations.

We cannot forget that back in 2013, hardline Islamists used a terribly photoshopped face of Jamaat leader Delwar Hossain Sayeedi on the moon on Facebook and made it viral among a section of fanatic people, saying Sayeedi's face was seen on the moon as a symbol that the government was unfairly treating this "holy" man. We cannot forget how fanatics used Facebook to spread hatred against bloggers and "atheists", against writers, thinkers and in general all good values of our society. We saw violence, gory deaths amid deep political conflicts. Thousands were arrested, hundreds were tried and our social-political fabric changed forever.

But there was no action against Facebook – except for the fact that the BTRC had blocked access to some pages like Basher Kella (which did not work).

We also cannot forget that when the government requested YouTube to remove a video insulting our prophet and YouTube declined saying it was against "freedom" of speech/expression. The government then blocked access to YouTube for many months, and ultimately surrendered.

But eventually YouTube removed that video. YouTube and Facebook, under pressure from various countries, are now making new community guidelines and filtering contents.

We, therefore, need to make all tech giants accountable to us. If they are doing business in Bangladesh, they should be made accountable. How?

Well, we can start by framing a law that defines usage of the digital space for business, commerce and expression. If Facebook or Google wants to do business in Bangladesh, they should abide by our law – or else their advertisements from Bangladesh cannot be posted. Once the government touches this nerve, they would either leave Bangladesh out – or comply with our law.

Facebook, Google and other technological giants have been enjoying an unfair advantage since early 2000. We cannot allow this unfair competition.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel