Enlist state-run companies in stock market: PM

The prime minister also instructed to enhance the financial capacity of state-owned companies

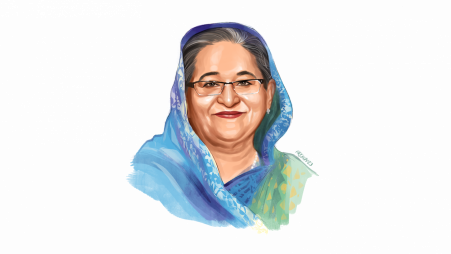

Prime Minister Sheikh Hasina has stepped in for the stock market listing of state-owned enterprises (SOEs) after more than a decade of no progress, despite a series of initiatives at the ministry and regulator levels.

At a meeting of the Executive Committee of the National Economic Council (Ecnec) on Thursday, the premier ordered the Finance Division to work on the capital market listing of SOEs.

She aims for financial strengthening of the enterprises, Planning Minister Major General (retd) Abdus Salam and Planning Secretary Satyajit Karmaker said at a press briefing after the meeting.

The order came during Ecnec's approval of a project to transform Chhatak Cement Company into a dry-process cement manufacturer from the existing wet processing.

The Finance Division will analyse and sort out which state-owned companies can go public, and the proposal with the list of companies will be submitted to the prime minister, said Satyajit Karmaker.

"Public listing would help increase the competitiveness of the SOEs for competing with private companies," added Abdus Salam, mentioning that by going public, firms would control their costs.

For instance, he said, many private sector companies significantly surpassed the state-owned Chhatak Cement Company, despite starting much later.

Hence, SOEs need to grow a competitive mindset, learn to take care of their own liabilities, and work faster for financial performance, said the minister.

Only then, SOEs can finance at least small projects for their expansion out of their profits, he conveyed the prime minister's emphasis.

SOEs and moves to list them

According to the Bangladesh Economic Review 2022–23, there are 48 state-owned non-financial enterprises that have been categorised into seven sectors – industry, energy and utilities, transportation and communication, trade, agriculture and fisheries, construction, and services – in the form of corporations, boards, and authorities in the country.

Many of the corporations own and run several companies in their respective industries.

In the fiscal 2021-22, all the SOEs' total revenue was Tk2.27 lakh crore, while the annual average growth in the previous four years was 6.93%. Their net profit was only Tk4,808 crore in the fiscal year.

Following the successful listing of oil distributors Padma, Meghna, and Jamuna and gas distributor Titas in the 2000s, the then Finance Minister AMA Muhit instructed the listing of many more that never were executed except for the listing of Bangladesh Submarine Cable Company in 2012.

Finance Minister AHM Mustafa Kamal in 2019 asked state-owned banks Sonali, Janata, and Agrani to go public in six months, but there has also been no progress.

Capital market experts said, despite being asset-heavy, SOEs mostly fail to make money in Bangladesh unless they enjoy a monopolistic edge in the market. Their lack of competitiveness is due in large part to their mindset and workplace culture.

For instance, there are 22 SOEs listed on the Dhaka Stock Exchange. Of them, oil distributors, due to their monopoly, earn a lot to pay high dividends.

In contrast, two sugar mills are losing 4-6 times their paid-up capital every year. Also, electric cable manufacturer Eastern Cables, motorcycle assembler Atlas are making losses as they failed to compete with the private sector.

In December 2021, the Bangladesh Securities and Exchange Commission (BSEC) wrote to 17 government-owned profit-making firms to target stock market listings.

Later, in January last year, the regulator made a list of 29 state-owned firms and wrote to the Prime Minister's Office to initiate their listing process.

The list consisted Bakhrabad Gas Distribution Company, LP Gas Ltd, Gas Transmission Company, Jalalabad Gas Transmission and Distribution System, Pashchimanchal Gas Company, Sylhet Gas Fields, Bangladesh Gas Fields Company, Rupantarita Prakritik Gas Company, North-West Power Generation Company, Electricity Generation Company of Bangladesh, Pragoti Industries, Karnaphuli Gas Distribution, Bangladesh Insulator and Sanitaryware Factory, Hotels International Limited, Biman Bangladesh Airlines, Bangladesh Telecommunications Company, Bangladesh Cable Shilpa, and Essential Drugs Company Limited, Carew and Co, Sadharan Bima Corporation, Dhaka Power Distribution Company, Eastern Refinery, Telephone Shilpo Sangstha, Jiban Bima Corporation, Ashuganj Power Station, Sundarban Gas Distribution Company, BR Power Zone, Jamuna Fertilizer and Northern Electricity Supply Company.

ICB Capital Management, the investment banking subsidiary of the state-owned Investment Corporation of Bangladesh, has already started working with some of the firms to create awareness among their officials regarding the right practices as a publicly listed firm.

Experts also stressed the government's awareness of minority shareholders' rights before it seriously looked at modern, efficient SOEs, the listing of which could provide the firms or the government with a huge sum of capital to grow further.

Titas Gas, listed in 2008, attracted investors, including foreign funds, due to its high dividends, gigantic asset base, and monopoly business in its areas. The energy regulator's orders squeezing Titas Gas's profit margin last decade were a memory the investors want to forget as they suffered capital erosion.

However, in recent years, the government, while dealing with publicly traded SOEs, has shown several positive gestures, including that with the Power Grid Company. The huge sum of legacy share money deposited by the government in the company was converted into preference shares instead of common shares, which offer the public shareholders relief from the fear of assets and earnings getting divided among too many shares.

The non-cumulative nature of the Power Grid preference shares also offers the company relief as it will not have to pay a mandatory dividend against the preference shares in a bad year, which analysts believe is a generous move by the government.

Also, Titas Gas, after an unpleasant experience, got some of its profit margin back as the energy regulator widened the dictated pricing to some extent last year.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel