Two-thirds of LPG sellers hold on to bulk importers to stay afloat in dollar crisis

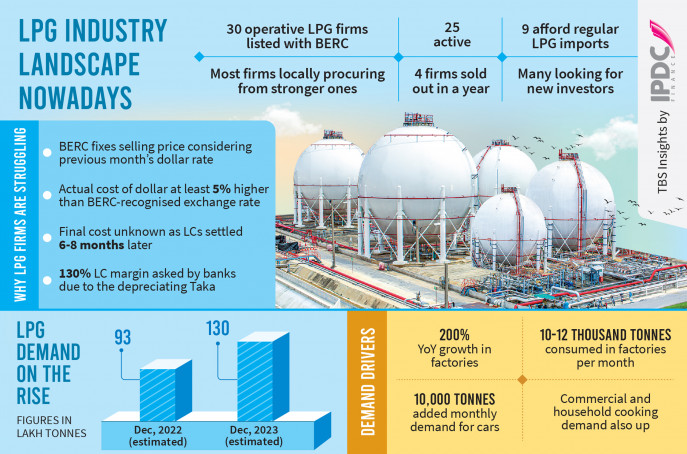

The liquefied petroleum gas (LPG) sector in Bangladesh is in serious crisis. About Two-thirds of the 30 LPG companies in the country are now struggling with an everyday task that has become extraordinarily difficult, that of opening Letters of Credit (LCs) to import this indispensable cooking fuel which has also become the go-to for industries and automobiles.

The overwhelming reason is the ongoing dollar crisis, according to the industry insiders.

These companies find themselves in a difficult situation. They are being forced to keep their factories churning by tapping into the gas supply from a select few companies.

Companies like Omera, Bashundhara, BM, Uni, Jamuna, United are among the few chosen ones, who are importing LPG in large quantities.

Now it's all about managing that elusive working capital and sidestepping potentially colossal losses. It's a dance with the dollar crisis, and these companies are doing their best to juggle the challenges to keep the machines churning out products.

Omera had imported around 15,000 tonnes of LPG a month in the second half of 2022; nowadays, it is importing 25,000 tonnes monthly to meet the increasing demand from the industrial and automobile users. It also supplies the other brands bottlers who are unable to import on their own.

On the other hand, after huge investments for infrastructures and holding a strong market position, most others, including Navana, and G-Gas, started to depend on Omera for local procurement.

At least 18 companies were importing bulk LPG a year ago, and now, not even half of them are able to manage to open LCs for imports on a regular basis, said Azam J Chowdhury, president of LPG Operators Association of Bangladesh (LOAB).

For instance, G-Gas, a concern of engineering conglomerate Energypac, used to import 5,000 tons or more LPG a month. It could not import any for the last three months.

"Due to the crisis of the greenback, dollars are nowhere available at the official rate. Banks are asking for even a 130% LC margin against the multimillion dollar LCs," said Humayun Rashid, managing director and CEO of Energypac.

"When an industry is incurring continuous losses, the unforeseen high LC margin is not affordable," added Rashid who is also the president of the International Business Forum of Bangladesh.

To stay afloat in the business of essential commodities and to keep its popular brand afloat, his company, like most others, is locally procuring only a portion of what it used to import, thus losing in the competition.

Unlike others, the LPG business cannot pass all their additional costs on to the consumers as they have to sell at the Bangladesh Energy Regulatory Commission (BERC) fixed retail prices.

The gap between the official exchange rate and the practical rate at which LCs are settled months later is determining how much loss an LPG importer will incur per cylinder, according to chief financial officers of LPG companies.

For instance, the BERC while fixing the LPG retail price of Tk117.02 per Kg for December, considered the weighted average exchange rate of Tk116.39 per dollar, at which companies settled LCs in the previous month while importers are rarely getting the dollar below Tk120.

Atiar Rahman, head of finance at Omera Petroleum said, "Every single taka we pay for a dollar in addition to the BERC-recognised exchange rate, is causing a Tk10-12 in loss per 12 Kg cylinder."

Companies are incurring a loss of around Tk80 per cylinder as they have to buy dollars at Tk122 or even more.

Just paying more for a dollar alone won't solve the LC opening problem.The high LC margin is also increasing the financial cost of the already struggling companies that had been financially bleeding for more than a year, said the Chief Financial Officer of another LPG firm that was forced to stop importing a few months ago.

"We only know the selling price of our product at the local market but we don't know how much our purchase cost would be until six months later," said Mohammad Yasin Arafat, director of Jamuna Gas.

The cause of this paradox is that the LCs are settled 6-8 months later. Yasin said the continuous devaluation of Taka against the dollar has created a situation where delay in settling LCs are making the imports more expensive, on a retrospective basis, he added.

Azam J Chowdhury said, "We raised our concern in this regard during the last meeting with the energy regulator."

BERC considers only the documented costs of companies while the unofficial and undocumented cost of managing dollars for LCs far exceeds the official rate, said LPG industry CFOs.

The banks are opening LCs for importers with dollars sourced from the dollar-surplus exporters only if the importer is ready to pay an unrecorded additional price per dollar, they added.

"We all are chasing both the dollar and the exchange rate since May 2022, and except for a very few months in between when the dollar was stable for a while, cumulative losses and the cost of finance were only going up", said head of another LPG company that used to import 2,500-3,000 tonnes of LPG per month until it could not keep up with losing money any more and lost its ability to pay the banks back.

Even some of the market leading firms failed to keep their gas imports smooth in the last one year and consequently fell behind in competition.

Four LPG firms have been sold to new investors in the last one year and many others are looking for buyers because of the unbearable financial struggle now.

Bangladesh LPG sector, that almost entirely depends on imported LPG, has got a rare landscape where more than two dozen active firms are competing to sell at the regulator-fixed prices.

The country was consuming some 90,000-100,000 tonnes of LPG per month a year ago and it surged to 1,25,000 to 1,40,000 tonnes currently. Around 20,000 tonnes of the added demand came from cars and factories, say LPG marketers.

Atique Munir, Chief Operating Officer of a top tier apparel exporter Fakir Fashions Ltd, said the depreciating Taka is raising the factories' cost for industrial LPG, the only choice right now they can rely on because of the natural gas grid's inadequate pressure.

The company is now planning to depend more on industrial LPG from next month. However, the rising dollar and the unpredictable local price of LPG are concerns for them.

Factories having no foreign exchange income are even more apprehensive of further depreciation of Taka as it might raise their cost of fuel.

The undocumented costs of companies are often being reflected in the unofficial retail price hike in the "fixed price" market for the cooking gas in cylinders as consumers often have to pay Tk50-150 extra for a 12 Kg cylinder.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel