IMF warns of stubborn inflation and weaker global growth in 2024

In most countries, the IMF, an institution charged with monitoring the health of the global economy, foresees inflation remaining above central bank targets until 2025

The International Monetary Fund lifted its global inflation forecast for next year and called for central banks to keep policy tight until there's a durable easing in price pressures.

The IMF boosted its projection for the pace of consumer price increases across the world to 5.8% for next year in its World Economic Outlook released Tuesday, up from 5.2% seen three months ago. The call for vigilance on inflation comes as it also trimmed the forecast for economic growth in 2024.

In most countries, the IMF, an institution charged with monitoring the health of the global economy, foresees inflation remaining above central bank targets until 2025.

The forecasts are a much-anticipated event at annual IMF-World Bank meetings, which are taking place this week in Marrakech, Morocco — the first time they've been held in Africa in 50 years. The event unfolds in the wake of a deadly weekend assault on Israel by Hamas that shook the world and revived fears of a wider conflict in the Middle East — home to almost a third of global supply of oil. The attacks present another factor in a period marked by global uncertainty.

Central banks in major economies including the US and European Union have raised interest rates aggressively for more than a year to curb inflation that reached 8.7% globally in 2022, the highest level since the mid 1990's.

"Monetary policy needs to remain tight in most places until inflation is durably coming down towards targets," Pierre-Olivier Gourinchas, the IMF's chief economist, said in a briefing with reporters. "We're not quite there."

The surge was spurred by factors including coronavirus pandemic supply chain disruptions; fiscal stimulus in response to the global lockdown; subsequent strong demand and a tight labor market in the US; and food and energy disruptions from Russia's invasion of Ukraine, which had a particular effect in Europe and the UK.

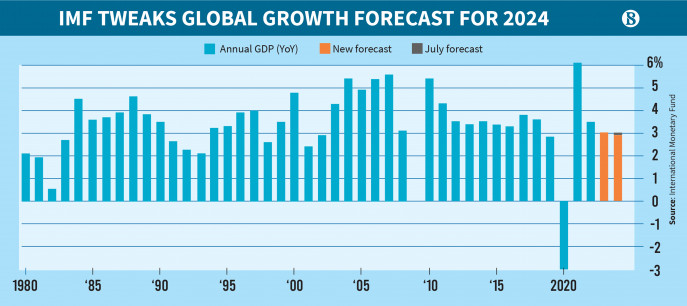

The fund sees global growth of 2.9% for next year, down 0.1% from its outlook in July, and below the 3.8% average of the two decades before the pandemic. Its forecast for 2023 is unchanged at 3%.

Since April, the fund has been warning that medium-term prospects have weakened. Factors holding back the expansion include the long-term consequences of the pandemic; the invasion of Ukraine; the breakdown of the world economy into blocs; and the central bank policy tightening.

"We see a global economy that is limping along, and it's not quite sprinting yet," Gourinchas said.

While the outlook for global growth is low, it's relatively stable and the IMF sees better odds that central banks can tame inflation without sending the world into recession.

Yet the steadiness in the IMF's aggregate projection for growth masks some important changes in the individual country forecasts that underpin it. The US, the world's largest economy, had its projection for this year raised to 2.1% from 1.8% in July and next year's estimate increased to 1.5% from 1%, based on stronger business investment in the second quarter and resilient consumption growth.

The IMF sees the US unemployment rate rising to a peak of 4% by the last quarter of 2024 — less than the 5.2% projected in April, "consistent with a softer landing than earlier expected for the US economy."

On the other hand, the growth forecast for China, the world's second-largest economy, was cut to 5% from a 5.2% estimate for 2023 and to 4.2% from 4.5% in 2024. China's economy is losing momentum because of declines in real estate investment and housing prices that endanger government revenues from land sales, as well as weak consumer sentiment.

"Restoring confidence, cleaning up that sector is going to require forceful action by the authorities, and we've seen some move in that direction, but more is needed," Gourinchas said. "If that doesn't happen, then there is a chance that that problem could fester and become worse."

The growth estimate for the euro area was also cut, to 0.7% in 2023 from a previous 0.9% estimate, and to 1.2% in in 2024 from a 1.5% projection earlier.

There's also divergence among European economies, with Germany seen contracting more than previously expected amid weakness in interest-rate-sensitive sectors and slower trading partner demand. France, however, had its forecast upgraded after there was a catch-up in industrial production and external demand outperformed in the first half of 2023.

The IMF boosted Japan's growth forecast for this year to 2% from a previous 1.4% projection, as it's bolstered by pent-up demand, a surge in tourism, accommodative policies, and a rebound in automotive exports that were previously held back by supply chain challenges.

The UK growth outlook for next year was cut to 0.6% from 1%, reflecting tighter monetary policies to tame still-high inflation and lingering impacts of the terms-of-trade shock from high energy prices.

The IMF has repeatedly warned about fragmentation in the global economy, or its breakdown into geopolitical blocs along fault lines because of tensions between the US and China, as well as Russia's aggression.

The fund sees trade growth of 0.9% this year, down from 2% expected in July and compared with a 4.9% average in the two decades before the pandemic. That reflects shifts toward domestic services, lagged effects of dollar appreciation, which slows trade owing to the widespread invoicing of products in dollars, and rising trade barriers.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel