SME Foundation in quandary with Tk50cr FDRs in PK Haldar's scam-hit NBFI

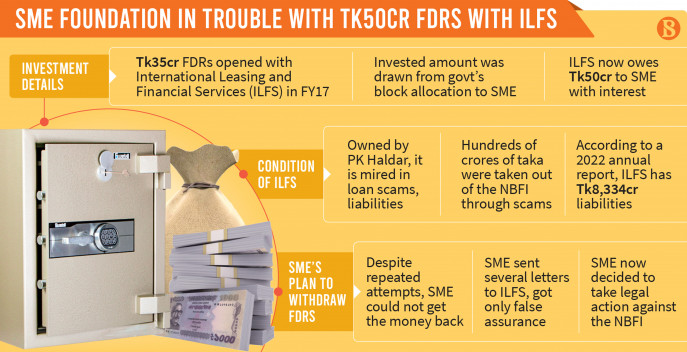

The Small and Medium Enterprise (SME) Foundation has found itself in deep water with around Tk50 crore investment in fixed deposit receipts (FDRs) made to the International Leasing and Financial Services (ILFS) Limited — a non-bank financial institution (NBFI) owned by Prashanta Kumar Halder — mired in loan scams and heavy liabilities.

Prashanta Kumar Halder, also known as PK Halder, is a fugitive banker and businessman who is accused in around three dozen cases of financial crimes such as money laundering.

The foundation has been trying to get back the money — which it invested from its Endowment Fund made of the government's block allocation — from the NBFI for several years now.

To withdraw the FDRs, it had sent repeated letters to the ILFS but got only false assurance in response.

Md Masudur Rahman, chairperson of SME Foundation, told The Business Standard, "The previous board of the foundation opened the FDRs. The current board has taken various initiatives to rescue the capital. Several letters have also been sent to the financial institution, but despite repeated assurances, they did not return the capital, let alone profits."

"The board has decided to file a case against ILFS to recover the money. We are completing the procedures that have to be done before filing the case," he said.

In the 2016-17 fiscal year, SME Foundation opened FDRs worth Tk35 crore of Endowment Fund with the ILFS head office and Gulshan corporate branch. The ILFS now owes about Tk50 crore to the SME Foundation with interest.

According to the 2021-22 financial year report, the foundation has FDRs worth around Tk370 crore. Out of which, Tk200 crore belongs to the Endowment Fund.

The money of the Endowment Fund has been invested in several banks including state-owned Bangladesh Development Bank Limited (BDBL), Krishi Bank, Agrani Bank, Rajshahi Krishi Development Bank, First Security Islami Bank, Padma Bank, Premier Bank, IFIC Bank, Jamuna Bank and ONE Bank.

An endowment fund is a kind of investment fund that a non-profit organisation holds, and amounts are frequently withdrawn from the fund to meet general and specific needs.

Moreover, Tk89.49 crore of the SME foundation's Reserve Fund and Tk81.05 crore of the General Fund are in different banks.

A reserve fund is a savings account or other highly liquid asset set aside by an individual or business to meet any future costs or financial obligations, especially those arising unexpectedly.

SME Foundation Chairman Masudur Rahman said the foundation could not take up new programmes due to a lack of funds.

"The SME Foundation is an institution of the Ministry of Industries. I have also informed the ministry. The ministry is also pressing the financial institution but there is no solution yet," he said.

A top official of the foundation, on condition of anonymity, said the organisation was running well at that time when the FRDs were initiated. However, due to a lack of proper supervision, loan scams have occurred and the investors are now paying the price.

"An investigation has also been done by the foundation. In that context, it was decided to file a lawsuit. The foundation is facing problems due to non-availability of capital," said the official.

The ILFS was hit by loan scams in 2019. Hundreds of crores of taka were taken out of the organisation through fraud. A large number of people have defaulted due to anonymous lending.

In 2019, the ILFS was suspended from trading on the main board of the Dhaka Stock Exchange. Although the suspension period has been extended for almost three years, there was no initiative to resume transactions.

When the Bangladesh Bank applied for liquidation of the financial institution, the High Court constituted a new board for the institution. The court-directed board is performing the duty to run it. This board has already undertaken some plans.

According to an annual report for 2022, the ILFS has Tk8,334 crore liabilities. Among the liabilities, borrowing from banks, financial institutions and agents is Tk1,312 crore.

Term deposits and other deposits account for Tk2,869 crore, in which, the term deposit amount is Tk2,871 crore and other deposits Tk52.28 crore. Other liabilities stood at Tk4,152 crore.

The term deposit represents deposits from individuals and institutions for a period of not less than three months.

Other deposits represent deposits received against the lease and direct finance on signing the agreement, which is subject to repayment on the expiry of the agreement.

The ILFS disbursed Tk4,126.87 crore. Of which, 90.86% or Tk3,749 crore is classified. Only, Tk377 crore unclassified, according to its latest annual report for 2022.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel