Why Bangladesh mutual fund industry lags behind despite beating the stock market

Mutual funds are collective investment tools that pull money from investors and invest them in markets in an informed way to create long term wealth

With an emergence of a bunch of new generation asset managers equipped with the maximum professional preparation to manage investors' money, the mutual fund industry in Bangladesh is generating higher return than the stock market indices or fixed deposits do.

Mutual funds are collective investment tools that pull money from investors and invest them in markets in an informed way to create long term wealth.

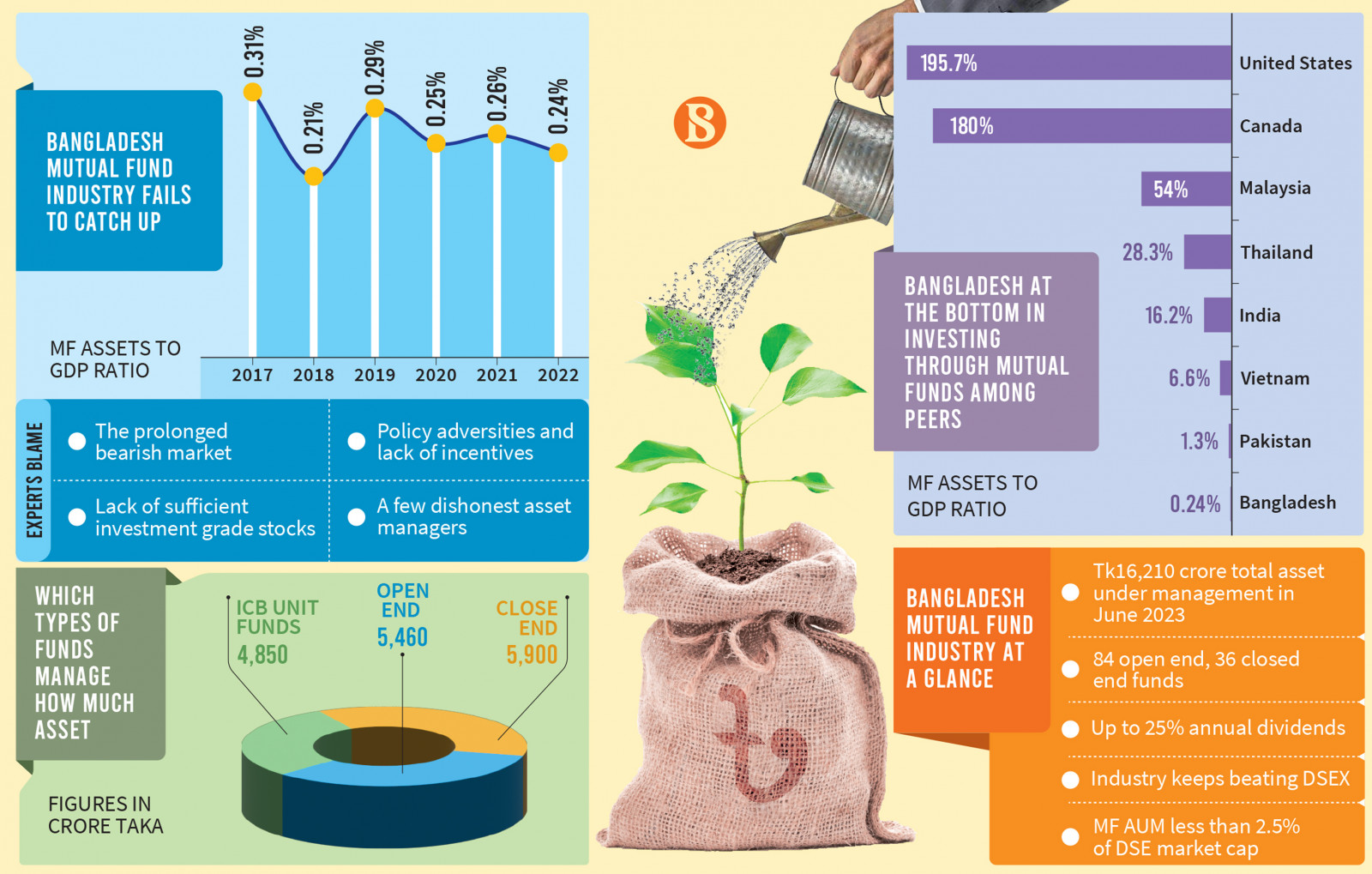

Having several dozen new asset managers and responses from a group of long term investors, the industry's assets under management (AUM) grew to over Tk16,200 crore at the end of June from Tk2,500 crore some 15 years ago.

"The growth might sound impressive, but it was nothing if we compare to potentials and that in the other economies," said Waqar Ahmad Choudhury, vice president at the Association of Asset Management Companies and Mutual Funds (AAMCMF).

Just like the entire capital market that failed to catch up with the growth of the country's economy, the 120 mutual funds together equal to less than 2.5% of the total market capitalisation of the Dhaka Stock Exchange (DSE), no improvement from where it was years back.

Also, in terms of mutual fund industry AUM to GDP, Bangladesh is at an extreme bottom as the ratio is declining in the country, while other countries with much bigger bases are growing.

A report by EBL Securities last week revealed that Bangladesh's AUM to GDP ratio shrunk to 0.24% at the end of June 2022, from 0.31% in 2017.

While the AUM in the developed markets like the USA, Canada were 180% to 195% of their respective economies. Malaysia raised it to 54%, Thailand to over 28%, neighbouring India to 16%, Bangladesh's most pronounced comparator Vietnam already made it to 6.6%, and even for Pakistan the ratio is 1.3%, according to the report titled "Diving Deep into the Mutual Fund Industry of Bangladesh: Fund Composition and Performance Analysis."

The smaller mutual fund AUM has some significant negative impact on the capital market and the economy, say experts, as a weak base of informed institutional investors lets the market be dominated by herding behaviour that keeps so many pump and dump rallies, bubbles and busts alive.

Prime Minister's Private Sector Development and Investment Advisor Salman F Rahman at different speeches stressed the need for strengthening the base of institutional investors to build a better capital market.

The securities regulator, eying a bigger mutual fund industry, has awarded several dozen asset management company licences in the last 15 years.

However, not all its policy decisions helped the industry. For instance, doubling the tenure for closed end mutual funds later last decade, violating the trust deeds during formation, hurt investors' confidence as their money was stuck for another decade.

Mutual funds used to enjoy a big quota for buying low risk primary shares and the Bangladesh Securities and Exchange Commission (BSEC) after the pandemic reduced it drastically to let individuals enjoy the benefit.

"Not only primary share quota, many of our policies are practically encouraging the mass people to try their luck in the stock market instead of investing through the world's most popular and proven tools for long term wealth creation," said Waqar Ahmad Choudhury.

For instance, an individual's annual dividend income up to Tk50,000 is tax-exempt in Bangladesh, which is Tk25,000 if the dividend comes from mutual funds.

Individuals have no limit to directly invest in listed securities for tax rebate. Open end mutual funds also were in the list and the National Board of Revenue (NBR) imposed a limit of Tk5 lakh for non-listed, open end mutual funds if invested for tax rebate.

The markets abroad, which had a big and strong mutual fund industry, came through policy incentives that made the instruments lucrative to the masses and even to institutional investors, said Choudhury who is the managing director of Vanguard Asset Management managing over Tk300 crore.

From 2017 to 2022, AUM in Bangladesh grew at a compound annual growth rate of 7.72%, which was over 14% in India, 11% in Sri Lanka and 8.1% in Malaysia, according to the AAMCMF.

Mutual fund investors for the last fiscal year also faced a double taxation in their dividend income and thanks to the NBR that realised and corrected it recently.

Despite the fact, a prolonged bearish market, a lack of enough diversified investment grade stocks, unconventional restrictive measures like floor price altogether hurt mutual fund returns in Bangladesh. The industry average return was beating the broader stock market indices over years and the compound annual average return of mutual fund investors was higher than the FDR, he said.

Dishonest acts by only a few of the nearly five dozen asset managers did hurt investors' confidence, he accepted, adding that regulators, trustees, auditors should strengthen their monitoring and supervision so that no industry player can act against investors' interest and hurt their confidence.

"The AUM of mutual funds had potential to grow to over Tk1.6 lakh crore by now if the problems were removed," he added.

The central bank imposes no cap for banks to invest in a bond, while it restricts it for subscribing to at best 15% of a mutual fund.

Restoring the quota facility for primary shares, raising the tax free dividend income limit to Tk5 lakh for individuals, reducing the capital gain tax on institutes if that comes from mutual funds, allowing more wealthy individuals to invest in mutual funds for tax rebate and securities regulator's push to institutional investors for a mandatory exposure in mutual funds like it did for bonds, were included in his association's list of recommendations.

Encouraging well performing asset managers was another task pending, he said, adding that some asset managers even pay 20%-25% dividends a year while capital appreciation was a bonus on top of that.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel