Export diversification: Current scenario and possibilities

The high export concentration in RMG is transforming our economy but also leaving us extremely vulnerable to global shocks. If Bangladesh is to continue its growth trajectory, export diversification is essential

Bangladesh's export basket is primarily dominated by its Ready Made Garments (RMG) sector. The sector was initiated in the late 1970s with nine export-oriented garments manufacturing firms which initially earned less than a million dollars per year before transforming into the second largest garments exporter by 2015.

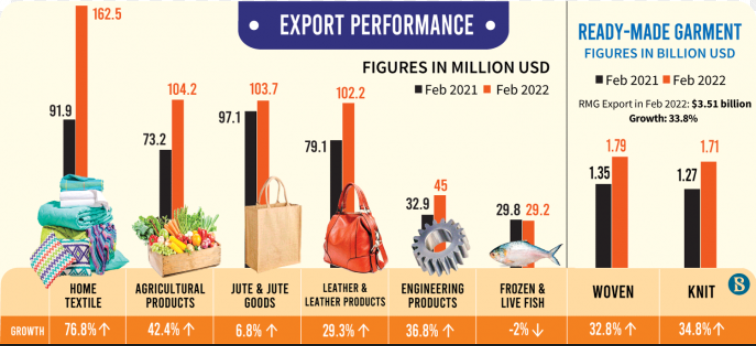

At the moment, the RMG sector's current contribution to the total export of the country is 85%. Keeping this in mind, it would be relevant to observe how other industries/sectors are faring.

This year in the shipbuilding industry, Ananda Shipyard marked the export of 6,100 deadweight tonnage container vessels to the United Kingdom. The total export share of the plastic industry has reached 1.5%. The light engineering industry is also steadily developing, accounting for approximately 0.4% of total exports.

Bangladesh has already become a popular source for quality leather, leather goods and footwear. The country exported US$335.51 million of leather goods and footwear in the last fiscal year. Non-leather footwear exports reached US$ 449.15 million in the fiscal year 2021-2022.

With annual job growth rates declining to 1.8% between 2010 and 2016 despite accelerated export growth, the RMG sector's potential to create new jobs is also waning. M Syedur Rahman / Senior Consultant, Development and Policy Management Ltd

According to the latest data released from the Export Promotion Bureau (EPB), Bangladesh exported pharmaceuticals worth over US$100 million in the first half of the current fiscal year which ended in December 2021. This represents a 22% growth considering the export volume of US$169 million in the fiscal year 2021.

Bangladesh currently exports furniture to more than 40 countries including India, Bhutan, Canada, Switzerland, Spain, France, Japan, Norway, Saudi Arabia, Poland and the United States. So far the sector has achieved a decade high of US$ 110.36 million from furniture exports in the last fiscal year.

Globally known 'Gartner' magazine recognised Bangladesh as one of the leading ICT and IT-enabled sources of service companies. Bangladesh exported ICT and IT-enabled services worth US$70.81 million in the last fiscal year.

In the fiscal year 2021-2022, Bangladesh's total export was $52.08 billion, including exports of RMG worth $42.613 billion. Based on these figures, it is evident that Bangladesh could not exhibit a significant improvement in terms of export diversification. The high export concentration in RMG is transforming our economy, jobs and income but also leaving us extremely vulnerable to external global shocks due to changes in global demand and price.

There is an enormous potential for diversification within the RMG sector. Nearly three-fourths of RMG exports are limited to nine destinations - the USA, Germany, the UK, Spain, France, Italy, the Netherlands, Canada and Belgium. Bangladesh can aim for emerging Asian markets such as South Korea, China and India. In addition, Central Asia, the Middle East and African markets can be targeted.

Moving on to other promising sectors, pharmaceutical exports can grow in larger volume by taking advantage of the opportunities provided by the patent exemption by the Agreement on Trade-Related Aspect of Intellectual Property Rights (TRIP) which is set until 2033. International regulatory authorities like UK-MH, Australia-TGA and the EU have already certified some local pharmaceutical companies.

Beximco Pharmaceutical Ltd and Square Pharmaceutical Ltd have already obtained the certification from the US-FDA. These two companies also own additional accreditation from EMEA (Austria), TGA-Australia, TFDA (Thailand), Health Canada, BPOM (Indonesia), ANVISA (Brazil), AGES (Germany) and GCC-DR (GCC countries).

To reduce the cost of raw materials, more manufacturing facilities need to be established for Active Pharmaceutical Ingredients (API). Bio-equivalency testing is also a major issue and it has to be outsourced. Developing local test facilities can enhance export growth. Policy support and export incentives from the government can bring momentum to pharmaceutical export, thus attributing to diversification.

The Heckscher-Ohlin theory, a general equilibrium mathematical model of international trade, suggests that a country tends to primarily export those commodities which make use of its available resources more thoroughly. Based on this theory, we can engage the leather sector more for export diversification due to the availability of primary raw materials locally.

The government could provide the leather industry with policy support similar to that offered to the RMG sector, this would prove advantageous. The leather sector contributed to 3.4% of the total export earnings of Bangladesh during 2015-16. The sector has a lot of potential to grow due to the availability of a large number of skilled workers.

The global market size of plastic was calculated to be $570 billion in 2021 and it is growing at an average annual rate of 20%. Bangladesh's share is only 0.5%. The major obstacle to export growth is procuring quality certification in line with the international standard. This challenge may be overcome by collectively engaging the trade body to arrange the certification process. Government offers favourable policies (exemption of export duty and bonded warehouse facility) for the plastic sector and this should enhance the export volume.

The primary export items of the light engineering sector consist of bicycles, objective lenses, transformers and batteries. During the fiscal year of 2020/21, bicycle exports amounted to approximately $130 million with the EU being the top market for Bangladeshi-made bicycles. With sufficient policy support from the government, this sector can add more value to export diversification.

Globally, the market size of the shipbuilding industry is around $1600 billion annually. The market size of small ships is $400 billion worldwide. By availing a single percent of the small ship market, Bangladesh will be able to export $4 billion in a year. According to data from the EPB, Bangladesh exported small ships and vessels worth $45.95 million in the 2011-2012 fiscal year. The government may pay more attention to this sector as a part of the export diversification effort.

Similarly, the furniture sector can grow further and complement export diversification if given the adequate policy support from the government.

A research paper by Asmina Akter published in the 'London Journal of Research in Management and Business', applied the Granger Causality Test to measure the impact of export diversification. The result has shown that export diversification is not playing a significant role in the economic growth of Bangladesh.

Back in 2016, with the publication of the Asia Pacific Trade and Investment Report 2016, it had been stated that the price of RMG exports would continue to decline. Taking such a factor into consideration, despite the comparative advantage of low wage rates, whether over-reliance on the RMG sector is a good idea must be questioned.

IFC report published on 11 January 2019 wrote that Bangladesh's GDP has enjoyed an annual growth rate of 7.3 to 7.9% in the year 2018-2019, with two million new entrants joining the labour force every year. According to the 'World Bank Feature Story' published on 14 November 2017, 20 million young people are set to join the labour force over the next decade.

Bangladesh hosts around 5,000 ready-made-garments factories and employs around 4 million workers. To minimise the huge gap between the demand and supply of labour, massive job opportunities must be created and export diversification can achieve this goal.

Current development and academic literature suggest that export diversification will be a key factor in sustaining Bangladesh's economic growth. With annual job growth rates declining to 1.8% between 2010 and 2016 despite accelerated export growth, the RMG sector's potential to create new jobs is also waning.

Even more relevant to Bangladesh is that developing countries tend to benefit more from diversification than most advanced countries. Overall, the evidence is strong that export concentration has been detrimental to the economic growth performance of developing countries in the past decades. If Bangladesh is to continue its growth trajectory, export diversification is essential.

M. Syedur (Saeed) Rahman is a Senior Consultant at 'Development and Policy Management Ltd' and can be reached at newmsr@outlook.com.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the opinions and views of The Business Standard.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel