RMG accessory makers take a hit as raw material prices skyrocket

The RMG export growth has returned to positive territory, but the accessories sector is unable to benefit from it

It's a paradox. Garment accessories and packaging makers are now losing money even though apparel exports are climbing.

The explanation is simple: prices of raw materials used by the backward linkage industry have skyrocketed in the international market but garment manufacturers, the clients of the industry, are not ready to pay higher prices.

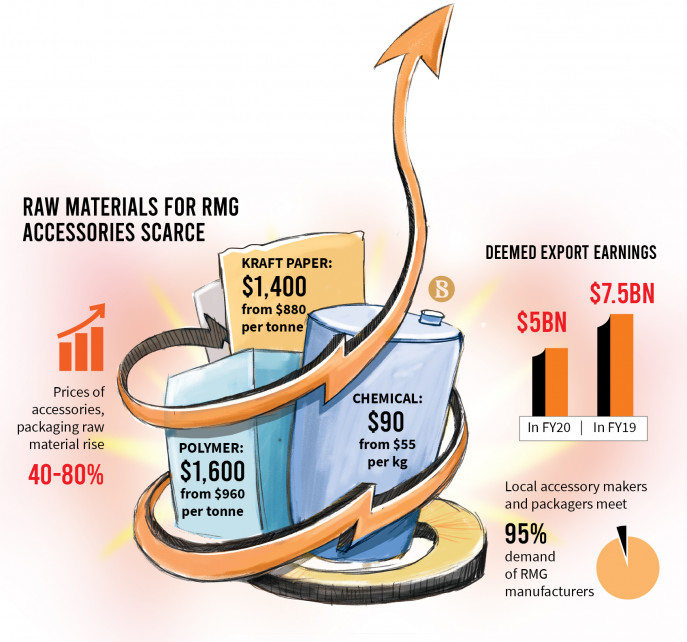

Increased demand following the complete rebooting of manufacturing hubs in China and India after the Covid-led shutdown has caused a steep hike in prices of necessary raw materials such as polymer, yarn, kraft paper and chemicals ranging between 40% to 80%.

But the accessories manufacturers are not getting higher prices for their products as readymade garment prices have dropped in the global market, industry insiders say.

"Prices of raw materials have gone up steeply, but RMG exporters are not ready to pay the extra for accessories. We are forced to sell products at lower pre-pandemic prices," Al Shahriar Ahmed, general secretary of the Bangladesh Apparel Youth Leaders Association said.

There are about 1,800 factories producing garment accessories and packaging items in the country. They supply 40 types of products, such as buttons, plastic hangers, polybags, labels, zippers, tags, tapes, thread, ribbon, rivets, laces, hooks, transfer film, paper, and ink, to the RMG industry, according to industry sources.

The accessories and packaging manufacturing industry's investment now stands at around Tk35,000 crore. About six lakh workers are engaged in the industry.

Industry owners say they are losing money by importing at a higher rate but not getting a fair price at home. Lack of enough capital is also forcing them to import lesser amounts of the now costlier raw materials and lose production.

"The kraft paper we used to import at $800 per tonne now costs $1,400. But apparel exporters are reluctant to increase prices for packaging items they buy from us. We were forced to reduce production to minimise losses," AKM Mustafa Selim, owner of SAMS Packaging, told The Business Standard.

"We do not have enough capital either. Earlier, I could import 100 tonnes of raw materials with my full capital, but now I can get about half. Banks are also not giving us additional loans. We are barely keeping our factory running to retain the workers," he added.

When apparel exports plummeted after the pandemic hit in March last year, the accessories factories had to shut down. The accessory makers, also known as backward linkage industry, reopened when the RMG sector roared back on the back of stimulus support from the government.

The RMG export growth has returned to positive territory, but the accessories sector is unable to benefit from it because of a sharp rise in raw material prices.

Prices of raw materials for accessories and packaging items have started rising since last January. Over the last five months, prices of yarn increased to $3.5 from $2.5 per kg, polymer used to make poly bags and hangers has jumped to $1,600 from $960 per tonne, and kraft paper to $1,400 from $880 per tonne, said Shahriar of the Apparel Youth Leaders Association.

The prices of ink and chemicals have also increased by $9-$12 and $90 per kg from $7 and $55 respectively, he added.

The Bangladesh Garments Accessories and Packaging Manufacturers and Exporters Association said their factories are in the SME category, but most of them have not received loans from the Tk20,000 crore stimulus package announced by the government.

Abdul Quader Khan, president of the association, told TBS, "Freight costs have gone up too. But we are not getting increased prices. So, factories are struggling for survival."

He demanded that the government offer a 1% cash incentive against exports and reduce corporate tax to 12% for the garment accessories sector.

In the fiscal 2019-20, the accessories and packaging manufacturing sector earned $5 billion in deemed exports and in the fiscal 2018-19, its earnings amounted to $7.5 billion, the accessories makers' association said, citing the Export Promotion Bureau and the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

The total apparel export earnings were $33 billion in FY20 and $40 billion in FY19.

Locally produced garment accessories and packaging items meet 95% of the demand of the RMG sector, which accounts for 86% of the country's export earnings. Some 10% more can be supplied from the backward linkage industry if it goes into production at full capacity, according to the accessories and packaging makers' association.

Many factories might shut down if they continue to lose money, owners fear.

They say the apparel sector had continued to receive an uninterrupted supply of accessories and packaging items from domestic sources because of its strong backward linkage even when imports and exports around the world, including China, remained suspended amid the pandemic last year.

If the backward linkage shrinks, the country's main export sector will have to rely on imports for huge quantities of accessories. There is also a risk of an increase in lead time as well as additional costs. This will negatively impact garment exports as well.

Shafiul Islam Mohiuddin, former president of the BGMEA and also owner of garment and accessories factories, told TBS that owners of accessories factories should take a strong stand to get fair prices of their products.

"I think the country's accessories manufacturers should be able to raise prices as the prices of raw materials for garment accessories in the international market go up. But, at the moment, prices of readymade garments have come down globally. So, exporters are not paying us more for accessories and packaging items," he added.

BGMEA director Mohiuddin Rubel said, "In the last five years, our production cost has increased by 30%, and buyers have also reduced prices of apparel items by 2%. How can we pay more for packaging items and accessories?"

"We ourselves are getting lower prices for garment items but we did not cut prices of accessories and packaging items. If buyers do not increase prices of readymade garments, we shall not be able to pay more for accessories either," Mohiuddin added.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel