Israeli attack on Iran: Oil price won't be a major issue, but LNG price can make us suffer, says energy adviser

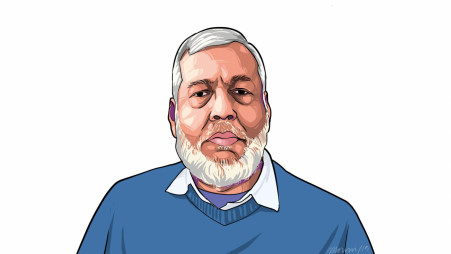

In the wake of the escalating conflict between Israel and Iran, global oil prices surged more than 10%, sparking concerns over energy security and economic stability in import-dependent nations like Bangladesh. However, according to the country's Power, Energy, and Mineral Resources Adviser, Muhammad Fouzul Kabir Khan, while the situation is alarming, Bangladesh is not immediately at risk due to prior preparations and ongoing supply arrangements.

Speaking to The Business Standard, the adviser reassured that the immediate impact on oil supplies is likely to be contained. "The Israel-Iran war is very bad news for a country like Bangladesh, whose energy security largely depends on imports, as the oil price is already soaring," he said.

Khan noted that Bangladesh has already secured its oil supply for June and July through prior purchases made in May. "We are safe up to July. We would absorb the shock of up to a Tk 18-20 hike per litre, but if it escalates further, then we would be in trouble," he said, adding that the government's plan to reduce domestic oil prices might be delayed due to the global volatility.

From July onwards, Bangladesh will enter a six-month long-term oil supply contract, which the adviser believes will provide some buffer against market disruptions. "The premium in the contract is fixed, and only the index will vary. This gives us comfort amid the current volatility," he explained.

Despite some stability in the oil supply outlook, Khan expressed concern about liquefied natural gas (LNG), which he said is more sensitive to global market shifts. "We will not face a major problem in fuel pricing but will face a heat in LNG pricing as we have to buy from the spot market," he stated. Spot market purchases are subject to rapid price changes, making Bangladesh's LNG supply chain more vulnerable in the short term.

The energy adviser emphasized that no immediate decision has been made to scale back LNG imports despite the risk of price hikes. "We are not thinking in that direction as we have to observe the market closely first and then decide," he said.

Shipping disruptions, potential supply chain delays, and rising freight costs are also among the broader concerns tied to the conflict. With Bangladesh heavily reliant on global trade routes for both imports and exports, any protracted tension in the Middle East could affect everything from energy supplies to garment exports.

In conclusion, Khan urged for close monitoring and strategic caution. While Bangladesh has built some cushion to absorb short-term oil shocks, LNG remains a critical area of vulnerability. If the conflict escalates further or prolongs, it could pose significant challenges to Bangladesh's energy pricing and broader economic stability.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel