NBR ready to offer speedy customs clearance facility to more firms

At least 10 companies may get authorised economic operator (AEO) status in a month

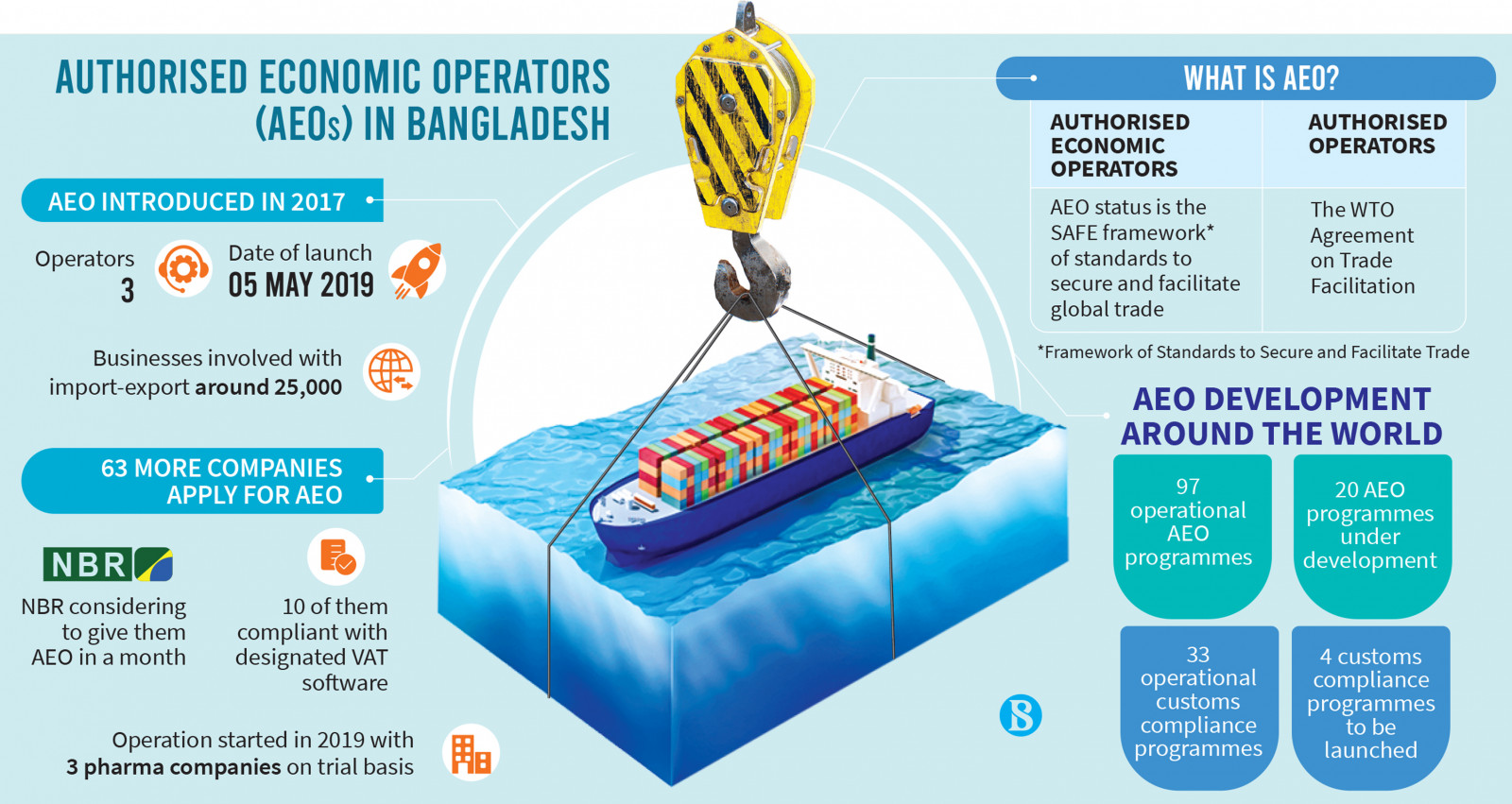

The revenue authorities have taken a fresh move to put in operation the globally-practised trade facilitation system, authorised economic operator (AEO), in Bangladesh. Sixty-three companies have applied for the privilege to be a member of the AEO firms that are entitled to enjoy faster customs clearance at ports.

The National Board of Revenue (NBR) offered the coveted status only to three firms in 2019 and officials have said they would select at least 10 more firms – mainly from textile, pharmaceutical and leather sectors – for the AEO privilege within a month.

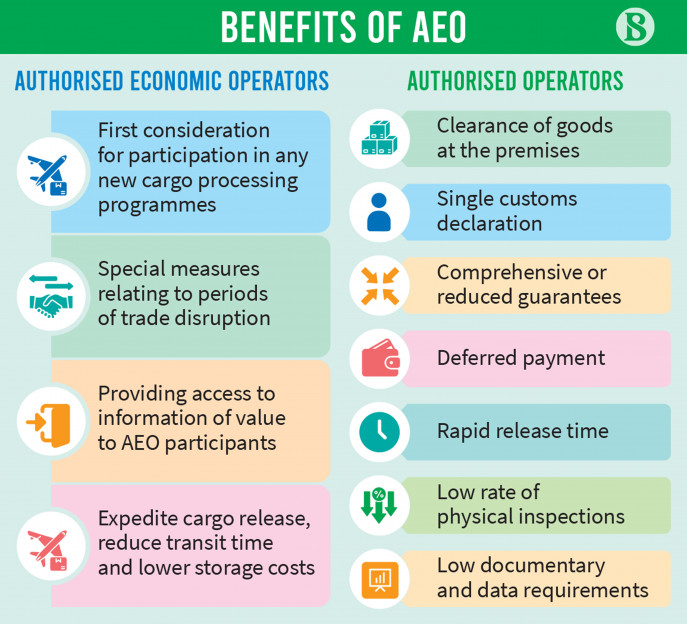

A firm with the AEO status enjoys the privilege of carrying their goods from ports to their warehouses directly without physical customs inspection, which helps them save time and stay on external trade schedules.

Fresh move to make it work

The NBR's Customs Valuation and Internal Audit Commissionerate is sorting out applications from the 63 companies seeking the recognition, its Commissioner Mohammad Enamul Hoque told The Business Standard.

In April this year, NBR took the initiative to provide more firms with the AEO facility. But the revenue board is yet to select any firm due to non-fulfilment of compliance conditions.

The Customs Valuation and Internal Audit Commissionerate hopes that 10-15 companies will comply with the NBR's conditions.

Commissioner Enamul Hoque told TBS that most of the companies are not using NBR-designated software for value added tax. "Almost all of them have their own software. If there is any anomaly in their accounting system, it is quite tough for us to find it out in their customised software," he said.

But, at least 10 companies have informed them of contacting software firms to install the NBR-designated VAT software, he mentioned, adding, "After getting their performance report, we will give them AEO recognition and hopefully it may take a month."

According to NBR sources, out of 63 firms, at least 12 are involved with textile and readymade garment export and import. Apart from that, 10 companies of Abul Khair Group, three of Bangladesh Steel Re-Rolling Mills, two of Beximco, two of Apex Footwear, and Shah Cement, Eskayef Pharmaceuticals, Nestle Bangladesh, Syngenta Bangladesh, and Fair Electronics are also among applicants for the AEO status.

Picard Bangladesh Limited has also applied for AEO but it does not use any VAT software.

Saiful Islam, managing director of the company and also the president of the Metropolitan Chamber of Commerce and Industry, told TBS, "As our company is 100% export-oriented and is exempted from VAT, we are not supposed to have a VAT software.

"If any firms do not have a bad past track record, they should get the AEO recognition."

Mohammad Mizanur Rahman, deputy general manager (commercial) of Envoy Textile Mills Limited, told TBS, "Our company is using VAT software, but the NBR has asked us to install its nominated software. We are working to install a new one within a short time."

Stalled progress

The World Customs Organisation (WOC) introduced the AEO programme in 2005 and Bangladesh amended the customs law in 2017 to simplify the customs formalities.

In 2018, the NBR issued an order, specifying the criteria for AEO and in the following year it extended the facility to three pharmaceutical firms.

The progress has stalled since then for, what businesses say, NBR's failure to improve procedures and popularise the programme.

AEO status needed for competitiveness

But Bangladesh's neighbours and trade competitors are well ahead with growing numbers of AEO firms as part of their strategy to ensure a stable and reliable global supply chain.

According to WCO data, the USA has 11,020 AEO firms, the EU 17,895, India 4,496, China 3,203, South Korea 845, and Japan has 706 AEOs.

Bangladesh's major contender in apparel export, Vietnam launched the programme in 2011 and is now moving one step ahead as it prepares for signing AEO mutual recognition agreement (AEO MRA) to reap maximum benefits from new generation FTAs including the European Union as well as newer ones such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership or the Regional Comprehensive Economic Partnership.

Even though Bangladesh has three firms with AEO status, the WOC's AEO Compendium does not mention it.

Why the progress has been slow

Leading drug-maker Square Pharmaceuticals is one of the three companies that got the AEO status from the NBR on a trial basis in 2019.

These companies were supposed to get faster clearance at Chattogram and Dhaka customs houses.

A top official of Square Pharma told TBS on condition of anonymity that the status does not mean anything for them as there is no improvement in terms of customs clearance time for their goods. "It still takes 3-4 days like before," the official claimed.

"From our end, we do not have any limitations, but the customs has a bureaucratic complexity," he pointed out.

However, according to the NBR, the companies could not avail the facilities meant for AEO firms as they have not installed the NBR-designated VAT software, a condition for getting the desired service.

Businesses think the customs authorities have not changed their attitude about businesses and do not trust them, which is the main reason for failure of the initiative.

Businesses with AEO status told TBS that they were supposed to get their consignments released from ports within 24 hours, but that did not happen.

According to the World Bank's last ease of doing business report in 2020, Bangladesh ranks 168 out of 190 countries. A lack of customs and port expertise is one of the key reasons for this backwardness.

Besides, according to the World Bank Logistic Performance Index (LPI) 2018, Bangladesh is behind all its major competitors, including China, Vietnam, India, and Cambodia. Again, the country performed the worst in customs clearance among the six LPI indicators.

The NBR's latest time release study (TRS) revealed in early September shows that in Chattogram customs house, it took 11 days and six hours to release a consignment after the ship's arrival at the port. When compared to the previous TRS conducted in 2014, there is no significant improvement in goods release time at the port.

A top customs official, who was once involved with this process, told TBS that customs officials were not used to the AEO system and there was some ambiguity also in NBR's order. But now NBR is considering fine tuning the order which may help make the system more functional.

Md Saiful Islam, president of the Metropolitan Chamber of Commerce and Industry (MCCI) told TBS that customs officials should trust the AEO firms to make the system functional.

Mohammad Hatem, executive president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), hailed the move to offer AEO status to companies and termed it as a "positive" initiative that could help reduce congestion at ports and reduce time and cost for the businesses. This would also help in improving the ease of doing business, he observed.

"We urge making this system functional as early as possible," he added.

Former NBR member of customs policy Md Farid Uddin, however, said, "It cannot become fully functional without political commitment and a holistic approach by the NBR"

AEO privilege and criteria

To get goods released without physical customs check, AEO firms are to send their documents earlier so that almost all types of customs procedures are completed before the goods arrive at the port.

In very few cases, officials inspect physically on a random basis in the port or after releasing goods. All communication with the customs authorities will be through online.

The facility will be given on the basis of certain criteria. These include having a satisfactory compliance record under the Customs, VAT and Income Tax Act, the applicant being free of guilt for the previous three years, no revenue arrears and the amount of fine, in any case, being less than 1% of the total value.

In addition, the authorised capital of an applicant organisation should be Tk15 crore and the paid-up capital should be Tk5 crore, and the amount of import should be at least Tk5 crore per annum.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel