The dollar crunch chronicles

A look at how other countries are dealing with it and whether we have viable alternatives

Bangladesh has caught a serious case of dollar crunch.

The Russia-Ukraine war broke out when the world was slowly recovering from a once-in-a-generation pandemic. This resulted in a rise in fuel prices worldwide. For the same reason the US dollar – the most common international currency – is also rising. It has also been weaponised to some extent by the US to isolate Russian President Vladimir Putin over his war on Ukraine.

The dollar gained more than 10% this year alone and its value is at a 20-year high compared to its peers, making trade pricier globally. Owing to a rise in imports and the slow inflow of remittances Bangladesh too is suffering from a dollar crisis.

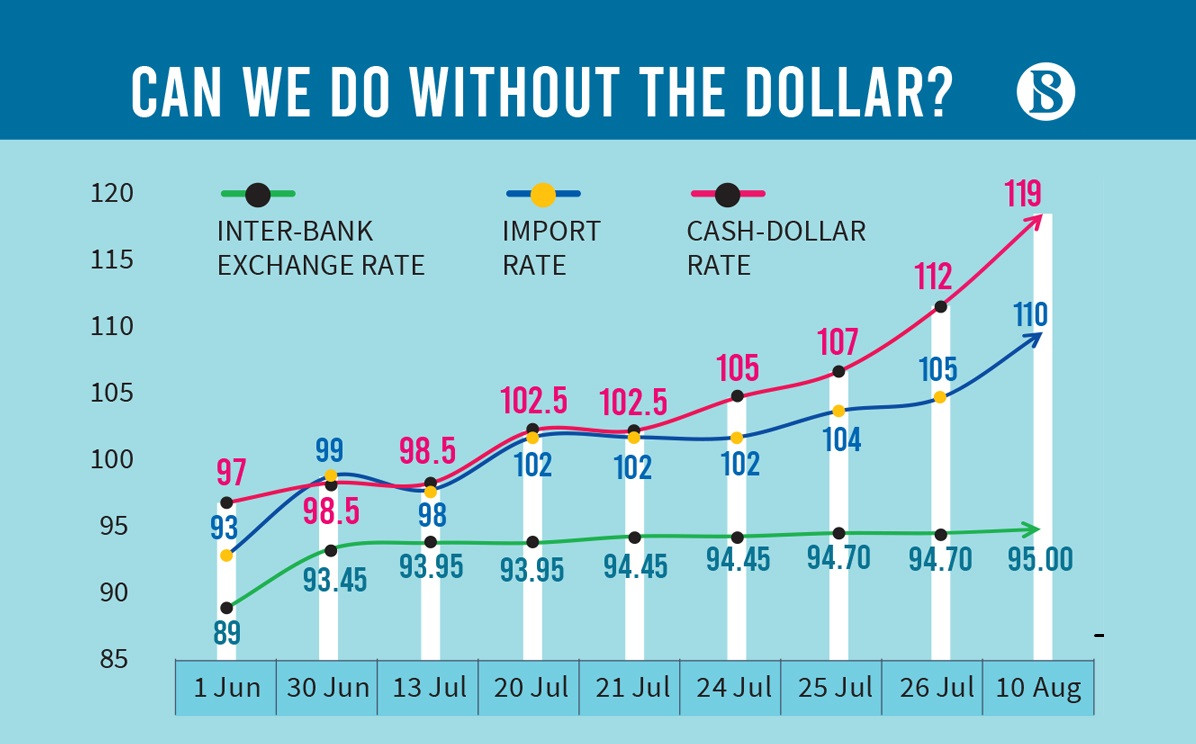

In Bangladesh, the cash US dollar rate climbed to an all-time high of Tk112 on 26 July. The inflation rate in the country hit a nine-year high of 7.56% in June this year. Experts fear that the unusual rise in dollar price will further fuel the inflation. Banks are also feeling the crunch as the import LC rate surged to Tk105, further adding to price pressures and inflation.

Countries, especially in Asia, are adopting different methods to try and get a handle on the situation. Some are allowing the use of local currency to settle cross-border trade deals bypassing the dollar, while others are linking payment systems through MFS. How successful can such moves really be? Do these attempts impact Bangladesh in any way? And what can be our takeaway from such approaches?

Settling cross border payments with local currency

Bangladesh's neighbour and trade partner India is also being affected by the rising dollar. The Indian rupee – the third-worst performer in Asia in the past month – declined to a record low of more than 80 to the dollar, adding to worries of imported inflation as well as an external deficit blowout, reports Bloomberg.

To ease their dependency on dollars, the Reserve Bank of India (RBI) recently initiated measures to allow rupee settlement of cross-border trade deals. RBI came up with an arrangement for invoicing, payment and settlement of imports and exports in rupees, which means that Indian banks can act as custodians of funds in international transactions settled in rupees.

Many assumed that this means the rupee is trying to become an international currency. However, experts say that assumption is incorrect. For a currency to be international it has to be freely traded across the world, between third parties, which have no connection to the country it was minted in.

Financial analysts believe India is doing it to grab opportunities such as discounts on Russian oil. For example, India imported $1.3 billion of Russian crude in April, making it their fourth largest source. They are looking to settle such payments using the rupee.

This is however also somewhat supported by India's foreign reserve.

"This transaction is happening at a pegged rate. The cost that is being incurred due to doing so is being accommodated by the Indian government by using dollars from their reserves," said Dr Khondaker Golam Moazzem, research director, Centre for Policy Dialogue.

So, can we take a similar approach while trading with India?

"I am not sure how useful it might be for us, because of the trade deficit. We import goods worth around $10 billion from India but export goods worth around just $1 billion. Where will we find the excess rupee?

There is also the issue of the rupee not being as stable as the dollar.

"What if it devalues sharply?" said Dr Ahsan H Mansur, executive director, Policy Research Institute.

"The Chinese yuan is also a good option. The International Monetary Fund (IMF) has included the Chinese Yuan in the Special Drawing Right valuation basket (supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund). But the issue of trade deficiency remains," he added.

Dr Moazzam is of the opinion that neither local banks nor export-importers will be interested in adapting to such a volatile currency. The dollar is backed by huge reserves, gold and other assets. It will be unwise for us to consider such a move at this point in time.

A 'de-dollarised' payment system

By November, five of Southeast Asia's biggest economies, including the Philippines, are set to sign a deal to integrate their network. Payments made through the system will use local-currency settlements between the countries, meaning payments transacted in Thailand using an Indonesian app would directly be exchanged between rupiah and baht, bypassing the need for US dollar as intermediary, according to a Bloomberg report.

The central banks of these countries are targeting to link their payment systems, which will let people buy goods and services throughout the region by scanning QR codes.

MFS has also taken off in a big way in Bangladesh. Can Bangladesh be a part of this network? Perhaps we could create a similar network of our own in the SAARC region.

Experts however do not think it is likely. As intra-southeast Asia regional trade is quite high, they can dedollarise and negate the impact of the dollar. But Bangladesh does not have similar trade ties with that region. If we had a lot of trade with that region only then we could have gone for such a solution.

"Only 11% of our trade takes place with that region, including China. We import some petroleum-based products from there and export a couple of finished goods. So, we can't contribute that much to that system," said Dr Moazzam.

He does not think creating a similar link involving SAARC countries is on the cards either. Southeast Asian countries have a production and financial network between them; there is no such network in the South Asian region. Where there is no trade cooperation, financial cooperation is impossible.

Can currency swapping be the way forward?

A currency swap sees that the two parties agree to exchange a certain amount of foreign currency at a predetermined rate, protecting against fluctuations.

Just last month China's central bank signed a bilateral currency swap agreement with the Monetary Authority of Singapore. The deal has a size of 300 billion yuan (about $44.6 billion), or 65 billion Singapore dollars. It will be valid for five years.

"I think currency swap can be a solution. But it should only be done with powerful economies like India, China or Japan. It should also only be done as a last resort, if things become as dire as Sri Lanka. If the situation is not that desperate we should not go for it," opined Dr Mansur.

Replacing dollar with Euro

Another option central banks could have considered is replacing the dollar with Euro in their foreign exchange reserves. However, since the European Union is at the forefront of the Russo-Ukrainian war, they are taking heavy damage.

The Euro, usually a stable currency, has now dropped in value and for the first time since 1999 reached parity with the dollar. Experts think countries cannot go that route at the moment but this can be a viable option in the future.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel