Islamic Finance sanctions 40% of its loans without collateral

The company disbursed a total of Tk387.55cr as short-term, lease, term, and housing finances

Islamic Finance and Investment Limited, a non-bank financial institution, has sanctioned 40% of its total loans without collateral such as mortgage of land or lien on shares, its auditor has said.

In its financial report for 2021, the auditor mentioned the company disbursed a total of Tk387.55 crore as short-term finance, lease finance, term finance and housing finance.

However, the company – listed on the country's capital market – has a corporate and personal guarantee against the sanctioned loans.

At the end of 2021, the loan from the company stood at Tk1,336 crore.

According to the Bangladesh Bank guideline, collateral is an asset pledged by a borrower to a lender until a loan is paid back. If the borrower defaults, then the lender has the right to seize the collateral and sell it to pay off the loan.

The hesitation of a borrower to provide collateral could signal to the financial institution that the borrower is fully aware of the implications of making this pledge, and if he does provide collateral, then he is likely to do everything to avoid the loss of the pledged asset, it added.

A senior officer of a renowned non-banking financial institution, on the condition of anonymity, said depending on the relationship with the customer, loans are often disbursed only with a guarantor.

"But it is not a good practice for the institution. This increases the risk," he added.

A central bank official said there is a scope to provide collateral-free loans to small entrepreneurs in some emerging sectors such as women entrepreneurs and agriculture.

"However, it should not be more than Tk5-10 lakh. There is no scope to provide a bigger loan without collateral," he added.

SQ Bazlur Rashid, acting managing director of Islamic Finance, told The Business Standard, "This is a very complicated matter. So it is not possible to comment on this in simple language."

The post of its managing director fell vacant in June last year after Abu Zafore Md Saleh resigned over allegations of breaching rules over hiring and enjoying financial benefits.

Some of its senior officials were also involved in these irregularities; the Bangladesh Bank found such instances during an inspection.

The company then sought to hire Chowdhury Manzoor Liaquat, a former managing director of Union Capital. But the central bank asked the company to refrain from hiring him as its chief, as the financial health of Union Capital deteriorated under his leadership.

The central bank also instructed the company to appoint someone with a clean chit as the managing director so that he can solve the problems of the company.

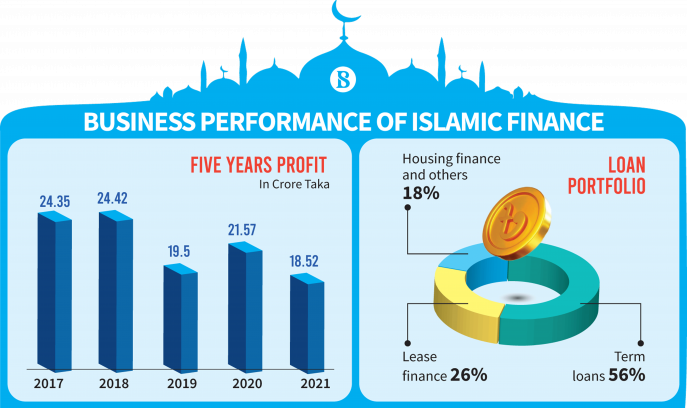

In 2021, Islamic Finance's net profit decreased by 14% to Tk18 crore and the earnings per share stood at Tk1.32. But it declared a 10.50% cash dividend for its shareholders amid declining profit.

The downward trend continued in the first quarter of 2022. During the January-March quarter, its profit fell 28% to Tk4.19 crore and the earnings per share were Tk0.30.

Islamic Finance said in the financial report, that profit had decreased mainly due to an increase in profit suspense and maintaining of provision against general investment for irregular repayment of investment clients. In addition, the company is currently in a financial crisis due to deposit withdrawals by customers.

Meanwhile, its share price increased by 3.86% and closed at Tk21.50 each on Monday on the Dhaka Stock Exchange.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel