Govt borrows Tk13,000cr from banks in May, highest in a month

The government repaid Tk2,783 crore to the Bangladesh Bank

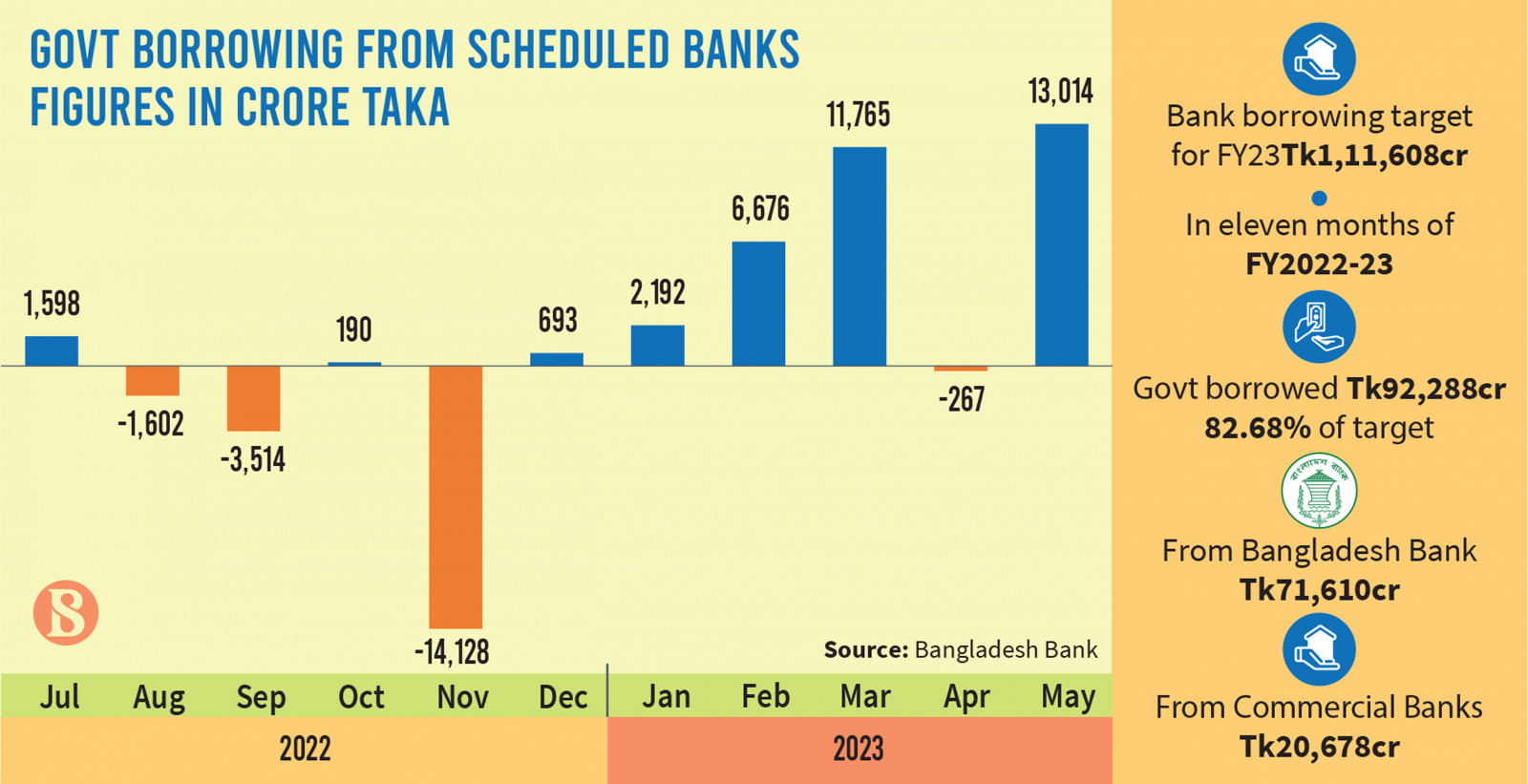

The government borrowed Tk13,015 crore from banks in May alone, which is significantly higher compared to just Tk7,663 crore borrowed in the previous 10 months combined.

In the same month, the government repaid Tk2,783 crore to the Bangladesh Bank, according to data from the central bank.

At the end of May, its borrowing from the central bank stood at Tk71,610 crore, compared to Tk2,146 crore at the same time last fiscal year.

Bankers said inflation is rising due to soaring import costs, and the situation is exacerbated by the government's borrowing from the banking system to meet its budget deficit.

According to data from the Bangladesh Bank, in the 11 months of the current fiscal year, the government has borrowed from the banking system – the central bank and scheduled banks – to the tune of Tk92,288 crore which is 82.68% of the target for the entire financial year.

At this time in the last fiscal year, the government's bank borrowing was only Tk32,515 crore.

In the July-May period, the government borrowed Tk20,678 crore from banks compared to Tk30,368 crore in the last financial year.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, told The Business Standard, "The government's bank borrowing has increased as it could not collect revenue according to its target. The government borrowed heavily from the central bank through devolvement which was not good thinking."

"The government has increased borrowing from scheduled banks rather than central bank loans. If this debt increases, it will ease inflation to some extent," he added.

The government's revenue collection target for the fiscal 2022-23 was Tk3.70 lakh crore. However, in the first 10 months, the revenue collection stood at Tk2.50 lakh crore, which is only 67% of the target.

The managing director of another bank told TBS on condition of anonymity that the amount of deposits has been increasing in the last few months due to which the government has increased its borrowing from banks. Apart from this, banks are also investing in government treasury bills and bonds due to reduced demand for private sector loans.

According to data from the central bank, the deposits of the banking sector stood at Tk15.48 lakh crore at the end of April. In that month, deposits increased by about Tk25,000 crore.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel