Cash-strapped banks increase borrowing from central bank

Liquidity crisis has deepened in the country's financial sector amid slow recovery of outstanding loans and lower collection of deposits, while several banks are meeting their demand by borrowing from the central bank every working day this month.

According to industry insiders, banks spending a huge sum of cash money in buying dollars over the past year have also contributed to the present tumult.

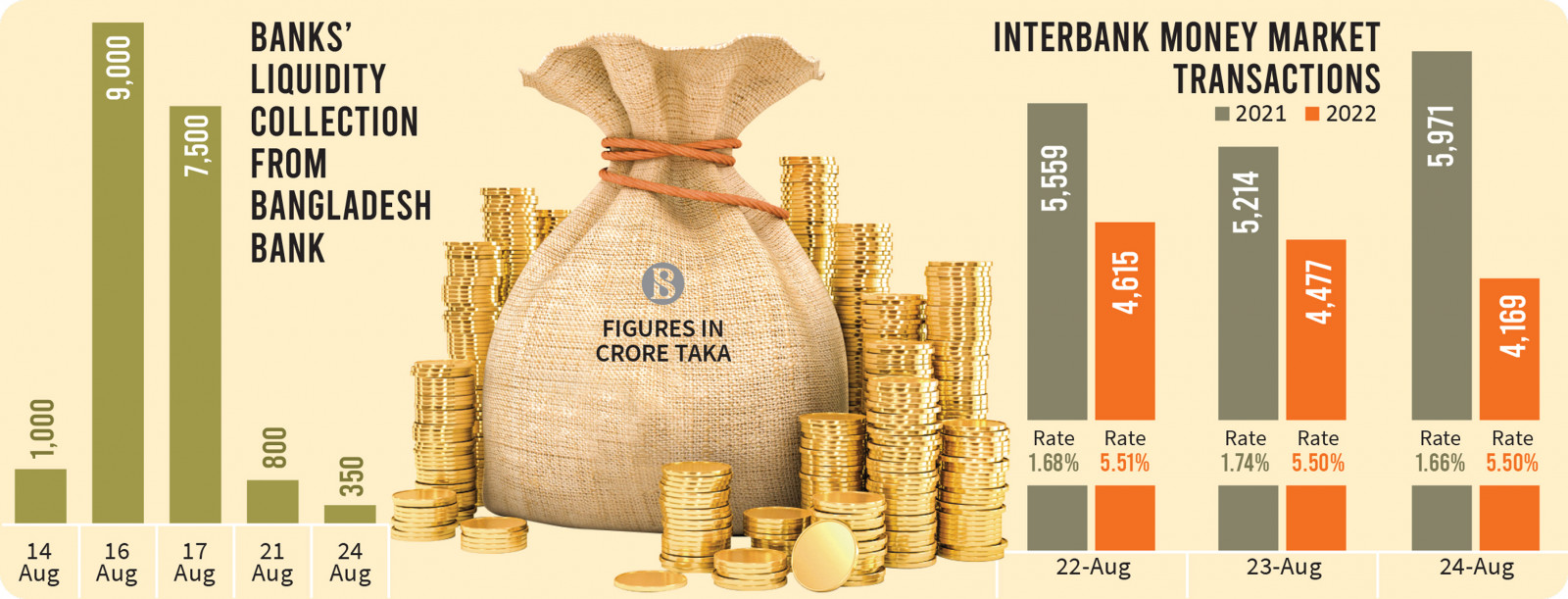

Data obtained from the Bangladesh Bank show that some banks borrowed about Tk800 crore from the central bank on 21 August this year. On the 14th, 16th, and 17th of this month, the central bank lent Tk10,500 crore, Tk9,500 crore, and Tk7,500 crore, respectively. For this, the central bank has charged a maximum interest of 5.5%.

Besides a surge in borrowing from the central bank, the interbank call money rate also has marked a sharp increase in recent times.

According to the Bangladesh Bank's data, the weighted average overnight interest rate on call money has been hovering above 5% throughout this month, which was less than 2% in the corresponding period of last year. In the previous years, the rate used to exceed 4% centring on Eid and other festivals that triggers a surge in demand for liquid money.

However, the call money rate in the cases of a seven-day and 14-day tenure is around 10%.

The call money rate is the interest rate on overnight or short-term loans from one bank to another to meet urgent needs.

According to the Interbank Money Market Transactions figure on Wednesday, Tk4,169 crore was traded on the day at 5.50% interest rate.

The money market rate has been around 5.5% since the first week of this July. On 6 July, the rate was 5.48%, which rose to 5.85% the following day.

Market insiders said there has been a massive demand for dollars in the banking sector since August last year in the wake of an increase in imports and a decrease in remittance inflows to the country. Against such a backdrop, banks are meeting their needs by buying dollars from the central bank.

The Bangladesh Bank's data show, banks that are suffering from a shortage of dollars purchased $7.5 billion from the central bank for Tk67,500 crore in the fiscal 2021-22.

In continuation of the last year, banks have continued to face the dollar crisis from the beginning of the current financial year.

An analysis of the central bank's data shows that the growth in deposits with banks was very low compared to loans this June. In June this year, deposits with banks posted an 8.9% year-on-year growth while the growth in loans was 13.81%.

To keep the foreign exchange market stable, the central bank has taken several steps including elevating LC margins to reduce imports of luxury as well as less necessary goods. At the same time, the central bank continued to sell dollars to banks from its foreign exchange reserves to help settle urgent government imports.

According to the latest statistics, the central bank has sold $1.8 billion for Tk17,603 crore in the 47 days of the current fiscal year that began on 1 July.

A report by the Bangladesh Bank says surplus liquidity in the country's banking sector at the end of June 2022 was shown at Tk2.3 lakh crore, of which only Tk20,000 crore was liquid money while the rest of the surplus money remained invested in government treasury bills and bonds.

Besides, the government had treasury bills and bonds worth Tk3.23 lakh crore at the end of June this year – meaning the government had taken out this sum of money in the form of loans from banks.

In this regard, Safiul Alam Khan Chowdhury, managing director of private sector lender Pubali Bank, told The Business Standard that many banks are going through a liquidity crunch, so they are taking loans from the central bank. He, however, said his bank is not suffering from the cash crisis as its collection of deposits is on the rise while the number of depositors also is increasing.

But, the managing director of a fourth-generation private bank on condition of anonymity told TBS that since his bank cannot meet its daily expenses with the cash money in hand, it is forced to borrow from the central bank.

Asked about this, the Bangladesh Bank's Executive Director and Spokesperson Sirajul Islam told TBS that banks had to buy large amounts of dollars throughout the last one year because of an increase in imports, which fueled a liquidity crisis in the banks.

Now the banks are taking money from central bank through repo to keep their cash flow normal, he mentioned, adding that many banks borrow through securities such as treasury bills and bonds held by central banks but this is for a short time as they are returning the money to the central bank after a specific period of time.

According to the latest data of the Bangladesh Bank, a bank on Sunday applied for Tk270.64 crore under the two-day term repo facility, but the cash-strapped bank received Tk135.32 crore from the central bank at 5.5% interest rate.

On the other hand, five banks had sought Tk9,385 crore in loans from the central bank under the seven-day term repo facility, against which the central bank gave Tk4,692 crore to the banks.

On the other hand, 14 banks had applied for Tk7,451 crore in loans from the Bangladesh Bank under the two-day special liquidity assistance scheme and were given the desired amount.

In total, against 20 banks' application for Tk17,108 crore on Sunday, the central bank has lent Tk12,279 crore at 5.5% interest.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel