Banks' distressed assets surge by Tk1 lakh crore in a year amid rising defaults, rescheduling

26 banks to face capital shortfall if top 3 borrowers default

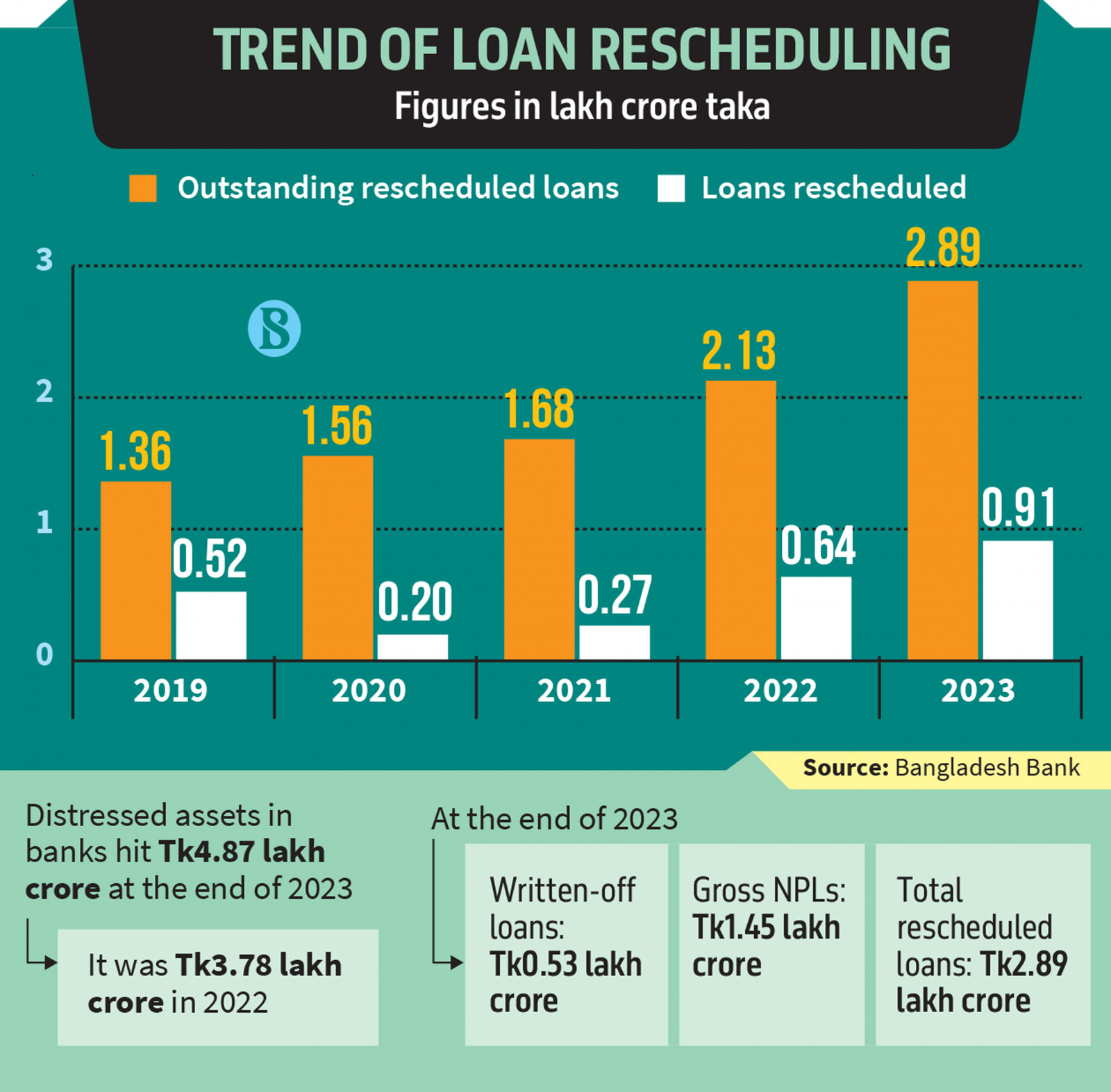

Distressed assets in the country's banking sector reached Tk4.87 lakh crore at the end of December 2023, with bankers attributing the increase to high non-performing loans and the rescheduling of large loans with nominal down payments.

According to the Bangladesh Bank's Financial Stability Assessment Report for 2023, published on 26 September, the distressed assets amounted to Tk3.78 lakh crore by the end of 2022. This indicates that the amount of distressed assets has increased by Tk1.09 lakh crore over the span of one year.

This disclosure of the distressed assets is part of an ongoing $4.7 billion loan package from the International Monetary Fund. The first report detailing distressed assets for 2022 was published last year.

This latest financial stability report showcases the central bank's alignment with international financial reporting standards, encompassing non-performing, rescheduled, and written-off loans. When combined, these factors result in a total of nearly Tk4.87 lakh crore in distressed assets within the banking sector by the end of 2023.

Among these, defaulted loans amounted to Tk1.45 lakh crore, rescheduled loans totalled Tk2.88 lakh crore, and written-off loans reached Tk53,612 crore.

A bank can write off only those loans that have hardly any chance of recovery and have been classified as "bad/loss" for at least three years. The respective bank must have maintained 100% provision against that particular loan after adjusting the interest suspense from the outstanding balance.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, told The Business Standard, "Non-performing loans in the banking sector are continuously increasing. Currently, our NPL stands at just over Tk2 lakh crore, but if the loans of certain business groups, including S Alam, turn into NPLs, it could officially rise to Tk3-3.5 lakh crore. This figure does not include loans under various legal frameworks."

The current loan amount in banks is around Tk16 lakh crore, with defaults reported at less than 12% of disbursed loans, according to the central bank. However, if large loans, including those from the S Alam Group, are taken into consideration, the NPL ratio could reach 20%.

"In many countries, including China, the NPL ratio once reached 30-40%," the banker noted, adding that even with many NPLs, it was managed over time.

"Controlling this issue requires strong leadership across all sectors, as well as a strengthening of our regulatory and legal systems. India has a master circular on wilful defaulters that we should consider adopting, along with necessary amendments to various regulatory rules," he added.

The central bank report states that the asset quality of the banking sector may have deteriorated partly due to a lack of oversight on regular, rescheduled, or restructured loans and advances, as well as slow progress in recovering NPLs.

Additionally, external factors such as the ongoing Russia-Ukraine war, the Israel-Palestine conflict, and other global and domestic challenges may have impaired borrowers' repayment capacity, which in turn could have contributed to the decline in the overall asset quality of the banking sector, it added.

Tk91,221cr loans rescheduled in 2023

According to the Bangladesh Bank report, a record Tk91,221 crore in loans was rescheduled in 2023, an increase from Tk63,720 crore in 2022.

This marks a significant rise compared to the previous highest amount of Tk52,370 crore in 2019, when a one-time exit policy was introduced to facilitate the rescheduling of large loans.

The central bank report said, "The stated policy might have contributed to the increase in rescheduling of loans in 2023. Furthermore, banks were allowed to reschedule loans of particular sectors (such as shipbuilding and cold storage-related loans) for longer tenure."

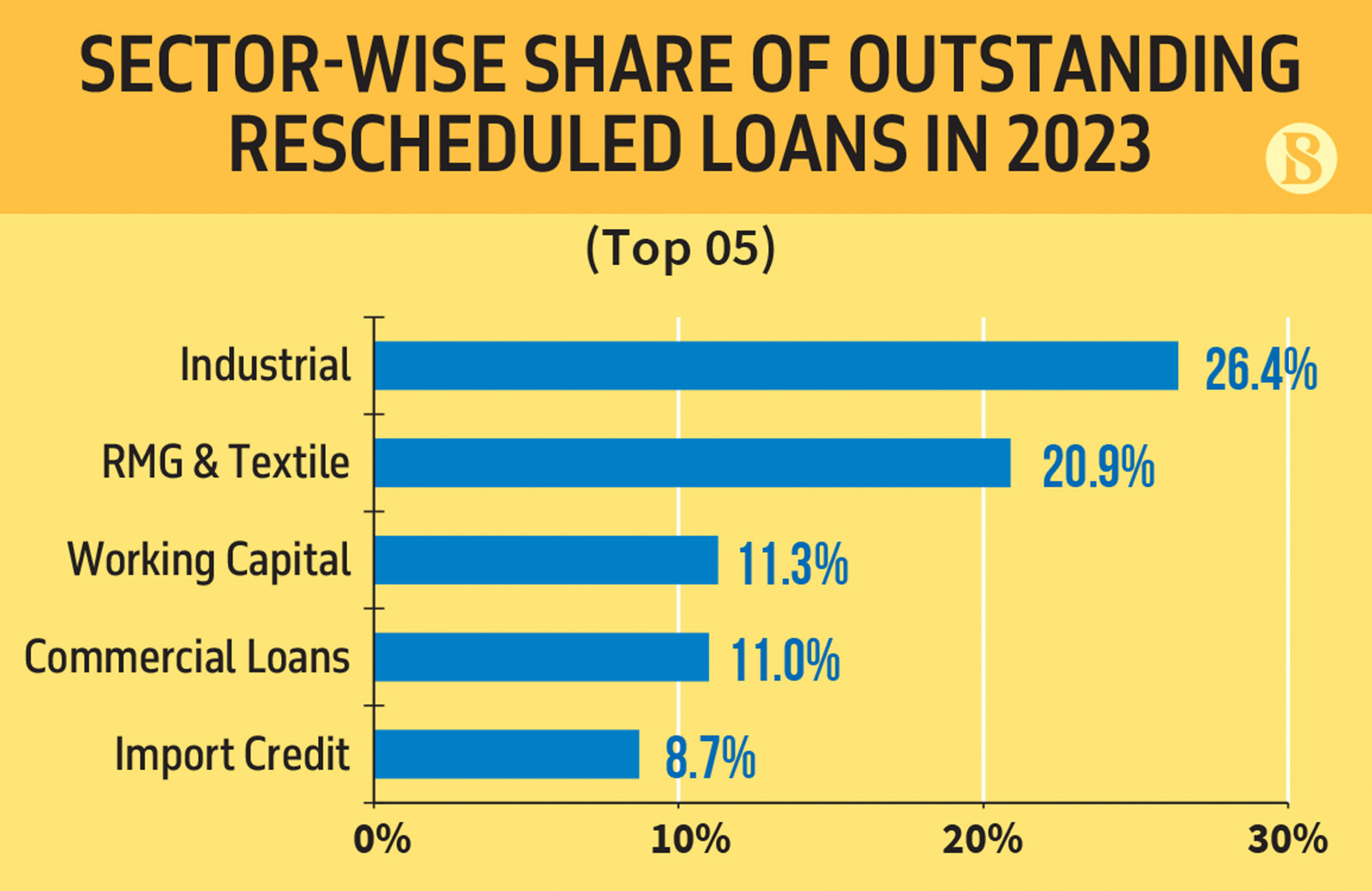

Most of the outstanding rescheduled loans were related to the industrial, ready-made garment, and textile sectors, accounting for 26.4%, 20.9%, and 11.3% of the total outstanding rescheduled loans, respectively.

Industry-wise data indicates that 64.8% of the outstanding rescheduled loans were attributed to large industries, while medium industries received 10.5%, and other industries accounted for 15%.

26 banks to face capital shortfall if top 3 borrowers default

Twenty-six banks will fail to maintain the minimum required Capital to Risk-weighted Assets Ratio (CRAR) if their top three borrowers default, according to the Stability Assessment Report for 2023.

The CRAR is the ratio of a bank's capital to its risk-weighted assets and current liabilities.

Under international regulations, banks are required to preserve capital. According to the "Basel III" policy, lenders in Bangladesh must maintain 10% of their risk-weighted assets or Tk400 crore, whichever is higher, in preserved capital. If a bank fails to meet this requirement, it is considered to be in a capital shortfall.

The number of banks facing capital shortfalls was reported as 22 in the previous year's assessment. As of the end of December 2023, the report indicates that in a pre-shock scenario, 10 scheduled banks could not maintain the minimum required CRAR.

Under a stress scenario that considers the default of the top three large borrowers, an additional 16 banks would also become non-compliant with the minimum CRAR. Furthermore, another five banks would fall short due to a 3% increase in NPLs.

An additional 27 and 13 banks would be unable to maintain the Capital Conservation Buffer (CCB) of 2.50% under the existing CRAR, following the shocks of the top three borrowers defaulting and a 3% increase in NPLs, respectively.

"The default of the top three borrowers will have a significant impact on the capital adequacy ratios of individual banks as well as the banking sector as a whole. The banking sector's CRAR would decline to 7.50% from the pre-shock level of 11.64% due to the default of these borrowers at the end of December 2023," the report states.

"In the case of a combined shock, which includes the aggregate results of increases in NPLs, falls in the forced sale value of mortgaged collateral, negative shifts in NPL categories, interest rate shocks, exchange rate shocks, and equity price shocks, the banking sector's CRAR would likely decrease to 6.84% from the pre-shock level," it adds.

The banking industry's CRAR fell by 19 basis points to 11.64% at the end of December 2023, down from 11.83% the previous year.

However, it still exceeds the minimum regulatory capital requirement of 10.0% of risk-weighted assets under the Basel III capital framework. The number of CRAR-compliant banks increased to 51 as of the end of December 2023.

For comparison, the capital adequacy ratios among neighbouring countries are as follows: India at 16.8%, Pakistan at 19.7%, and Sri Lanka at 16.9%, as published by their respective central banks.

Banking sector profitability

In 2023, the banking sector registered a 10% increase in operating profit, reaching Tk37,643 crore, up from Tk34,222 crore in 2022, despite a 20.63% rise in net interest income.

However, the net operating income of the banking sector experienced a decline of 32.95% compared to 2022, primarily due to a significant increase in non-interest expenses in 2023.

Consequently, net profit saw a moderate increase of 4.32%, rising to Tk14,841 crore in 2023, up from Tk14,226 crore in 2022.

Additionally, the allocation for loan loss expenses or provisions grew by 24%, standing at Tk10,944 crore in 2023, compared to Tk8,767 crore in 2022.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel