Manufacturers don’t have a demand problem yet

Supply-chain snarls are pinching margins, thwarting companies’ efforts to fill orders; but customers still buying

The supply chain has huffed and puffed, but it hasn't knocked industrial demand down — at least not yet.

A dangerous combination of logistics logjams, widespread parts shortages, hiring difficulties and rising inflation had threatened to make this earnings season a particularly ugly one for the manufacturing sector. Those pressures are real; they're taking a bite out of margins and preventing companies from shipping goods to realize sales in the short term. But the early rounds of manufacturing and transportation earnings indicate that customers aren't yet pushing back on price increases to offset the inflationary knock-on effects of these supply-chain snarls. Appetite for both new industrial equipment and freight services to haul it remains robust and is showing no signs of wavering. Chief executive officers are increasingly willing to invest in new capacity, suggesting they don't expect that demand to disintegrate.

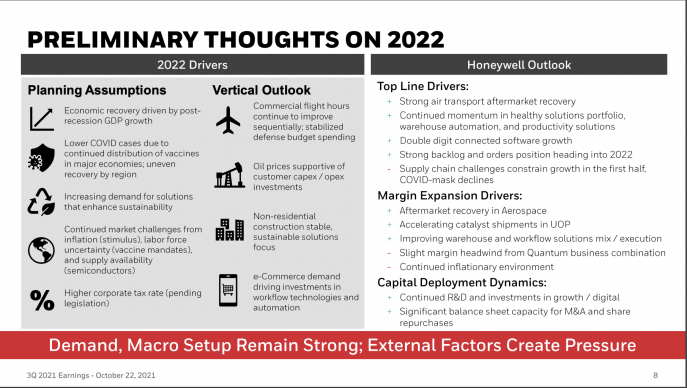

Honeywell International Inc. on Friday lowered its sales guidance, citing supply-chain constraints. Interestingly, these extended to its aerospace unit as smaller component makers struggled to bounce back after the Covid doldrums. The bottlenecks may cause Honeywell to miss out on as much as $800 million of sales between the recently ended third quarter and the last stretch of 2021 in the worst-case scenario. But it doesn't think that revenue is lost for good. "The customers still need those products," CEO Darius Adamczyk said on a call to discuss the results. To that end, there were a lot more pluses than minuses on a Honeywell slide highlighting its big-picture thoughts on next year. The company has experienced double-digit order growth year-to-date in each of its main units after adjusting for a natural easing in face mask purchases, Adamczyk said. "The only constraint that we see to some extent is the supply chain," he said. "I think the setup for Honeywell for 2022, 2023 is terrific. There is nothing here that makes me want to change my mind."

Dover Corp., which makes everything from garbage trucks to grocery-store refrigerators, has been ordering extra inventory to try to mitigate what's become a game of "whack-a-mole" with parts shortages that range from hydraulics to electronics components, CEO Rich Tobin said on a call this week to discuss third-quarter results. "All it takes is one missing piece," he said. "The math doesn't make sense, and it gets really complicated, and then you just say 'We need to stop.'" But there's no indication that efforts to build up buffer stock are fueling an eventual supply glut. "I am not aware — based on the yelling and screaming that goes on around here about getting the product out the door — that we've got any channels that are carrying excess inventory," Tobin said. "Everything that we can get out the door, our customers and distributors will take."

Indeed, Dover's third-quarter sales rose 13% compared with those in the period a year earlier (after backing out M&A and currency swings) and were also up relative to pre-pandemic levels. Orders jumped 25% on an organic basis. Demand is particularly robust for heat exchangers and biopharma pumps, and the company is adding additional manufacturing capacity to keep up. "Clearly, it looks like we're moving into a [spending] cycle in a lot of our end markets," Tobin said. This follows numbers from industrial distributor Fastenal Co. last week that showed revenue growth accelerated in September compared with the pace in July and August despite supply-chain distributions and labor shortages.

Double take

Industrial stocks sold off in September on inflation worries, but they've been bouncing back as earnings have come in better than feared

In the industrial freight world, Union Pacific Corp. said volume growth this year would be lower than previously anticipated because of the semiconductor shortages roiling the automotive industry and the congestion in US ports. But the company is still on track for its most profitable year ever thanks to cost cuts and higher prices. Asked how much room Union Pacific has to keep raising prices, Kenny Rocker, the railroad's marketing and sales chief, said he hasn't seen an environment this favorable for those discussions with customers since volumes were booming in late 2018.

Revenue jumped 24% at fellow railroad CSX Corp. in the third quarter; that was helped in part by shipping container storage fees and penalties collected for delays but also reflected broad-based growth, led by shipments of coal and metals. The company plans to hit the top end of its capital expenditure target for the year as it accelerates investments in new capacity, including additional overflow yards for shipping containers. "It's clear to us CSX is now more firmly committed to growth, even if it requires adding costly resources," Raymond James Financial Inc. analyst Patrick Tyler Brown wrote in a report. The company's biggest challenge is labor, even though it's been hiring as aggressively as it can, CEO Jim Foote said this week. The railroad has redesigned its recruiting process to streamline applications and should be in a much better position to capitalize on transportation demand that looks set to stay strong well into 2022 and possibly into 2023 — "unless some other crazy curveball gets thrown at us," Foote said.

Signs of a plateau

Shipping costs are still very high on a historical basis, but the feverish climb in rates seems to have ceased

The good news, as far as curveballs go, is that there's more evidence to suggest the worst of the supply-chain stress is behind us. Honeywell's Adamczyk said on Friday that he thought the semiconductor shortage would most likely peak in the fourth quarter. The supply crunch isn't "going to be completely alleviated, but it's going to get better," he said. Logistics operations are still far from normal. But "it's not getting worse," Dover's Tobin said. Average ocean freight rates have now declined for four consecutive weeks, as measured by Drewry. And the shipping industry is slowly starting to chip away at the congestion that's been clogging up US ports and railyards. Last week, about 25% of all cargo passing through the Port of Los Angeles took 13 days or longer to clear from the dock; that level of long-lingering containers had been cut in half as of Monday, Gene Seroka, executive director of the Port of Los Angeles, told CNN. The amount of time Union Pacific train cars dwell in terminals before they can be picked up by the railroad has improved 24% from July and dropped back down toward the company's 23 to 25 hour historical average.

"I'm still of the belief that most of what we see is temporary," Union Pacific CEO Lance Fritz said this week. "Ultimately, the way the supply chain is disrupted right now doesn't last." And once the current labor shortages and congestion issues are fixed, "there's some really good looking markers that tell us the economies in a pretty strong place and maybe it'll stay there for awhile," he said.

It's early yet in the earnings season. Next week will bring a deluge of updates from industry heavyweights including 3M Co., United Parcel Service Inc., General Electric Co., Caterpillar Inc. and many more. But initial reports indicate the manufacturing sector is still dealing with a supply issue and not a demand issue. That's a victory.

Disclaimer: This article first appeared on Bloomberg, and is published by special syndication arrangement.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel