Pandemic makes health insurance more desirable

Hundreds of thousands of people end up being broke every year if they suffer any critical disease or become disabled

Bangladesh, one of the most underpenetrated insurance markets, further lags behind in terms of health insurance coverage owing to a lack of a policy push, industry effort and market awareness.

The need for insurance support is now being felt by almost everyone who thinks about healthcare expenses amid the pandemic and an increasing number of corporate and individual clients are knocking insurers looking for suitable products.

In neighbouring India, around one-fourth of the people now avail some sort of health insurance coverage that helps them stay protected against any unforeseen health emergency.

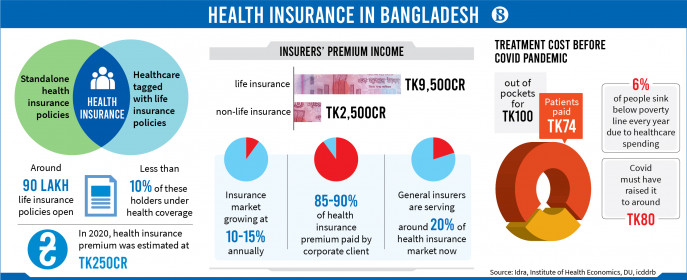

Bangladesh only managed to keep around 90 lakh life insurance policies open against its population of around 16 crore and less than 10% of life insurance policyholders are under health coverage.

Despite the state investments in public healthcare for decades and a booming private sector healthcare industry, Bangladesh is at the top of the global table for out-of-pocket healthcare expenses.

Even before the pandemic, patients were paying out of pocket expenses of Tk74 against every Tk100 spent and the pandemic might have already raised it to Tk80, said Syed Abdul Hamid, a professor of the Institute of Health Economics at the University of Dhaka.

Hundreds of thousands of people end up being broke every year if they suffer any critical disease or become disabled because of any major accident, he added.

Some 6% of the population sink below the poverty line every year in the country because of some health emergency cost, according to a 2021 joint study by the health economics professor and icddr,b researchers.

Health insurance could have saved them from financial ruin if health insurance was more prevalent, say industry experts.

Health insurance in Bangladesh

In Bangladesh, where people rarely agree to pay to get insured against any risk, health and accident insurances have been mostly tied to travelling abroad as many countries do not allow entrants without such a policy.

Even though the state has been supporting affordable public sector healthcare, a policy push for health insurance was simply not there and the concept of insurance support gained ground in the late 1990s, said SM Ziaul Hoque, acting chief executive officer of Chartered Life Insurance, a new generation life insurer focusing on group policies.

The insurance industry offers two types of health coverage – standalone health insurance policies and tagging healthcare with life insurance policies.

Due to regulations, only non-life insurers can offer standalone health insurance policies in Bangladesh. But they earn a much smaller share of the total annual health insurance premium as the private sector companies started late in the early 2010s.

On the other hand, life insurers offer their health coverage in conjunction with life policies and they began selling group life and health insurance policies decades ago, mainly to top corporations who ensure such coverage for their staff members.

As the industry does not need to report health insurance data to their primary regulator separately, any official data on the total annual health insurance premium or the number of insured people were unavailable.

Life insurers report their health insurance premium under the item "Group and Health Insurance", while non-life insurers put their's under "miscellaneous".

Health insurance is still concentrated on group policies as industry people estimate that 85%-90% of the total health insurance premium is being paid by good employers, mostly multinational companies and a few local corporations.

Only a handful of companies pay for employee health coverage

The number of such employers would not be more than 500 who pay for health coverage, according to Md Rafiqul Alam Bhuiyan, deputy managing director of Pragati Life Insurance Company, a leading name in group insurance policies.

In the absence of clear aggregate data, industry insiders make a rough estimate that around one-third of the group insurance premium is now being paid for health coverage and the share of health coverage is gradually increasing.

The life insurance industry earned around Tk730 crore in group and health insurance premiums in 2020, according to their primary reports to the Insurance Development and Regulatory Authority (IDRA).

Rafiqul said the estimated total annual health-related premium should now be around Tk250 crore.

The IDRA compilation also reveals that the life insurance industry's total premium income was around Tk9,500 crore and around Tk2,500 crore of non-life insurers the same year.

On the other hand, Chartered Life CEO SM Ziaul Hoque, who has been deeply engaged with group and health policies in some top companies for more than two decades, feels the figure would go even higher as some large life insurers are selling mandatory built-in health or disability coverage with their life insurance policies to individuals.

Increasing interest for standalone health insurance

General insurers are currently serving around 20% of the market and are likely to grow further as, in recent times, more and more employers and well-off individuals are asking for standalone health insurance policies, which cover a wider range of diseases, bigger bills and also in a trend to include more healthcare partners, said Shubashish Barua, an executive vice-president of Green Delta Insurance Company Ltd.

Shubashish, heading the Impact Businesses Division of the country's top non-life insurer, said, "It is high time we embrace health insurance to offer our people a better life. Without a policy push, wide health coverage would not be possible."

Echoing his industry colleagues, he said currently, in Bangladesh, as many as one million people are availing some sort of healthcare or disability insurance coverage and the number should rise ten times given the population, economic development and people's attitude towards life.

If the country's apparel industry, financial sector, public sector, law enforcement agencies and armed forces opt for their employees' healthcare financing through insurance, it would be a win-win for all as the number of insured people might easily cross two to three crore in a few years, he added.

Top companies – both from life and non-life sectors – are seriously exploring the health field and they mainly need a scale for sustainability and affordability of their products, said Istiaque Mahmud, an executive vice-president at Guardian Life Insurance, a new generation company that secured a huge base of clients through product innovation.

The woke individuals

For a majority of people in Bangladesh, insurance is not a top of the mind financial tool.

However, the ongoing Covid-19 pandemic is highlighting the need to think about health insurance and the role it can play in taking care of people, said Ala Ahmad, chief executive officer of MetLife Bangladesh, the market leader in life insurance business.

"We see that awareness about and interest in health insurance are rising among customers. This is because treatment of Covid-19 or other critical illnesses is very expensive," Ahmad added.

Green Delta Insurance observed a nearly double-digit growth in individual subscription to its standalone health insurance products last year and product queries are much higher nowadays.

Chartered Life, being a new player in the industry, has nearly doubled its premium income from health coverage during the pandemic, while the overall market has been growing at an annual 10%-15% rate since the mid-2010s.

The increasing customer queries for health products reflect the growing need for health coverage among the affluent middle-class people, said Guardian Life's Istiaque Mahmud.

In the financially stressful year of 2020, corporate subscription for group life and health insurances was almost flat at the end as some employers cut costs and some subscribed to expensive policies for the sake of their employee morale, said Pragati Life's deputy managing director.

"But, individual customers for health coverage grew," he added.

Need for the policy push and an ecosystem

Dr Syed Abdul Hamid of the Institute of Health Economics said top government officials demanded health insurance for all public servants and their family members several times, but nothing has happened yet, which could be a trendsetter to build a big industry and insure mass people.

The government initially planned a free life and health insurance for all its frontline pandemic fighters last year but finally went for a model of donation-style compensation to victims.

Citing some successful state initiatives like expatriate workers' safety insurance, and health insurance pilot projects, finance ministry officials said the lack of progress at this time was mainly because of the concerns about subsidies needed in every annual national budget.

Had the government embraced the life and health insurance model for the state Covid-19 fighters, it could have helped the industry earn a premium and learn to insure people against health risks, said SM Ziaul Hoque of Chartered Life Insurance.

Alongside effective trendsetting in the public sector, the government might think of policy pushes that would ask for mandatory health insurance coverage in every walk of life, industry people and health experts think.

Health insurance coverage for the masses would be very necessary for the sake of economic recovery from the pandemic fallout, said Professor Mustafizur Rahman, distinguished fellow at the Centre for Policy Dialogue.

"It is evident that good health and affordable healthcare add to economic productivity," he said.

Apart from the rich, only some state and corporate employees have access to affordable quality healthcare, either due to their departmental support or institutional policy on health insurance.

As health insurers are bound to ensure promised services to their clients, the government can think of subsidies there, even if it stresses the annual budget, the economist said.

However, health insurance also needs a supporting healthcare ecosystem to flourish as currently only private sector healthcare providers are in partnership with insurers and their reach is limited to the urban class, said health economist Abdul Hamid.

For nationwide reach, insurers at this stage might need partnership with government hospitals while public sector hospitals have no legal option to take bills from any third party, he said, adding that upgrading the relevant laws is a must for that.

Like some other serious insurers, Green Delta has already partnered with over a hundred hospitals in the divisional headquarters and the industry needs hundreds more with an equitable geographic distribution, said their executive vice-president Subashish.

Above all, awareness at every level and culture for health insurance is needed to help people feel financially secure in cases of illness or critical injuries, said Ziaul of Chartered Life.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel