Bangladesh external debt situation and vulnerabilities

The surge in the current account deficit in FY2022 pushed by global inflation has led to considerable public discussion and debate about the Bangladesh external debt situation and associated vulnerabilities. The unprecedented current account deficit has led to considerable pressure on the exchange rate, increase in short-term borrowings, and a depletion of foreign exchange reserves. Many see these developments as evidence of growing vulnerability of the balance of payments and the external debt situation. There is also a worry that the scheduled repayment of loans for a number of large infrastructure projects in the coming years will add to these pressures.

This is a healthy debate, but it is important that the discussions must be based on solid data and evidence. All efforts must be made to avoid speculative analysis that is not backed by evidence. This note seeks to provide an analysis of the external debt situation, and the underlying issues and challenges, with a view to clarifying the public debate on the facts of external debt and assisting the government's thinking on how best to move forward to stabilise the macroeconomy.

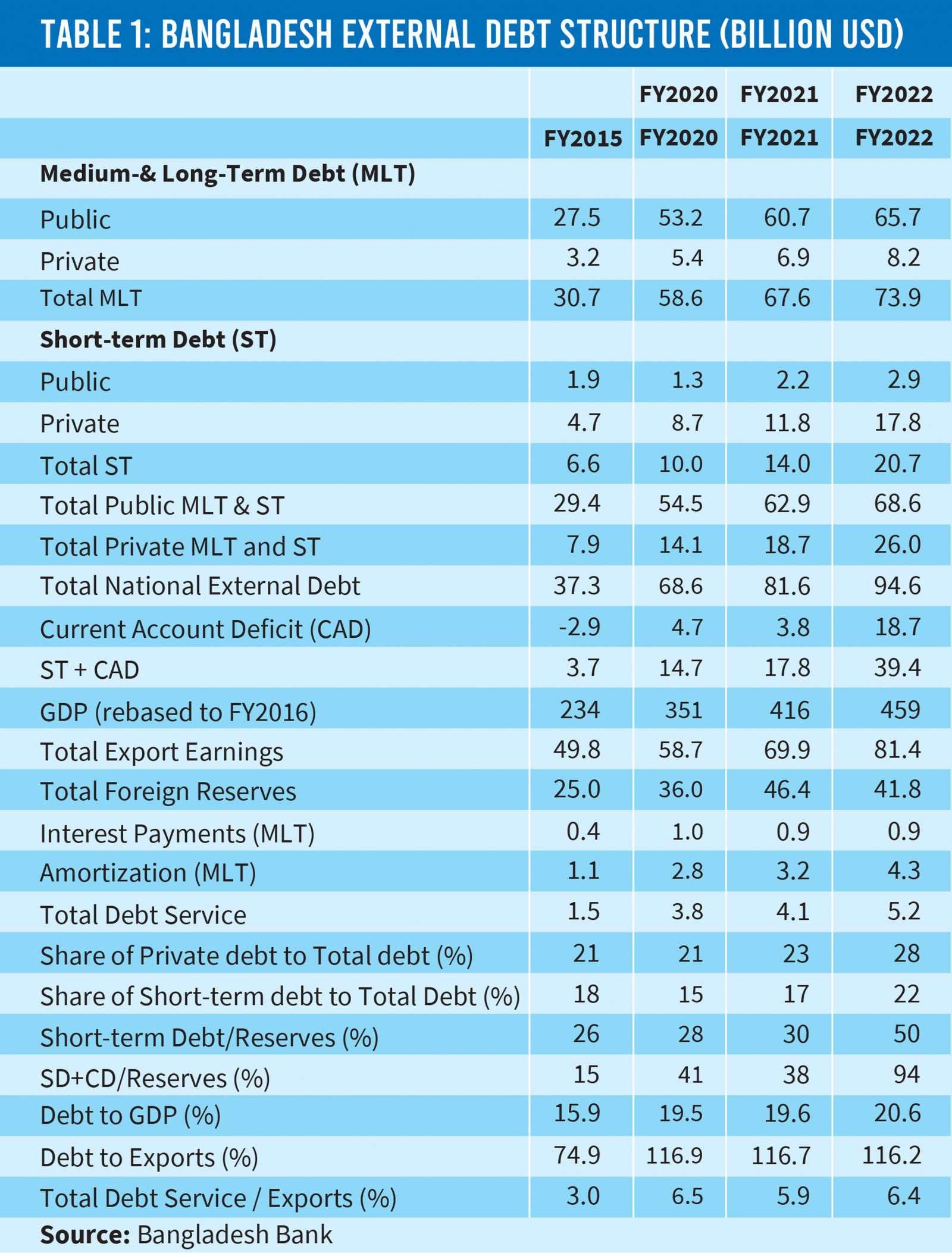

The evolution and current structure of external debt is shown in Table 1. Bangladesh has traditionally managed its external debt prudently. It has maintained a surplus or low deficit in the current account; it has largely relied on publicly-funded low-cost medium- and long-term foreign borrowing to finance its trade and investment needs; and the use of short-term credit has been modest. Combined with a major export drive in RMG and labour exports, Bangladesh external debt indicators, both short- term and long-term, have been comfortable.

The emergence of Covid-19 created some external sector difficulties through the loss of export earnings, but recovery happened fairly swiftly. In FY2021, the balance of payments and external debt indicators were all in the prudent zone. The long-term debt sustainability indicators (debt to GDP; debt to exports, debt service to exports) were all in the comfortable zone. The short-term vulnerability indicators (short-term loan to reserves and the combined short-term loan plus current account deficit to reserves) were within prudential limits (well below 1).

The advent of global inflation fuelled by the Ukraine War since March 2022 has exerted some serious pressure on the Bangladesh external sector reflected in the soaring value of imports. The Bangladesh exchange rate depreciated sharply as excess demand for foreign exchange along with an appreciation of the US dollar in the global markets pushed up the taka price of dollar. The import surge caused the current account deficit to rise to an unprecedented $18.7 billion in FY2022. The financing of this huge deficit required a resort to short-term borrowing as well as a substantial loss of reserves.

The cumulative effect of these developments was that the short-term debt indicators worsened sharply. The short-term debt to reserve ratio worsened from 30% to 50% between FY2021 and FY2022, while the ratio of short-term debt and current deficit to reserves weakened dramatically from a low of 38% in FY2021 to a high of 94% in FY2022. The medium-to-long-term debt indicators, however, remain in the comfortable zone.

How vulnerable is the current debt situation? From a medium-to-long-term perspective, there is not much need to worry if exports remain stable. Simulations show that the medium-to-long-term debt sustainability indicators remain within prudent limits. This is true even after accounting for the upcoming repayment schedule of a number of infrastructure projects including the Rooppur Nuclear Power Plant (debt repayments of $569 million per year starting in FY2027), the Padma Bridge Rail Link (debt repayments of $176 million per year starting in FY2024), the Karnaphuli Tunnel (debt repayment of $53 million starting in FY23) and the Expansion and Strengthening of the Power System Network under the DPDC area ($67 million per year starting in FY2025).

The short-term debt risk situation is tricky and could present a challenge. The sharp deterioration in the short -term debt indicators in FY2022 noted above needs to be reversed and stabilised. While they are still within prudential norms (ratio of less than 1), given the uncertainties of the Ukraine War and global inflation, Bangladesh would be well advised to protect its foreign exchange reserves against any further decline, while seeking to lower the current account deficit in the immediate short term (FY2023). This will require keeping the current account deficit at a level that can be fully financed through net MLT loans and net FDI flows, and a roll-over of the $20.7 billion short-term debt at a reasonable cost. These in turn will require stabilising the macroeconomy by using a combination of monetary, fiscal and exchange rate policies.

The main policy reforms entail unification of the exchange rate at the market determined rate with one exchange rate for all transactions (exports, imports and remittances), doing away with subsidies on exports and remittances, removing the interest rate caps to lower demand through an adjustment in the interest rate, preparing for a major overhaul of the tax system to strengthen revenue mobilisation, reforming the state owned enterprises to eliminate operating subsidies and earning a reasonable rate of return on invested assets, and increasing expenditure on health, education and social protection.

Sadiq Ahmed is the vice chairman at Policy Research Institute of Bangladesh

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel