The potential of Zakat to transform the Bangladesh economy

Zakat has the potential not only to alleviate poverty but also to contribute to the growth of Bangladesh’s economy

Zakat, one of the five pillars of Islam, is obligatory charity among Muslims. Those wealthy enough to afford to pay Zakat must pay forward to those who need the wealth to live more sustainably. At its root, it is a financial transfer that promotes development and stability by enhancing utility curves in Muslim economies.

The allocation of Zakat theoretically (and empirically) boosts the purchasing power of the disadvantaged people; consequently, an economy's aggregate production level sees increased output.

Furthermore, Zakat allows for vast participation in spending and production activities. According to a prior study by Kabir Hassan (2008), the contribution of Zakat revenues to Bangladesh's Annual Development Program (ADP) ranged from 21% in 1983/1984 to 43%in 2004/2005.

In Bangladesh, no state wing oversees Zakat management. Rather, the Center for Zakat Management (CZM) takes on this role and has developed a number of projects for collecting and distributing Zakat funds.

CZM's livelihood development initiative ZEEBIKA has thus far reached out to marginalised individuals, disadvantaged children for their education, and unemployed individuals. CZM also operates GUL BAGICHA, which grants stipends to underprivileged students.

In the rural and impoverished areas, ISANIAT and FERDOUSI programs also actively promote the establishment of sustainable livelihoods and improved well-being.

Within Bangladesh, there is no credible evidence or official data on Zakat's efficacy; the actual amount of Zakat is relatively in question. The current study addresses this issue and estimates the potential Zakat in Bangladesh using secondary data from relevant government data, websites, books, and journals.

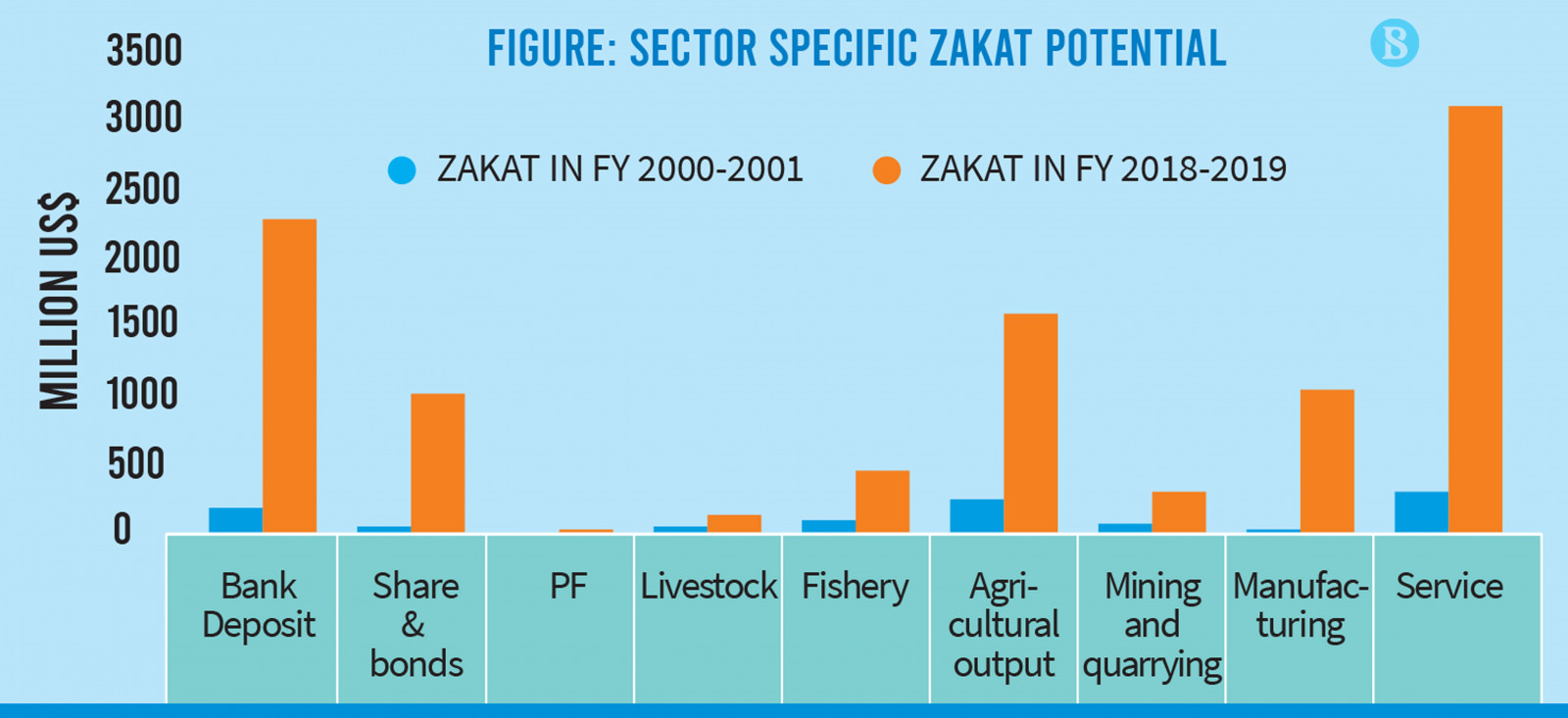

In the process of estimating national potential Zakat, nine sectors have been considered: (1) bank deposit, (2) shares and securities, (3) provident fund, (4) livestock, (5) fishery, (6) agro-crops & forestry, (7) industrial production, (8) trade services, and (9) mines.

The added value in the economy from these sectors are procured in different ways, i.e., different rates of Nisaab. An adjustment of living cost has been applied to the eligible sectors as part of the Nisab adjustment and living expenses to compute the Zakat potential.

Key Findings

The study first estimated the sector-specific Zakat potential. It is apparent that the aggregate Zakat potential in the service sector in FY 2018-2019 is much higher than that of other sectors and eleven times higher than the worth in 2000-2001.

Similarly, bank deposits accounted for $2,264 million in the current FY, which is 14 times more voluminous than the accruement in FY 2000-2001.

It indicates that the Zakat potential is incremental and rising with the contribution of sectors in the economy. For instance, Zakat on shares and bonds was $18.71 million in FY2000-2001, which amounted to around $1,000 million in FY 2018-2019.

However, the lowest contribution is marked by the PF sectors. Nevertheless, the Zakat worth generated from PF is $3.54 million, 13% higher than the worth in 2000-2001.

It is estimated that the aggregate potential of Zakat in Bangladesh was $9,749 million in FY2018-2019; however, that was only $809 million in FY2000-2001. Compared to the Zakat amount in FY2000-2001, the current amount of Zakat is 12 times higher. It is undoubtedly a positive indication of Zakat increment since it can help reduce the income disparity with economic growth.

Hence, the potential can be a blessing for the deprived communities if the growth of Zakat can maintain alignment with the economic growth and the value is efficiently used for the welfare of people.

The estimate also shows that around 35% of the national revenue and 21% of the national budget could be generated from the potential Zakat in Bangladesh on FY2018-2019. Moreover, the overall potential of Zakat accounts for 3.77% of Bangladesh's overall GDP.

Policy recommendations

The 8th five-year plan emphasises closing the gap between rural and urban economies by expanding the rural economy's non-farm sectors and creating employment for 11.3 million people. The goal is to achieve an 8.51% GDP growth rate and reduce the poverty rate to 15.60% by 2025.

Sector-wise, Zakat imposition along with taxation will help gain sizable revenue, further stimulating economic activities. Optimistically, the current potential of Zakat will increase exponentially like a multiplier which will help reduce the poverty plight with investment in target-based poverty reduction strategies.

It is estimated that Tk64,960 billion is required for the implementation of the 8th five-year plan, of which 81% of resources will be mobilised from the private sector. Zakat has strong implications in this voluminous revenue mobilisation from the private sector. The uncertainty in revenue generation from the private sector may create bottlenecks and thwart the growth projection.

The ultimate impact will fall on the SDG implementation and LDC graduation. Cognising these sectors in potential zakat calculation will increase the national Zakat amount.

Lastly, we must note that this current five-year plan is linked to the existing 20-year plan to enter the middle-income countries by 2041. The plan must maintain its link with SDG implementation, and there must be continuous monitoring of resources, supply, and metrics.

In Bangladesh, we share the following suggestions to enhance Zakat regulation and goal setting.

- A new government wing should be formed to coordinate with CZM to broaden the Zakat distribution channel with its vast resources and personnel.

- A separate law and policy should be formulated on how, when and to whom the Zakat allocation should be operated. Then the zakat distribution will effectively and efficiently reduce wealth distribution inequities.

- Bangladesh should introduce a tax rebate on the timely and accurately deposited Zakat by people.

- The vulnerable sections of a society should be divided and studied based on needs to determine Zakat allocation and efficacy.

In Bangladesh, the government can take the responsibility to initiate an effective mechanism of collecting Zakat effectively by collaborating with the CZM. A set of simple but effective ways are suggested:

- At first, two separate bodies should be formed. A body will take care of Zakat collection (annually) while keeping records at the individual level. The other body will collect Zakat at the corporation level. Data should be compiled between the bodies.

- Media (digital and physical) should broadcast the Zakat protocol and distribution efficacy. Like revenue allocation, the government should set a target of potential zakat collection and publish the national zakat report annually.

- For Zakat collection, a digital financial service should be operated per the Shari'ah. CZM can be the most suitable authority to take care of the system. As a result, one can easily deposit the Zakat by simply calculating his Zakat in one Mobile APP and deposit instantly.

- Every Zakat payer's identifiable information and payment information will be recorded and transparent but will not be disclosed publicly. A formidable IT department should regulate information control here.

- Every registered corporation in the National Zakat Foundation (maybe CZM) should follow a definite code and rule to deposit the Zakat amount – which the monitoring authority will impose and inform previously through the digital platform.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the opinions and views of The Business Standard.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel